General Electric Gets Out At The Top

Companies / Company Chart Analysis Apr 11, 2015 - 11:11 AM GMTBy: John_Rubino

Back in the early 2000s, General Electric -- previously known as the world's biggest, best managed maker of cool, useful things like jet engines and wind turbines -- discovered that it could make even more money by exploiting its AAA credit rating to borrow cheap currency and lend it out at higher rates. It ramped up its vendor financing, enabling customers to buy more of its stuff, and built a real estate empire that spanned the globe.

Back in the early 2000s, General Electric -- previously known as the world's biggest, best managed maker of cool, useful things like jet engines and wind turbines -- discovered that it could make even more money by exploiting its AAA credit rating to borrow cheap currency and lend it out at higher rates. It ramped up its vendor financing, enabling customers to buy more of its stuff, and built a real estate empire that spanned the globe.

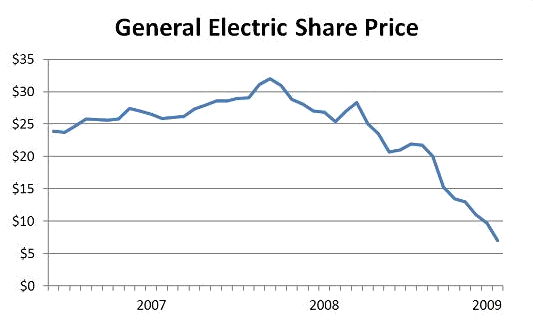

It took a while for people to figure out the the company, via its GE Capital division, had in effect become one of the world's biggest, most highly-leveraged banks. But eventually they got it, and when the real estate/derivatives bubble burst in 2008, being a major bank was like being a dot-com in 2000 or a silver miner today: a very bad thing in the eyes of shell-shocked investors. GE's market value reflected its new corporate persona:

Now it appears that GE's managers (unlike most of the people running today's governments and big banks) actually remember all the way back to the previous decade, and have decided that they don't want to live through a replay. This morning the company announced that it is selling a big part of GE Capital's real estate assets and using the proceeds to buy back stock. Some details from MarketWatch:

GE's Immelt shows how to break up a big bank

General Electric CEO Jeff Immelt has a good reason to be smiling, because he is delivering on his promise of focusing the company on its core industrial businesses.General Electric Co. just became a much safer stock for long-term investors, as CEO Jeff Immelt has finally delivered on his promise of turning the company back into an industrial powerhouse.

General Electric said on Friday that it would sell most of the assets of GE Capital Real Estate for roughly $26.5 billion to investment funds managed by Blackstone Group % with a portion of the loans going to Wells Fargo & Co.

The asset sale will result in $16 billion in first-quarter after-tax charges, of which $12 billion will be noncash charges.

This move follows the initial public offering of Synchrony Financial, GE Capital's consumer finance unit, in August. GE holds 85% of Synchrony's stock, but plans to complete its full exit from the business through a tax-free spinoff by the end of 2015.

GE Capital's remaining activity will be limited to providing financing for the parent company's industrial customers.

GE's news release announcing its latest and greatest reduction of GE Capital summed up the move beautifully, saying "the business model for large wholesale-funded financial companies has changed, making it increasingly difficult to generate acceptable returns going forward."

"Wholesale-funded" refers to GE Capital's traditional reliance on the commercial paper market for liquidity. The problem with this short-term funding model for a balance sheet with long-term assets is that during a financial crisis, overnight liquidity tends to dry up as it did for GE late in 2008. When the company had difficulty finding buyers for its paper, the Federal Deposit Insurance Corp. stepped in and through its Temporary Liquidity Guarantee Program (TLGP) was covering $21.8 billion of GE commercial paper. GE Capital registered for up to $126 billion in commercial-paper guarantees under the TLGP.

General Electric obviously wishes to avoid ever needing another government bailout. When GE Capital's ending net investment declines to roughly $90 billion at the end of 2015, the company estimates needing just $40 billion in funding, which is a relatively small amount. GE Capital will also "work with regulators" to end the unit's designation by the Financial Stability Oversight Council as a "systemically important financial institution." This means it will no longer be subject to the Federal Reserve's annual stress tests or the regulator's heightened level of scrutiny for major lenders.

Some thoughts

Wise move, now that virtually every measure of financial leverage is once again flashing red. Rich-world government debt has doubled in the past five years, student loans and subprime auto loans have replaced subprime mortgages at the junk paper buffet, and big-bank derivatives books are, amazingly, even bigger than when they nearly destroyed the global financial system. The next few years, in short, are going to be another terrible time to be a big bank, and GE's exit from that part of its business will look a lot like Sam Zell's exit from his real estate empire in 2007: really well-timed.

This won't make GE immune to a global slowdown, of course, and that's probably coming, given the oil debt and hedges on which banks now have to make good, the soon to be soaring default rates on subprime auto loans in the US and dollar carry trade plays in the developing world. So the share buybacks will probably be seen, in retrospect, as one of those peak-of-the-cycle cautionary tales for future CEOs.

But GE will at least be spared the indignity of another government bailout and share-price near-death experience.

By John Rubino

Copyright 2015 © John Rubino - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.