Gold and Silver Bears Shocked By Unusual Intra-Day Reversal

Commodities / Gold and Silver 2014 Dec 02, 2014 - 10:52 AM GMTBy: Jesse

"Through the mills of God grind slowly, yet they grind exceeding small;

"Through the mills of God grind slowly, yet they grind exceeding small;

With patience He stands waiting, with exactness He grinds all."- Baron Friedrich von Logau, Sinngedichte

As you know the Swiss gold referendum was defeated this Sunday, along with all the other initiatives issues like tax reform and immigration.

The metals bears were licking their chops and counting their chickens, and gold and silver both opened sharply lower in overnight futures trading. At one point silver broke the 15 handle and gold was testing 1150. And this was after the big price smack down in an otherwise dull holiday market on Friday for month's end.

The usual suspects, the metal perma-bear squirrels and shills, were exuberant over the folly of those wretched, foolish creatures, the goldbugs, which is anyone who might be long gold. Not to be confused with the new situation comedy called The Goldbergs which by the way is hilarious.

Even though spokespeople who work for companies that sell gold and related gold service like to deride those damn goldbugs and the yellow dawg whenever they have an opportunity like this. By the way, whatever happened to Kitco's Jon Nadler?

Well, that is how it is when the metals are down and things are at their darkest. I turned off the terminal and wrote it all off to the usual antics. I had added gold longs on the weakness last week late, some silver, and went into the Friday close buying volatility and shorting the Russell 2000.

Getting up early I had to drive in to the city to pick up some visiting relatives who had been on a little vacation, and so I missed all the action this morning.

When I came back home I was trying to brace myself for what the markets would show. And as I flipped on the television, Bloomberg TV was talking about the gold market slumping down over fifty dollars.

And then my trading terminal finally booted up and I had a pleasant surprise. I wrote about that intraday here.

Rod the Happy Hawaiian

What a reversal. What the heck happened. Gold was up about seventy dollars off the overnight lows, and silver was screaming higher with a seventeen percent gain.

The bears had come marching in last night like miles gloriosus, but were going out in the afternoon like the Italian army pursued by George S. Patton.

I was especially happy today when my long time friend and silver surfer, Rod the Happy Hawaiian, sent me an email saying that he locked in a silver buy last night with a 14 handle on it. Nice late 'Black Friday' buy. kaikaina.

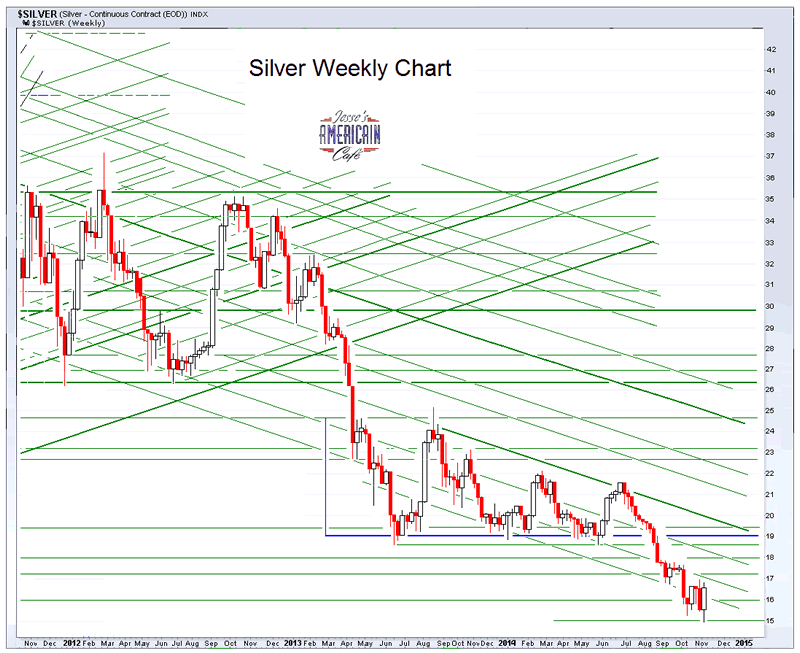

So does this mean that the bear market in the metals is over and done? Not yet.

