Developing Gold Market Situations - Stock Market Meltdown...

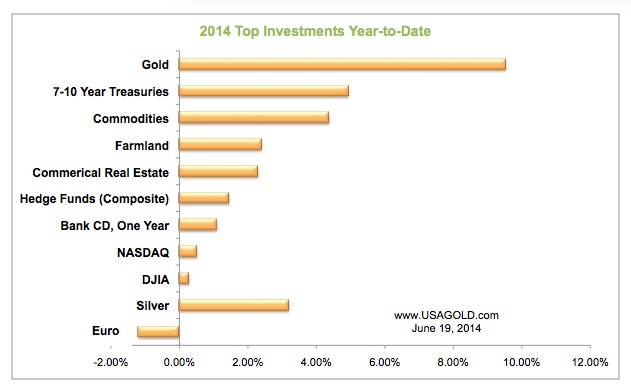

Commodities / Gold and Silver 2014 Jun 28, 2014 - 06:16 AM GMT As you can see in the chart below, even as we are consistently reminded that the stock market is trading at record highs, gold remains the best performer on the year thus far -- better than Treasuries, the euro, commodities, farmland, NASDAQ and the Dow Jones Industrial Average, better even than silver. The nearly 10% appreciation in the price began under what we believe to have been oversold conditions at roughly $1200 per ounce. Much of the early year upward price adjustment had to do with investors globally taking advantage of the oversold market. Over the first six months of the year, we have enjoyed a steady increase in business at USAGOLD. Many of the same clients who purchased gold in the $300 to $600 range in the late 1990s and early 2000s are buying now. It has been a good year for gold thus far, but what about the rest of 2014? At USAGOLD, we are monitoring three developing situations that we believe could have a profound impact on gold demand during the remainder of the year -- driving forces that could provide impetus for a classic gold run that could begin with a summer surprise. . . . .

As you can see in the chart below, even as we are consistently reminded that the stock market is trading at record highs, gold remains the best performer on the year thus far -- better than Treasuries, the euro, commodities, farmland, NASDAQ and the Dow Jones Industrial Average, better even than silver. The nearly 10% appreciation in the price began under what we believe to have been oversold conditions at roughly $1200 per ounce. Much of the early year upward price adjustment had to do with investors globally taking advantage of the oversold market. Over the first six months of the year, we have enjoyed a steady increase in business at USAGOLD. Many of the same clients who purchased gold in the $300 to $600 range in the late 1990s and early 2000s are buying now. It has been a good year for gold thus far, but what about the rest of 2014? At USAGOLD, we are monitoring three developing situations that we believe could have a profound impact on gold demand during the remainder of the year -- driving forces that could provide impetus for a classic gold run that could begin with a summer surprise. . . . .

1. A possible stock market meltdown

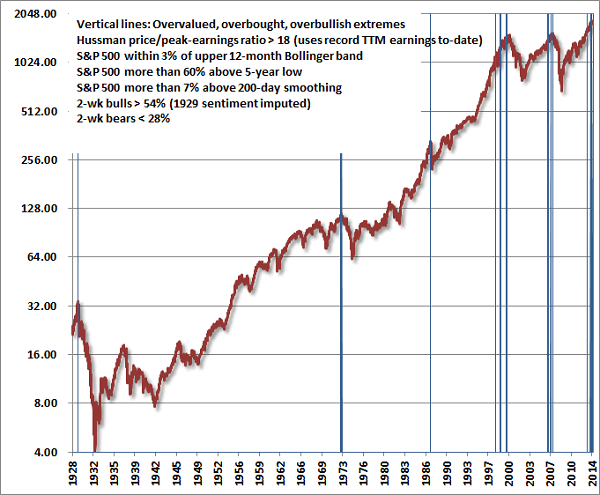

Jon Hussman (Hussman Strategic Advisors) is predicting a stock market correction in the near future that will wipe out 38% to 50% of current valuations. When it comes to the stock market, we give Hussman's analysis a bit more play on these pages than others simply because he called both the 1987 and 2007-08 crashes -- a feat few, if any fund managers can chalk up on their resumes. Hussman sees the same build-up of overvaluation now that he saw then and has issued warning to his readers. Some will be put-off by Hussman's Doomsday thinking, but we should keep in mind that "I didn't see it coming" was the most commonly verbalized refrain following the last stock market meltdown in 2008.

