Gold, Silver and Currency Wars

Commodities / Gold and Silver 2014 Oct 30, 2014 - 07:47 PM GMTBy: Jesse

"The US must win, since it has infinite ammunition: there is no limit to the dollars the Federal Reserve can create.

"The US must win, since it has infinite ammunition: there is no limit to the dollars the Federal Reserve can create.

What needs to be discussed is the terms of the world’s surrender: the needed changes in nominal exchange rates and domestic policies around the world."

Martin Wolf, Financial Times, 12 Oct 2010

I think this time it is Putin and the rest of the world who have said, 'nuts.' And China is playing 'Go' and skipping the trash talk, while they keep stacking their pieces where they will on the table.

I spent part of the day musing on the philosophical dimensions of money and debt. Perhaps that will bear fruit in a posting some day.

But this whole notion of the 'limit to the dollars the Federal Reserve can create' is intimately tied to the disagreement among nations I among others have chosen to call 'the currency wars.' The more theoretical that discussion becomes, the existential, the more Thomistic of a character it takes on with essence and accidents and all those things we sat through at university.

At some point in time, an Alexander will come forth and slice through that Gordian knot; and in that most real of acts make all Platonic tolerance vain, and vain all Doric discipline, with my apologies to Yeats and the sangre de Cristo.

So today could be viewed as an extensive bit of PR, and the management of perceptions. And they did a job of it. Shorter term the Fed has an impressive array of tools at its disposal. But mostly they are good at destruction and illusion and not very good at justice and sustainability.

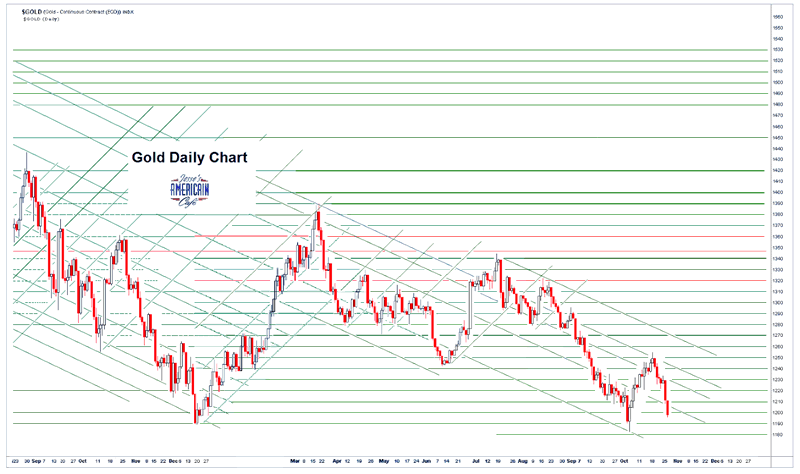

Today was a rough day for the precious metals, with the financial powers-that-be trying to prove that the end of QE III need have no negative effects on their financial engineering of The Recovery.

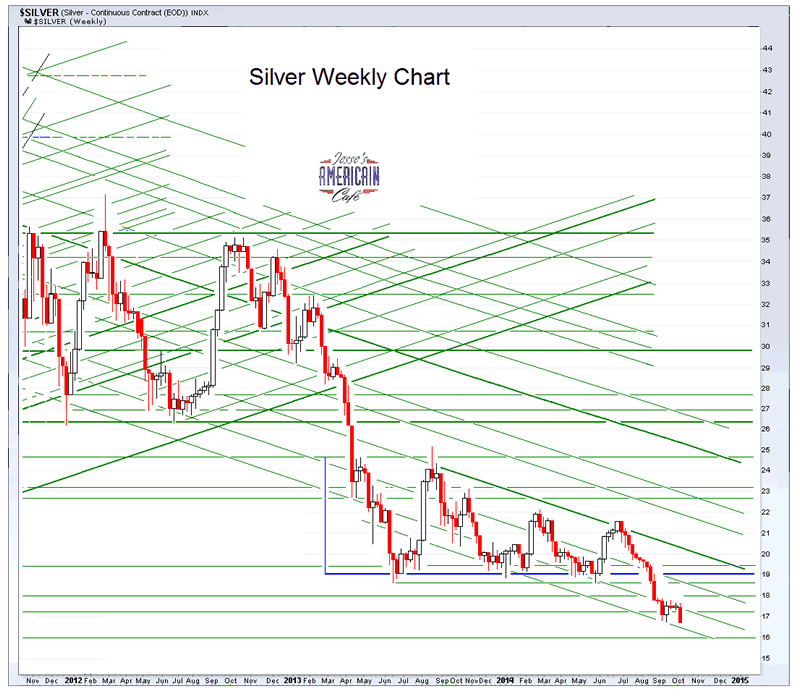

The greater the leverage or beta with regard to precious metals today the worse the decline. That seems obvious, but some disregard that when structuring their portfolios.

For example, gold bullion is performing better than silver, which is more variable, or lively, to the up and downside. And the miners and other leveraged means of owning precious metals have been taken out and beaten today.

PHYS has lost about .75% and PSLV about 2.8% since yesterday. But if one holds the miners, it could be much more.

I am not in silver in the short term here and now, but I did make one injudicious mining purchase yesterday, alas.

Let's see what happens.

By Jesse

http://jessescrossroadscafe.blogspot.com

Welcome to Jesse's Café Américain - These are personal observations about the economy and the markets. In plewis

roviding information, we hope this allows you to make your own decisions in an informed manner, even if it is from learning by our mistakes, which are many.

© 2014 Copyright Jesse's Café Américain - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Jesse Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.