Gold And Silver Price Central Bank Manipulation Or Chinese Accomodation? Both

Commodities / Gold and Silver 2014 May 24, 2014 - 06:28 PM GMTBy: Michael_Noonan

It certainly started out as central bank manipulation, doing everything possible to cover their theft and resulting deficiency of replaceable physical gold. Almost all of their unauthorized reselling or hypothecating went unnoticed or without any ability to stop the activity. China had a lot of its gold stored in the United States that was stolen in the 1990s. She has since become the world-leading economic powerhouse and is now in a position to force the Rothschild elites to make good on the theft, which they are doing.

It certainly started out as central bank manipulation, doing everything possible to cover their theft and resulting deficiency of replaceable physical gold. Almost all of their unauthorized reselling or hypothecating went unnoticed or without any ability to stop the activity. China had a lot of its gold stored in the United States that was stolen in the 1990s. She has since become the world-leading economic powerhouse and is now in a position to force the Rothschild elites to make good on the theft, which they are doing.

China wants to see the price of gold at the current low levels as she continues to buy up as much of the [not so readily] available supply. The central bank manipulation continues as a means of protecting the last vestiges of the soon-to-fail petro-dollar, and soon-to-fail as the world's reserve currency upon which almost global trade is based. The Chinese are willing to see gold stagnate at current levels as a better bargain during the final stages of their accumulation. It works for both sides for totally different reasons.

For how long can these low prices continue...the ever pressing question on the minds of the gold and silver community and topic of so many articles written by the experts? While many have striven to provide an answer, and 2013 failed to match the "predictions" as to the "When?" issue, the best answer is: For as long as it takes.

Back in January and February, it become more apparent that the highly anticipated huge rally for PMs was going to take longer than most expected. In April, we wrote an article that 2014 Could Be Yawner. There is no reason not to carry that notion further into 2015 before gold and silver begin to challenge their 1900 and 50 respective high price levels.

The one thing certain is that no one, absolutely no one can provide an accurate time-table for when PMs will trade at much higher levels. 2013 should be a reminder of the many who endeavored to fix a date and all of whom failed. It is utter nonsense to think anyone can accurately divine the future. The good news is that we do not need to actually know the "When?" All that matters is to be prepared for the eventuality.

If you are prepared, then you will have accomplished one of the most important responsibilities for wealth protection/preservation/growth as a means for survival. Instead of watching the Precious Metals Rally clock, an exercise in exasperation, so far, better to be secure in the knowledge that you have done what you need to do, and instead, start to relax and learn to enjoy more out of life.

If events are triggered that propel PMs higher, or even substantially higher next month, next Quarter, or next year, if you are prepared, you will be a winning participant! Once and as it happens, you will feel a sense of relief for having waited so long, and a sense of accomplishment for having prepared. If you have not fully prepared, you have a tenuous gift in both time and price in which to act as quickly as possible. The time to act and be better prepared is now, and at prices you and your children, and your children's children will not likely ever see again.

Those who are disheartened because events have not occurred in the time sequence that was hoped for are missing the point. This is not a get-rich-quick scenario confronting almost all of us. This is a matter of survival. All anyone can do is prepare. One does not eat well and exercise to live longer, one does both to be in the best possible health to live each new day. As it happens, those who watch their intake and take care of their physical health to enjoy daily living also tend to live longer, as an added reward.

Consider: Physical PM shortages, depleted physical for delivery on exchanges, record buying by the public, world-wide, record buying by China, corrupt central banker price manipulation, government theft or confiscation, unlimited derivative exposure, existing demand for the physical that far outstrips available known supply, unlimited printing of fiat that can only result in currency destruction, civil unrest in many countries, any one of which could lead to a wider war, plus a litany of unknowns that can be important.

They have already been factored into the current prices for gold and silver, and any one of these events, or a more potent combination of them acting in unison can drive up the price of PMs but have not, to date. This is what you need to know. Whatever it is that will launch gold and silver higher has not yet occurred. Many of the "Whatever it is" are already known factors, but their influence/effect has not yet been unleashed.

Yes, if the manipulation stopped, PMs would rally immediately, but the event that puts a halt to the manipulation has not happened, so that part of the suppression of gold and silver remains in play. For how long can it continue? Again, for as long as it takes. Does anyone have a better answer? [Not that better answers cannot be had.] For those who do not know the answer, the solution, or at least one good solution, is being prepared.