In a piece written for The Casey Report he says,

"Is this time materially different from 1929, 1972, 1987, 2000, or 2007? We doubt it. In the chart of overvalued, overbought, overbullish extremes below, I've replaced the Shiller P/E (which is a lightning rod) with a variant that I introduced in the 1990s, basing the P/E multiple on the highest level of trailing earnings observed to date surely an optimistic and forgiving measure today, given that profit margins are about 70% above historical norms, but one that signals rich valuation regardless. We certainly can't rule out movements further up the mountain (though to us, 2013 was largely a replay of 1999), but those movements are likely to appear small in the context of what will be erased over the completion of the cycle.

He concludes,

"Yet as much as we focus on the long-term good, equilibrium creates an unfortunate constraint: by encouraging one investor to defend their financial security by selling overvalued stocks, the result is that someone else must end up buying the stock at these same levels. That poor soul, we expect, is likely to be worse off for the trade. That may explain my philosophical aversion to speculating in steeply overvalued markets, and my ethical objection to policies like quantitative easing that encourage it. In order to profitably exit that speculation, someone else must be guaranteed misery. In a financial market where price signals encourage savings to be allocated toward productive uses, what helps an individual investor often helps the entire economy. But in a severely distorted and speculative market, any effort to help one investor is really quite a zero-sum game that requires someone else to be injured. This is just an unhappy result that years of quantitative easing have now foisted upon us."

Please see Hussman Strategic Advisors/Hussman Funds

In 2008, a massive move to gold accompanied the stock market decline and the descent into the Great Recession. The price of gold, after a brief decline, rose over 70% in a little over twelve months. The Dow Jones Industrial Average in contrast lost over 50% of its value. To put that in dollar terms, $1,000,000 in stocks would have become about $500,000. One million in gold would have become $1,700,000. That amounts to a $1.2 million portfolio swing. Those numbers -- a real life example -- are worth a treatise on the value of a gold diversification in uncertain times.

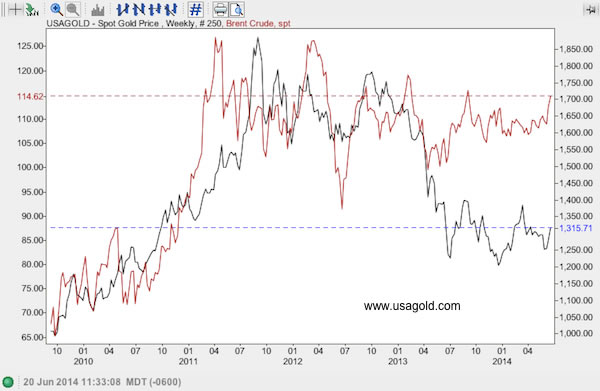

2. A potential adjustment in the gold-oil price ratio

Ever since Saudi Arabia's King Ibn Saud traded 35,000 old British sovereigns for oil concessions in his kingdom [1933], there has been a connection between oil and gold. The good king understood the difference between the value of gold and a paper promise. At the time, the British sovereign -- a coin many of you hold in your own financial kingdom -- could buy about ten barrels of oil. (British sovereigns at the time were valued at $8.24 and a barrel of oil was 85¢.) Today a British sovereign's melt value is roughly $71 and a barrel of oil is about $115. For the British sovereign to buy what it bought in terms of oil in 1933, it would have to be valued at $1150 or about $4900 per troy ounce -- a statistic that gives you an inkling just how undervalued gold might be for the long term.

Even the short term, as suggested by the chart below, looks good with respect to the gold/oil differential. It suggests gold is undervalued, perhaps severely undervalued. Given the situation in Syria and Iraq and the general heating up of the civil war between Sunni and Shiite across the Middle East, it is difficult to believe that the disparity will resolve itself in significantly lower oil prices. A more likely scenario under the circumstances would be for gold to play catch-up.

