Gold Safer Than A Bank Account...But Only If You Follow This Crucial Advice

Commodities / Gold and Silver 2014 May 23, 2014 - 11:50 AM GMTBy: Jeff_Berwick

Vin Maru writes: While investors in the precious metals sector had to endure a tough bear market in the past couple of years, there is a glimmer of golden light at the end of this dark tunnel. The fundamentals for gold ownership have not changed and remain as strong as ever, and that's why our special report Getting Your Gold Out Of Dodge (GYGOOD) comes highly recommended. Over two years ago, I started researching and writing this report with The Dollar Vigilante team. It is a complete compendium on how to internationalize your precious metal's holdings and move them out of the western financial system.

The reasons are clear on why we encourage moving your gold out of the financial system. There is a high degree of risk that desperate governments will take what they can, whenever they can, because... THEY CAN.

The highest risk to your gold holdings is not so much the price of gold but making sure it cannot be easily confiscated and taken from you like money in a bank account could be. We all have heard about the potential for money held in banks to be bailed in the next time the banking system goes into meltdown mode. But there is a new threat to your money held at banks and it comes from your very own government regardless of another financial meltdown.

As governments around the world become more desperate for higher tax revenues, they will empower themselves and increase their ability to confiscate your assets if they deem it necessary to do so, this includes money held in your bank account.

For example last week in the UK, the Common’s Treasury committee raised concerns about the potential powers that could be given to HM Revenue and Customs (HMRC) to confiscate cash from bank accounts without a court order. MP’s warned that innocent people face having money taken from their bank accounts by the taxman.

The committee recognizes the fact that there could be an “abuse” of power and that taxpayers could suffer “serious detriment” for no wrong doing if officials are able to take money directly from bank accounts. At the moment, tax officials can only remove money from your bank account when a person has failed to act on four formal warnings requiring payment and only after gaining permission from a magistrate or judge. The concerns revolve around how taxes are calculated and the security of the information gathered. Andrew Tyrie, who is the Conservative chairman of the Treasury committee doesn’t even trust the tax officials to be accurate. “People should pay the right amount of tax. But HMRC does not always ask for the right amount,” Mr Tyrie said.

MP’s who are reviewing the latest budget report say: "The ability directly to have access to millions of taxpayers’ bank accounts raises concerns about the risk of fraud and error."

“This policy is highly dependent on HMRC’s ability accurately to determine which taxpayers owe money and what amounts they owe, an ability not always demonstrated in the past. Incorrectly collecting money will result in serious detriment to taxpayers.”

This new tax power is due to be put into place next year and if it passes, the long reaching arm of the tax man will surely grab any money it can from your back account, legitimately or by error. When the government runs low on funds, which is a mathematical certainty, it will take the low hanging fruit of money held in bank accounts. Of course the justification for these changes is to get HMRC in line with other government agencies to access money held at the bank for people who have funds available and are not current with tax payments.

We see this as a growing trend, where desperate federal tax departments will be given carte blanche to access and take your money with very little recourse if you are deemed to owe them money. Of course once the precedence is set by one gov’t agency, then the potential exists for these powers to be extended to all government agencies in the future.

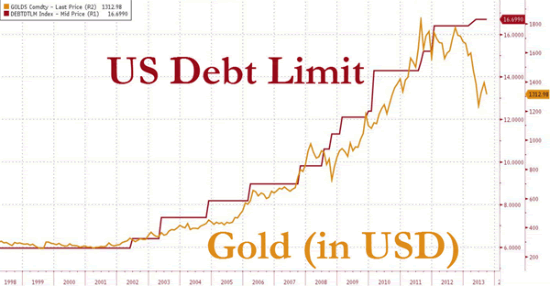

The good news is that people still have the option to store financial assets like gold outside the banking system which is not easily accessible by government officials as they get more desperate in the coming years. This is one of many reasons why you should continuously buy precious metals and store them safely away and out of the reach from easy confiscation. It’s a hard asset which is not easily taken from you if hidden or stored in private vaults, unlike digital money held in a bank which is easily confiscated by indebted government (Janet Yellen admits the federal governments deficits will rise to unsustainable levels) or the bankrupt banking system by way of bail-ins.

If you would like to learn about strategies for trading the precious metals sectors including the mining companies shares, you can sign up for our gold stock trading newsletter, the TDV Golden Trader or get additional information on precious metals investing including industry news and current pricing of companies in various precious metals indexes like the HUI, XAU, GDX, GDXJ and SIL ETF.

Anarcho-Capitalist. Libertarian. Freedom fighter against mankind’s two biggest enemies, the State and the Central Banks. Jeff Berwick is the founder of The Dollar Vigilante, CEO of TDV Media & Services and host of the popular video podcast, Anarchast. Jeff is a prominent speaker at many of the world’s freedom, investment and gold conferences as well as regularly in the media.

© 2014 Copyright Jeff Berwick - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Jeff Berwick Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.