The Swiss Gold Referendum Was Just a Storm in a Teacup

Commodities / Gold and Silver 2014 Dec 01, 2014 - 10:51 AM GMTBy: Bob_Kirtley

Results for Swiss gold referendum were released today, ending weeks of enthusiastic bulls calling for gold to rally to new highs on a “yes” vote and countless articles speculating about the impact of the result. The Swiss people voted overwhelmingly against the policy of that would have caused the Swiss National Bank to significantly increase their gold reserves. However, the excitement and the speculation around the potential impact of the result represents a misunderstanding of the event and indeed, the gold market as a whole.

Results for Swiss gold referendum were released today, ending weeks of enthusiastic bulls calling for gold to rally to new highs on a “yes” vote and countless articles speculating about the impact of the result. The Swiss people voted overwhelmingly against the policy of that would have caused the Swiss National Bank to significantly increase their gold reserves. However, the excitement and the speculation around the potential impact of the result represents a misunderstanding of the event and indeed, the gold market as a whole.

The chances of the proposal being passed in the first place were slim. The potential negative affect on the Swiss economy, the opposition from SNB and, as shown by the polling figures, the Swiss people, were all factors that made a rejection highly likely. However, even if one believed the contrary to these indications and that the Swiss would vote in favour of the proposed measures, why would that make them bullish on gold?

In the event that the Swiss voted to increase the gold reserves of the SNB, the added buying would have had very little impact on the gold price. The Swiss National Bank would have had five years to buy the necessary amount of gold, which estimates put at approximately 1500 tonnes. This means that the SNB could have simply bought 300 tonnes each year for the next five, which is actually a very small amount in terms of the global gold market.

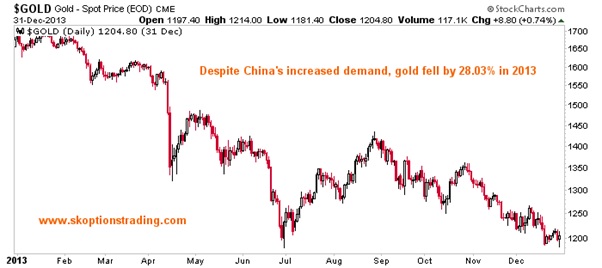

To see that an extra 300 tonnes in demand would have had little effect on the gold price one need only look at China’s purchases in 2013. Last year the country bought close to 1200 tonnes of the yellow metal, which according to the China Gold Association was an increase of at least 300 tonnes. Over that period gold still fell by 28%, its worst year on record in over a quarter of a century. This means that in a situation that sees demand for gold rise by more than one could reasonably expect to see from the passing of the Swiss gold initiative that the price of gold still collapsed.

What we can take from this is that it was unreasonable to expect that the vote would have a significant impact on the price of gold. This begs the question, why would anyone expect a vote in favour to have an effect?

The answer to this is that some, or more accurately as the recent excitement has shown, many investors misunderstand the dynamics of the gold market. A popular statistic used when citing how new demand is likely to affect price is the percentage of the mining supply that the new demand makes up.

This led to calls that if the initiative was passed that the SNB would have to purchase more than half of the global mining production, and that this would cause the price to spike. However, in 2012 around 2700 tonnes of gold was mined, which means that the entire 1500 tones required by the SNB could have been covered by 56% of that year’s production. This means that the 300 tonnes required each year could have been covered by a little over 11% of nearly mined gold. If that were the only supply of gold, then the referendum would have had the potential for a much greater impact.

What many do not realise is that there is more than 150,000 tonnes of gold stored in vaults across the world that can be traded. This means that investors and speculators have the potential to add far more to the gold supply than all of the miners combined. The result of this is that increases in demand of 300 tonnes can be easily absorbed by the gold market. This was the case with China in 2013 and what would have happened if the Swiss had voted in favour of increasing their gold reserves. This also means the supply and demand of physical gold is near irrelevant when considering the overall gold price, as investors outweigh them by such a large degree.

The probability of a result in favour of the initiative was low and the effect that this would have had on the price of gold was minimal. Nonetheless, permabulls clutched to the idea that there was the possibility of a new catalyst for higher gold prices and many others voiced their views on how bullish a “yes” vote would be, showing a clear confusion as to the workings of the gold market.

Given our views that calls for a rally on the Swiss gold vote were misplaced, we have remained short and intend to increase our short exposure to gold in the coming weeks. Our reasoning for this follows the same logic that we have used in the past to profit from both rising and falling gold prices.

The key factor in the determination of gold’s movement is the action of central banks. The accommodative stance currently being taken by the ECB has proven to be bearish for gold as it is actually likely to stimulate growth in the European economy, rather than inflate the money supply as QE1 and QE2 did.

Quantitative easing in the US is now over and the economy has continued to improve with overall growth and strengthening in the employment situation. This means that the Fed can continue to take hawkish action and move towards an interest rate hike in 2015. At the FOMC meeting later this month the Fed is likely to further discuss the timing of this increase, which is likely to have a significantly bearish impact on gold in the weeks following.

Moving to the longer term, the prospect and reality of rising interest rates in the US will drive gold to new lows, which the Swiss gold referendum did not have the potential to change. This storm in a teacup was, and is, simply noise in the market larger market situation. Many other events throughout the year have caused fluctuations in the gold price, but have not been determinants in the overall direction of the gold price, which is lower. When these have produced rallies we have faded them and have taken profits when they have caused selloffs. This situation is no different, so we will continue to hold a core short position gold going forward.

Our outlook on gold means that we have a target of $1030 for gold and will continue to take short positions on the metal to reflect this. We are so confident in our trading strategies that we are offering a money back guarantee on all 12 month subscriptions if our closed trades produce a negative return by December 1st 2015. To find out exactly what positions we currently have open in our model portfolio and our future trading recommendations the sign up below.

Bob Kirtley

Email:bob@gold-prices.biz

URL: www.silver-prices.net

URL: www.skoptionstrading.com

To stay updated on our market commentary, which gold stocks we are buying and why, please subscribe to The Gold Prices Newsletter, completely FREE of charge. Simply click here and enter your email address. Winners of the GoldDrivers Stock Picking Competition 200

DISCLAIMER : Gold Prices makes no guarantee or warranty on the accuracy or completeness of the data provided on this site. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This website represents our views and nothing more than that. Always consult your registered advisor to assist you with your investments. We accept no liability for any loss arising from the use of the data contained on this website. We may or may not hold a position in these securities at any given time and reserve the right to buy and sell as we think fit.

Bob Kirtley Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.