"Global conflict is now ramping up even more quickly than even I had anticipated — not just economic wars, currency wars and trade wars, but also civil wars, regional wars, cold wars, revolutions and social chaos. They will turn out to be some of most important events of your lifetime — events that will shape your financial future and the financial future of all those you love for the next 50 years. Unfortunately, however, most people still don't understand them. They don't know what's happening — let alone what to expect. They haven't connected the dots to gold. And they don't realize how deeply the conflicts tie back to oil and energy." -- Larry Edelson, Real Wealth Report

3. A possible make-up rally based on gold's historic undervaluation when compared to inflation

“That light at the end of the tunnel? It’s an oncoming train.” Popular joke from the 1970s

That oncoming train, as far as financial markets are concerned, might well be in the form of real unemployment and inflation numbers that the Washington’s politicians and Wall Street’s money managers don’t want you to know about. Recently, I made a post at the USAGOLD Blog suggesting that if you wanted to get a real fix on the inflation rate rely on your own experience at the grocery store not the Bureau of Labor Statistics’ (BLS) Consumer Price Index. Similarly, if you want to get a real fix on the unemployment and wage situation talk to the folks lined up with you at the check out counter and politely file what the Department of Labor is telling us.

Fortunately, for those who want more than an anecdotal grocery store based analysis someone has gone to the trouble to assemble numbers for public consumption that tell the real story on inflation and unemployment. That someone is economist John Williams of Shadow Government Statistics, the widely used website for those who simply do not believe the numbers circulated by the federal government. At present he has the inflation rate at nearly 10% (BLS-CPI = 2%) based the BLS' 1980 statistical methodology, and unemployment at over 23% when you factor in discouraged workers who were defined out of existence by BLS edict in 1994 (BLS Unemployment = 6.3%). That would put the Misery Index, inflation and unemployment combined, at 33% by Shadow Stats' reckoning and just over 8% using BLS' numbers.

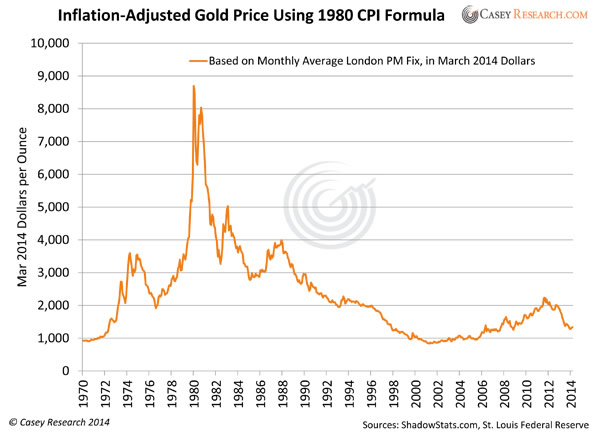

Below we offer a chart originally published at Casey Research on the inflation-adjusted price of gold using Shadow Stats numbers. We present it without comment, as it speaks for itself.

Chart courtesy of Casey Research

Reflections in a Golden Eye

Here are a some previously unpublished dust-jacket notes written over the past few months -- observations and reflections strictly for the advanced gold owner.

Barbarous no more

The collective viewpoint on gold has changed since the financial dust-off of 2008 -- the culmination to a process that began at the turn of the century. Gold has travelled the long and winding road from abandoned orphan and shunned castaway, to grudgingly respected over-achiever, and finally cause celebre. Having undergone a renaissance in the public psyche, It now stands in resolute opposition to the highly politicized monetary regime under which we all live -- and something of a saving grace on economically beleaguered Main Street. In a sense, gold has come of age. It is barbarous no more.

* * * * * * *

Gold owners East and West share common groundMany see the immense movement of gold from West to East over the past few years as a passing of the torch. Gold, they say, follows the flow of wealth. What is lost in the West is gained in the East. Though true, that shift tells only half the tale. The rest of the story has to do with a massive population moving up in the world economically. It just so happens that these same people live in cultures that venerate gold as a form of money and wealth. The impact on the demand side of the fundamentals' equation, as a result, is likely to be deep and long-lasting. Gold owners in the East have not usurped owners in the West. They have joined them.