There is another issue not talked about and that is the seeming failure of the elites who "appear" to be forced to sell their gold. The very foundation of the Rothschild formula is the acquisition of [mostly] gold, and also silver, in exchange for debt-based currency. There has not been a smarter collection of individuals, [or more devious and destructive], that comprise the Rothschild-founded central banking system.

It would seem odd that such an astute and all-powerful-behind-the-scenes-force as the elites would find themselves in such a compromised situation to no longer have any, or very little gold and silver left. It seems equally unimaginable that the elites could be so stupid if they have put themselves in such a weakened state. It is a possibility, and one of such incredible and fitting irony, if true.

What keeps them in power is the built-in structure they have accumulated in every major Western government under their control, which also includes the potent military, and the media to keep the masses dumbed down. The perverted transition of the United States from a sovereign Republic, with an organic Constitution that limits government, to an elite central banker-controlled, bankrupt corporation, known as the federal UNITED STATES, with its substituted federal statutory constitution that replaced the original, is the premier example of how the elites work through stealth, and over decades as their time frame, to accomplish their vile ends.

Whatever one chooses to believe, one still has to deal with the known facts, and what is factually known to date is that gold is at 1,300, [not 1,500, not 2,000, and certainly not 5,000 or 10,000 the ounce], and silver at 19, [not 26, not 50, and for sure, not 100 or 300 the ounce]. However corrupt or not reflective of the "real price" for PMs, the charts continue to be the most commonly accepted measure, at least for now.

Regardless of what one chooses to be the most accurate or reliable measure, there can be no dispute that preparation for what is to come is the best way to deal with "When?"

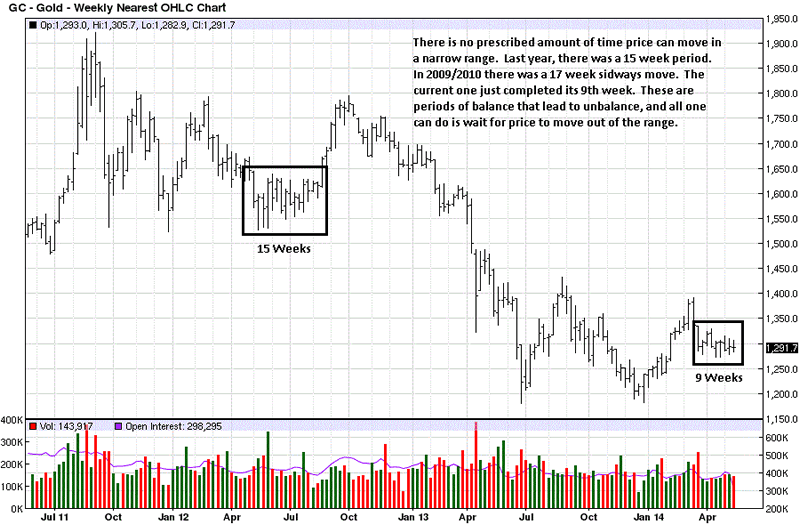

Weekly gold has been in a broad TR since last June '13, and a TR within a TR since Dec '13. There is no sense of urgency to leave the range-bound structure, so one can only exercise patience until something clearer develops, which will eventually happen.

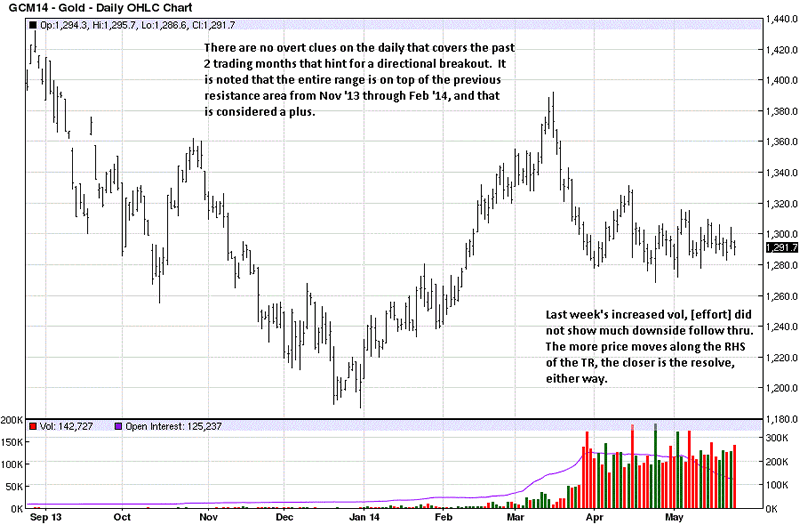

The 1280 area is an axis line, acting as resistance from November '13 through February '14, and it now acts as a support area for the past 2 months. The farther price moves along the RHS, [Right Hand Side] of the TR, the closer is gets to a resolve. Sentiment favors a move higher, but reality is that one need not know the breakout direction beforehand. All one needs do is to be prepared for a move in either direction, and follow the market's lead.