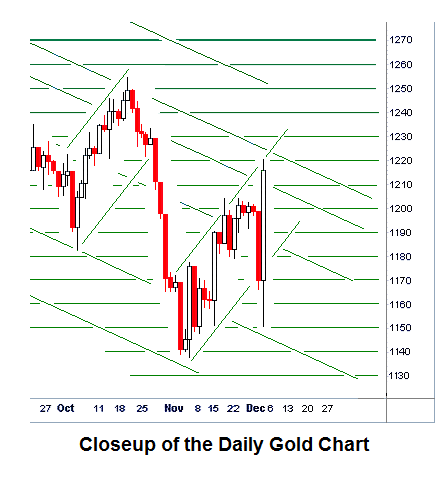

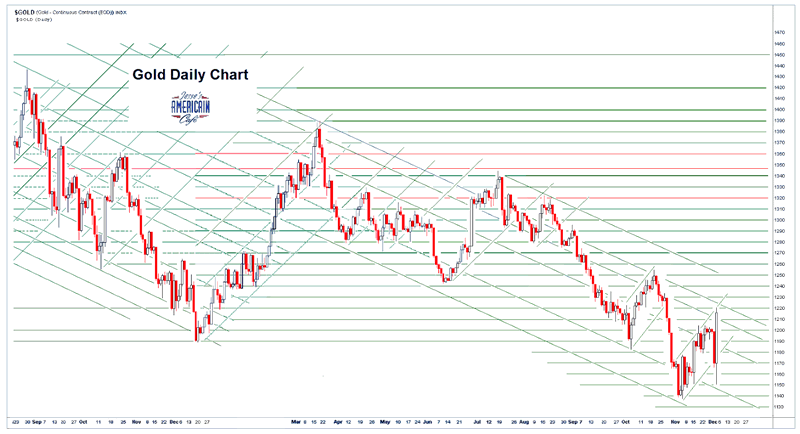

We can see from the charts that gold failed to break the downtrend yet, and has more upside work to do before we can call a trend change.