* * * * * * *

Stock Market Meltdown and Gold Market SituationsIt might go without saying that the American people not only have doubts about the economy, they have doubts about political leaders' ability to cope with it. A Pew Research poll conducted at the end of last year found that only 19% believe that the U.S. federal government can be trusted to do what is right just about always or most of the time. In an April Gallup poll, gold finished second in a ranking of favorite long term investments with 24% of Americans rating it the best option. (Real Estate, not stocks, finished first.) Working the front line of America's discontent, we at USAGOLD understand the relationship between the two polls.

* * * * * * *

Predicting the markets not like predicting phases of the moonFinancial Times’ John Authers wrote recently that the days of complicated portfolio strategies based on mathematical modeling were over, and that we stood now at the dawn of a new era in which behavioral finance would become the principle tool for predicting market behavior. He came to that conclusion after attending a meeting of financial analysts in Vancouver. “Simplicity," he writes, "is in. Greek letters are out, as are cunning strategies involving derivatives.”

The implied understanding is that crowd behavior and markets are definable and thus predictable, which they are not -- that there is a science to something in which very little science is involved. Predicting the markets is not like predicting the phases of the moon. As Charles Mackay went to lengths to point out in Extraordinary Popular Delusions or the Madness of Crowds, you cannot rationalize what is essentially irrational. That is one of the reasons why people own gold coins. Hedging one's portfolio with gold comprises the armchair approach to outlier or black swan events, and it is essentially foolproof. (See X-factors conspire against Fed, below)

"The only function of economic forecasting is to make astrology look respectable." - John Kenneth Galbraith

* * * * * * *

Gold and the Great RecessionPrivate investors around the world continue to add weight to their portfolios in the form of gold bars and coins – something that vexes its mainstream opponents who have never seen a gold market they like or found good reason to own the metal that has served mankind with distinction during the first roughly six years of the Great Recession – (or as it is now being called in some quarters, The Never-Ending Great Recession).

We must remember that gold started the Great Recession at roughly $700 per ounce, surged to nearly $1900 per ounce under decidedly disinflationary circumstances before correcting back to the $1200 level in recent times. Even at its near term bottom of $1200 per ounce, the gold price was still over 70% higher than it was at the start of the Great Recession. Those who bought the metal thinking that it would help them through difficult times appear prescient. In the meanwhile, none of the conditions that brought on the panic and crash of 2008 have been addressed. When even the International Monetary Fund (as it has repeatedly over the past several months) warns of potential disaster ahead, we should all heed the warning.

* * * * * * *

A note on the risks and consequences of gold price manipulationThe evidence is mounting that nefarious forces are at work in the gold market. Forces intent on manipulating the price to hold it in check. If these forces are so powerful, though, how did the price go from $300 per ounce in the early 2000s to $1225 today with an interim stop at $1900 in between?

Simply put, gold’s tendency under a fiat monetary regime is to rise – market pressure is constantly pushing the metal in an upward direction as the currency is debased. One could even make the argument that as long as we have a fiat monetary system, gold’s inherent tendency will be to rise. Long term graphs of both the dollar and gold since 1971 are testament to this inverse correlation. Any attempt to hold down the price in such an environment unavoidably comes with risks and consequences as natural market forces dish out their own brand of economic justice.

- As far as private sector is concerned, every manipulation of the gold price must at some point be covered with a compensating trade -- either to secure a profit on a short position or to eliminate market exposure. The recent downward manipulation of the London Fix by a Barclays trader, as an example, was covered with a compensating purchase almost immediately in order to eliminate market exposure. The market price quickly returned to its level before the manipulation.

- In the official sector, where a national government and/or central bank might be manipulating the price over an extended period of time to disguise currency weakness, risks and consequences come in the form of the loss of national reserves and/or mass bankruptcy in the mining sector. The classic example of this dynamic in action, of course, is the failed defense of the $35 per ounce gold benchmark. The comeuppance came when the United States under the Nixon administration was forced to close the gold window to stem the drain of its once prodigious reserves and allow the price to seek its free market level.

- For bullion banks technically on the hook for gold deposits they have leased or sold, an extended period of price weakness is likely to threaten supply and their ability to repay gold depositors. The comeuppance comes when depositors demand return of their gold -- a process which forces the banks back to the market as buyers to honor contracts that must be fulfilled in physical metal. The Central Bank Gold Agreement in 1999 was designed to restrict sales and leasing of official sector gold. This agreement, signed by the major central banks of Europe, set the stage for gold's dramatic breakout from the $300 level and the current secular bull market.