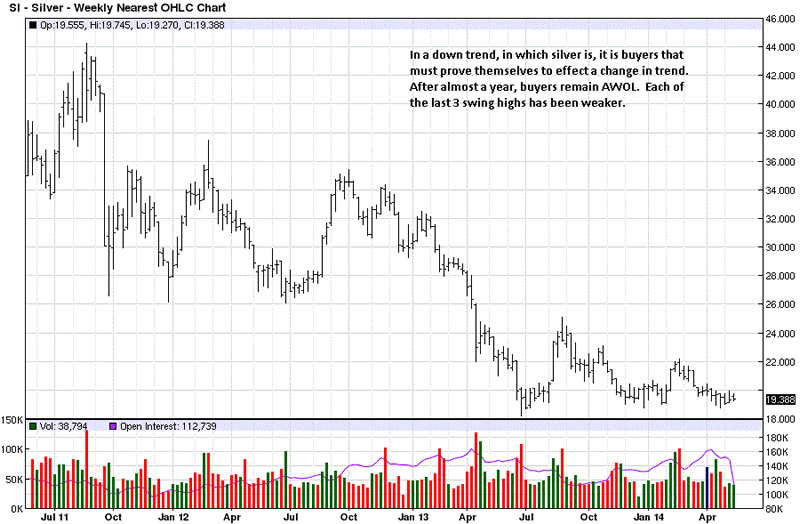

Little can be said of the silver market, from the expectation of a move higher. Buyers have been AWOL, [a military term: Absent With Out Leave], and nothing will change until there is evidence of strong upside moves accompanied by increased volume.

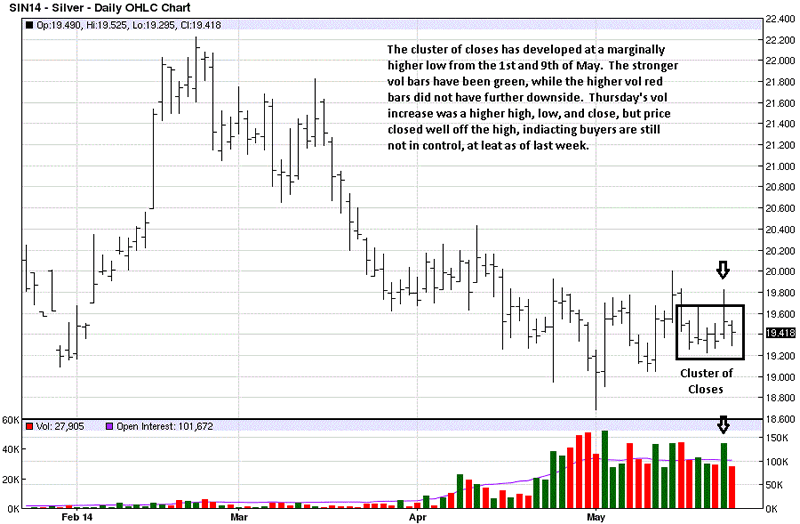

The problem with pointing out a small possibility of what could be positive activity is that it preconditions the mind to look for more supportive evidence at the expense of missing what could be a subtle negative development. Just wait for confirmation that buyers are starting to create wide range rallies with strong closes on increased volume.

If silver is to move higher, what we just described will make its presence obvious. Until it does, caution is advised. There could be another new recent low, and the odds for that event are greater than 50%. It may be a buying opportunity. How a new low develops, if at all, will make that assessment worth acting on, or not.

By Michael Noonan

Michael Noonan, mn@edgetraderplus.com, is a Chicago-based trader with over 30 years in the business. His sole approach to analysis is derived from developing market pattern behavior, found in the form of Price, Volume, and Time, and it is generated from the best source possible, the market itself.

© 2014 Copyright Michael Noonan - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Michael Noonan Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.