India Stock Market BSE SENSEX Bombay's Last Hurrah

Stock-Markets / India Feb 21, 2016 - 05:03 AM GMTBy: Austin_Galt

The BSE SENSEX is the Indian stock index which trades out of Mumbai or Bombay for those with a sense of nostalgia. Price hit a low of 22600 on the 12th February 2016 which was just over 24% down from the 2015 high of 30024.

The BSE SENSEX is the Indian stock index which trades out of Mumbai or Bombay for those with a sense of nostalgia. Price hit a low of 22600 on the 12th February 2016 which was just over 24% down from the 2015 high of 30024.

So, is that the end of the bear market? In my opinion, the answer is both yes and no. What? That sounds like I'm having a bob each way which is not uncommon for many technical analysts, I dare say!

But that ain't my style. To find out exactly what I mean, let's undertake a thorough examination of the technicals. We'll begin with the weekly and monthly charts before zooming in with the daily chart and then zooming right back out for some big picture analysis with the yearly chart.

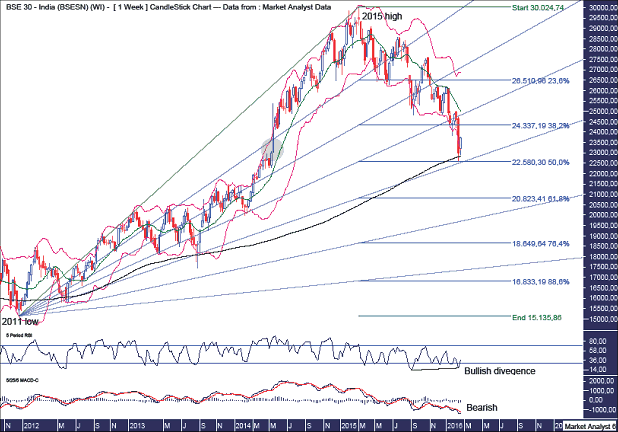

BSE SENSEX Weekly Chart

The green highlighted circle denotes the area whereby price really began to explode higher parabolic style. Price often corrects to these exact areas and that is exactly what has occurred here.

The Bollinger Bands show the recent low traded well below the lower band which is a common feature found at solid lows.

I have added Fibonacci retracement levels of the move up from 2011 low to 2015 high and this low was bang on support from the 50% level.

The Fibonacci Fan shows this low was right around support from the 61.8% angle.

The black line is the 200 period moving average and looks to have provided support.

The RSI shows a bullish divergence at this price low.

The MACD indicator is still bearish although the averages appear to be curling back up and price continuing higher from here will see a bullish crossover occurring shortly.

So, the recent low was at some very good support areas that all intersected each other at this point in time. I believe price is now headed higher. But to new all time highs?

Let's move on to the monthly chart.

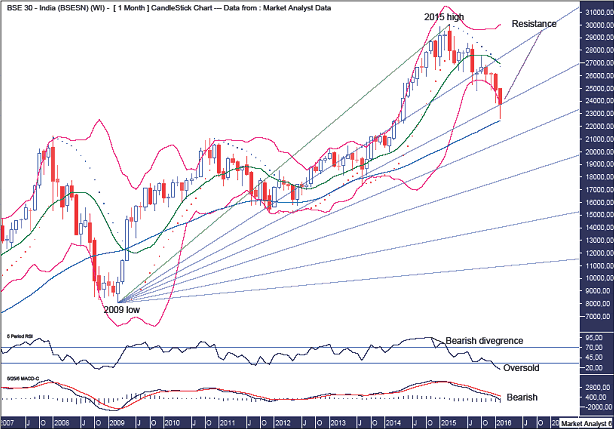

BSE SENSEX Monthly Chart

The Bollinger Bands show price pushing down into the lower band with this month's low already trading well below the lower band. I am now looking for price to bounce back possibly as high as the upper band. However, that doesn't necessarily mean new all time highs.

The PSAR indicator is bearish with the dots above price and I expect price to bust that resistance on this move higher. The dots currently stand at 26741.

The Fibonacci Fan drawn from the 2009 low to 2015 high shows price consolidating a little around the 23.6% angle before falling to just below the 38.2% angle. Price has subsequently bounced back up above this angle and I now favour a move back up to the 23.6% angle which will act as resistance.