Sooner or later, there is always a balancing of the books and the greatest beneficiaries are the long-term accumulators of physical gold coins and bullion. They are in a position to wait out the manipulations and take advantage of gold's inherent tendency to rise in a fiat monetary system.

Note on GATA/Chris Powell/Bill Murphy: By pointing out the futility of gold pice manipulation, I do not mean to diminish the outstanding work done by Chris Powell and Bill Murphy to expose and keep the public pressure on those who find it necessary to manipulate or rig the price. Their work has a gone a long way toward exposing the problems surrounding the London Gold and Silver Fixes and elsewhere in the gold market -- now the stuff of headlines in the mainstream financial media.

At times, when many had given up hope of the problem ever reaching the mainstream, GATA & company forged ahead under constant criticism from its adversaries. Now the problem has gone mainstream and GATA can bask in some long-deserved vindication. I hope it will continue its watchdog role with the ultimate goal of relieving the price compression that, as described above, has become part of the gold market equation. Perhaps someday soon on these pages we will be writing about a whole new gold market. If so, GATA will have played a significant role in getting us there.

* * * * * * *

Gold standard a distant dream, central bank purchases a present reality"We suggest one keep identities straight; invest with central banks, not against them; and consider the hollow rhetoric of the establishment that may temporarily suppress its paper price 'a gift.' They are working for physical gold holders, not against them." - Lee Quaintance and Paul Brodksy, QB Asset Management

I am often asked whether or not I view the gold standard as the best prescription for what ails American monetary policy. I should say from the start that my views are those of a businessman, as opposed to those of an economist or a politician. As such, they generally lack any real political or academic conviction. Our mission at USAGOLD is not to alter the political and economic landscape. Instead it is to go about the practical business of interpreting and adjusting to the current economic weather conditions whatever they might be. To be straightforward about it, we do not believe that we are going to see a return to the gold standard any time soon, so much of the discussion on gold’s utility in the economic system is more an academic exercise than a business reality.

At the same time, though, there is a movement afoot among central bankers and high-profile economic thinkers of profound interest to gold owners, simply because its implementation will play such a significant and direct role in physical gold demand over the coming years. That movement has to do with the inclusion of gold in central bank reserves, not necessarily as backing to their currencies, but as a reserve asset to balance and hedge the risks of holding foreign exchange. Diversification is the mechanism at work in the transition of central banks from net gold sellers (and lessors) to net buyers, just as it is for the attuned private investors. That blueprint in my estimation is the future of official sector participation in the gold market.

I first became aware of this approach to central bank gold from the early writings of Columbia University's Robert Mundell, who later went on to win the Nobel Price for economics. He played a key role in the European Union's inclusion of gold in its reserves and is sometimes called "the father of the euro." In 1997, in a speech at Latrobe College in Pennsylvania, Mundell outlined his theories with respect to the use of gold in central bank reserves:

"I do not think that we will see the time when either of those two great economic powers, the United States and the European Union, will ever again fix their respective currencies to gold as they have in the past. More likely, gold will be used at some point, maybe in 10 or 15 years when it has been banalized among central bankers, and they are not so timid to speak about its use as an asset that can circulate between central banks. Not necessarily at a fixed price, but a market price. . .Gold is going to be a part of the structure of the international monetary system for the 21st century, but not in the way it has been in the past. We can look upon the period of the gold standard, the free coinage gold standard, as being a period that was unique in history, when there was a balance among the powers and no single superpower dominated."

Seventeen years later, as Mundell predicted, gold is being bandied about as an important component in the monetary system of the future. Ben Steill of the Council on Foreign Relations, World Bank president Robert Zoelick, former Kansas City Federal Reserve president Thomas Hoenig and former Fed chairman Alan Greenspan -- all have spoken favorably of gold's restoration as a component of central bank reserves, but with the exception of Alan Greenspan, who has advocated at times a return to gold-backed money, that advocacy is along the lines described by Mundell.