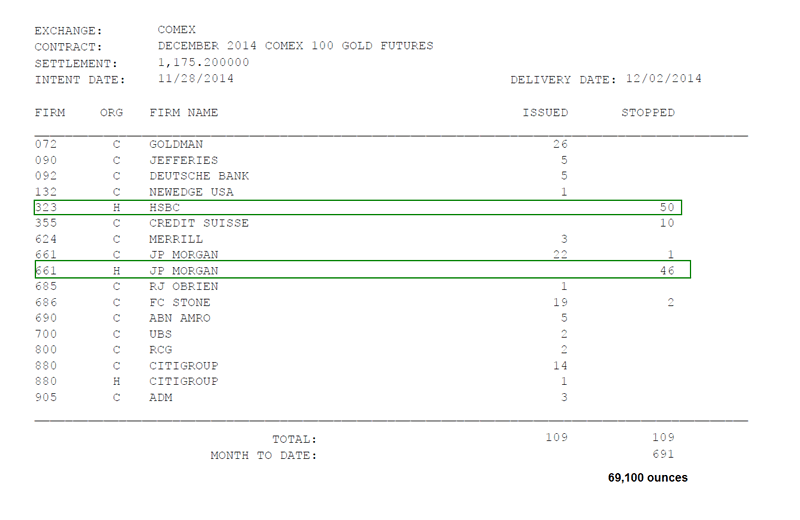

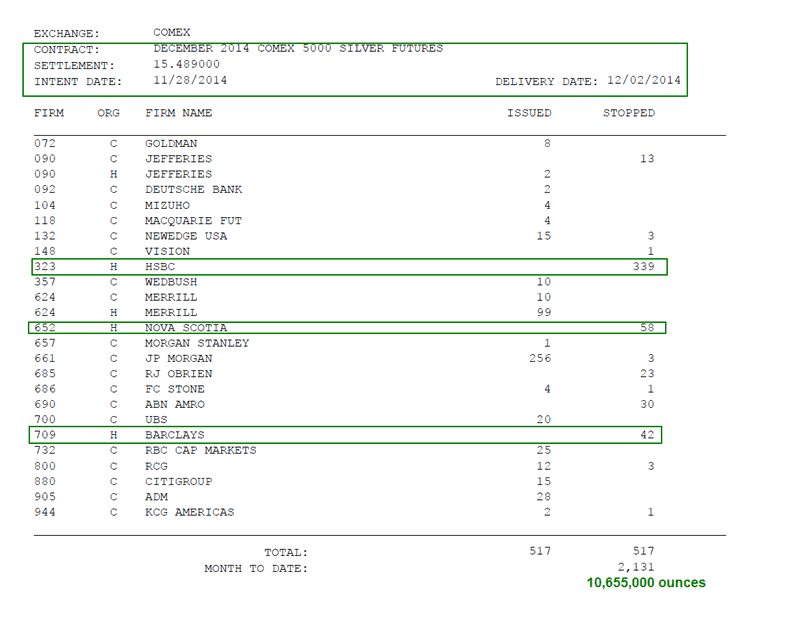

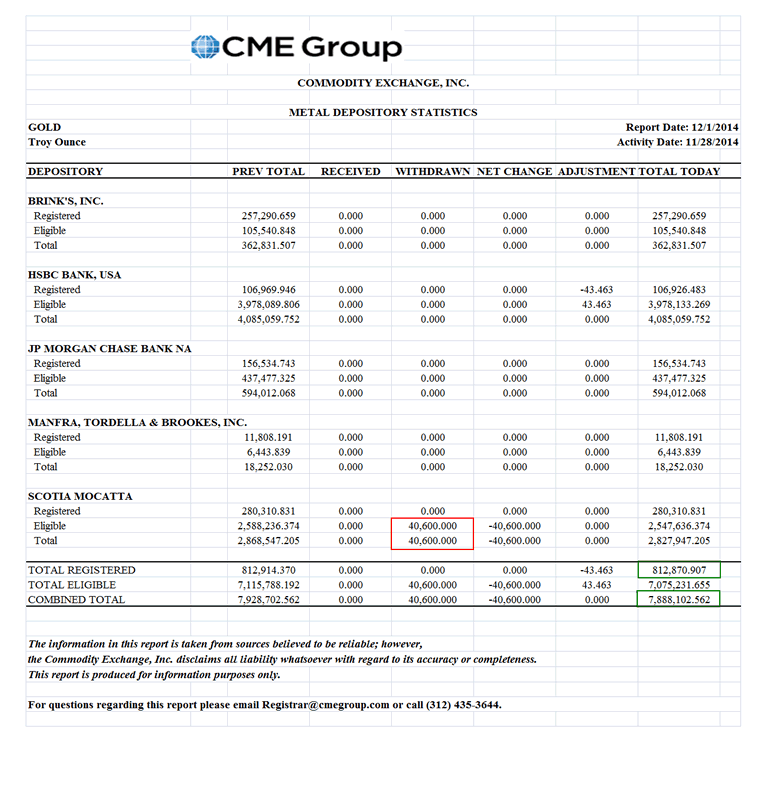

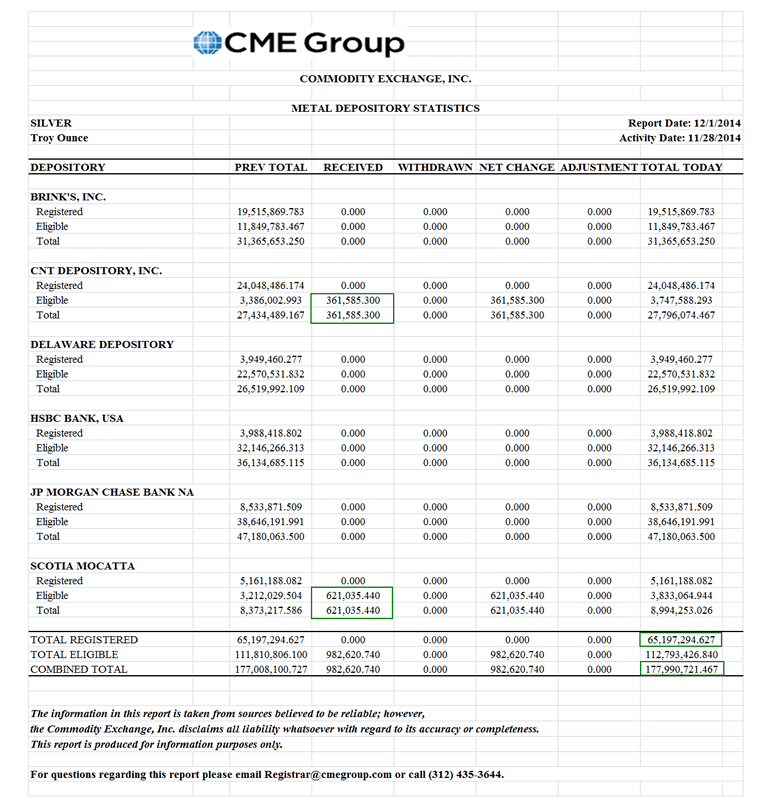

If you look at the delivery reports from last week you can see that we are now in a different month, a lot more active one to say the least. JPM and HSBC were stopping December Gold contracts for their 'house accounts,' and HSBC, Barclays, and Nova Scotia were stopping December Silver for their 'house accounts.'

So one could make the case that this was a bear trap, and that some funds and specs had come in shorting like heroes and were shorn by the big market makers like sheep. See the video excerpt below for some live action sequences.

That does not mean that this brutal bear market in the metals is over yet. But it was certainly a nice change of pace. Just because the sharks were swimming in our direction today does not mean that they will be doing so tomorrow.

I will say that if we saw such a sharp V bottom reversal in most any other market we would be looking at some fairly bullish signals. But not in the precious metals these days.

This Comex market is disconnected from the real world and any kind of fundamentals that I have been watching for quite some time. It seems more like a game of Liar's Poker than an efficient method of price discovery and capital allocation for a global industry.

So, overall the markets are still perverse and unreformed, and there is a Non-Farm Payrolls report on Friday. And I have lost any hope that the US markets will be reformed, unless they hit a very hard stop first, with all the collateral and commensurate carnage born from years of abusive practices.

Apparently the lessons from 2001 and 2008 have already been forgotten. One can appeal to reason and justice, and even to the most practical exigencies of common sense and informed self interest, but it is hard to stop a group of privileged insiders who are consumed by greed, and feel arrogantly entitled to do whatever they wish, whenever they wish, to whomever they wish, and become inordinately wealthy by doing so.

By Jesse

http://jessescrossroadscafe.blogspot.com

Welcome to Jesse's Café Américain - These are personal observations about the economy and the markets. In plewis

roviding information, we hope this allows you to make your own decisions in an informed manner, even if it is from learning by our mistakes, which are many.

© 2014 Copyright Jesse's Café Américain - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Jesse Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.