* * * * * * *

X-Factors conspire against FedX-factors such as foreign bond demand or the lack thereof, do not play well with the numbers crunchers at the Fed. Economics, in their worldview, is a hard science – something that can be reduced to a string of numbers on a computer screen that can then be plugged into a formula to predict the future course of the economy. It is a worldview that says that economan and econowoman are in the end rational and predictable. They act in ways that can be defined within a computer algorithm.

Were it all that simple. . .

Alan Greenspan shed light on the limits of Fed policy in a Financial Times interview earlier this year with Gillian Tett: “I am not a neophyte," he said. "I have been trading derivatives and things and I am a fairly good mathematician. But when I was sitting there at the Fed, I would say, ‘Does anyone know what is going on?’ And the answer was, ‘Only in part’. I would ask someone about synthetic derivatives, say, and I would get detailed analysis. But I couldn’t tell what was really happening.”

Frederich von Hayek spoke eloquently on this subject in his 1974 Nobel Laureate acceptance speech, aptly named The Pretence of Knowledge:

“If man is not to do more harm than good in his efforts to improve the social order, he will have to learn that in this, as in all other fields where essential complexity of an organized kind prevails, he cannot acquire the full knowledge which would make mastery of the events possible. He will therefore have to use what knowledge he can achieve, not to shape the results as the craftsman shapes his handiwork, but rather to cultivate a growth by providing the appropriate environment, in the manner in which the gardener does this for his plants.

There is danger in the exuberant feeling of ever growing power which the advance of the physical sciences has engendered and which tempts man to try, ‘dizzy with success’, to use a characteristic phrase of early communism, to subject not only our natural but also our human environment to the control of a human will. The recognition of the insuperable limits to his knowledge ought indeed to teach the student of society a lesson of humility which should guard him against becoming an accomplice in men's fatal striving to control society - a striving which makes him not only a tyrant over his fellows, but which may well make him the destroyer of a civilization which no brain has designed but which has grown from the free efforts of millions of individuals.”

If I had my way, this quote would be bronzed and hung in the board room of the Federal Reserve directly over the seat of its new chairwoman, Janet Yellen. Paul Volcker, who many consider the best central banker of the current era, once made a comment that central banking was a modern invention largely of the past one hundred years on which the jury was still out. "By and large," he said, "if the overriding objective is price stability, we did better with the nineteenth century gold standard and passive central banks, with currency boards, or even with 'free banking."

In the wake of the 2008 debacle and its aftermath, Volcker could substitute the words "price stability" with "financial stability" and sharpen a valuable observation. In the absence of an enlightened approach along the lines von Hayek recommends, a gold diversification for the private investor can serve as ample substitute and turn out to be the most rational approach of them all.

With that, my friends, we will bring this issue in for a landing. . . . . .Happy Trails until we meet again. MK

If you are looking for a gold-based analysis of the financial markets and economy, we invite you to subscribe to our FREE newsletter – USAGOLD’s Review & Outlook, edited by Michael J. Kosares, the author of the preceding post, the founder of USAGOLD and the author of “The ABCs of Gold Investing: How To Protect And Build Your Wealth With Gold.” You can opt out any time and we won’t deluge you with junk e-mails.

By Michael J. Kosares

Michael J. Kosares , founder and president

USAGOLD - Centennial Precious Metals, Denver

Michael J. Kosares is the founder of USAGOLD and the author of "The ABCs of Gold Investing - How To Protect and Build Your Wealth With Gold." He has over forty years experience in the physical gold business. He is also the editor of Review & Outlook, the firm's newsletter which is offered free of charge and specializes in issues and opinion of importance to owners of gold coins and bullion. If you would like to register for an e-mail alert when the next issue is published, please visit this link.

Disclaimer: Opinions expressed in commentary e do not constitute an offer to buy or sell, or the solicitation of an offer to buy or sell any precious metals product, nor should they be viewed in any way as investment advice or advice to buy, sell or hold. Centennial Precious Metals, Inc. recommends the purchase of physical precious metals for asset preservation purposes, not speculation. Utilization of these opinions for speculative purposes is neither suggested nor advised. Commentary is strictly for educational purposes, and as such USAGOLD - Centennial Precious Metals does not warrant or guarantee the accuracy, timeliness or completeness of the information found here.

Michael J. Kosares Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.

.jpg)