The blue line denotes the 50 period moving average and price looks to have found support at this line.

The RSI shows a bearish divergence at the all time high while it has now made a new low in oversold territory. I expect a big rally now but considering there are no bullish divergences at this low I favour this will be a bear rally only and fail to make new all time highs.

The MACD indicator is bearish but a multi-month bear rally will likely see a bullish crossover occur in the months ahead.

So, now that I am favouring a bear rally only from here, where is this bear rally likely to end?

Let's go to the daily chart to answer that question.

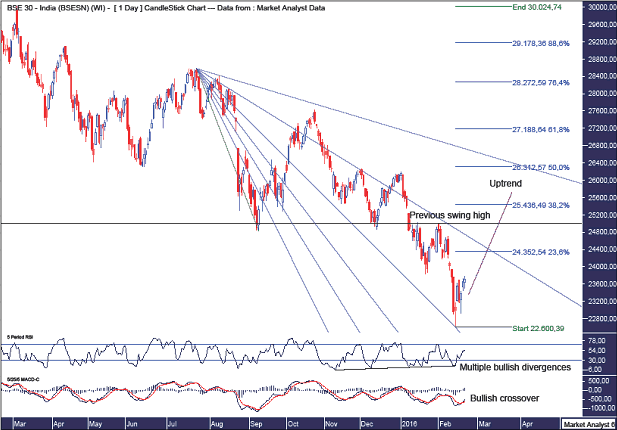

BSE SENSEX Daily Chart

I have drawn a bearish Fibonacci Fan which shows the recent low bouncing off support from the 61.8% angle.

The RSI shows multiple bullish divergences forming at this price low while the MACD indicator has just made a bullish crossover.

The horizontal line denotes the previous swing high at 25002 and price taking out that level will confirm the rally is indeed in progress.

So, how high do I expect this bear rally to trade?

First rallies in new bear trends often make deep retracements and that is my expectation here. I have added Fibonacci retracement levels of the move down from all time high to recent low and my minimum expectation is for price to reach the 76.4% level at 28272 while the 88.6% level at 29178 is not to be discounted.

So, if price rallying back to at least the 76.4% level would imply a move up of over 25%. That is considered a bull market. This explains me having a bob each way on whether or not the bear market is over. This bear rally could be considered a new bull market within the overall new bear market.

Let's wrap it up by checking out the big picture with the yearly chart.

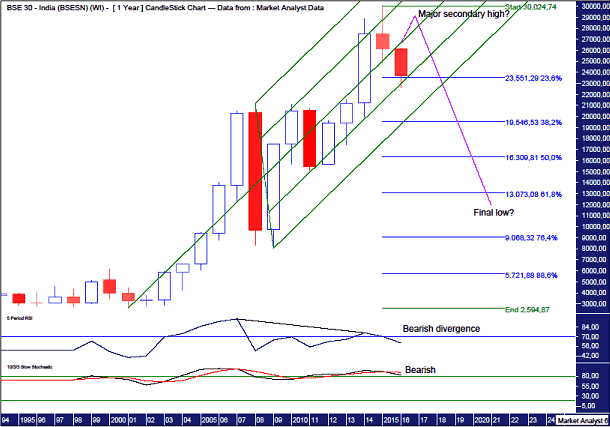

BSE SENSEX Yearly Chart

The 2015 candle was a bearish reversal with some follow through to the downside already having taken place. I now expect a move back up to test the high. Now, while I believe a bear rally only is t be seen, the bear case is actually not out of the question but price would need to take out the 2015 high this yearthereby creating a bullish outside reversal candle for 2016. That would mean a rally of over 33% this year. It is certainly possible but I just don't favour it.

I have drawn an Andrew's Pitchfork which shows the recent low right around the internal line within the lower channel. I now expect price to do some more work around the middle band before a massive downtrend begins to play out.

As for the long term view, after a major secondary high is in place, I believe price is set to get wiped out as we head into the end of the decade.

I have added Fibonacci retracement levels of the move up from 2001 low to 2015 high and price clipping the 61.8% level at 13073 will be a target to look for in the years ahead.

The RSI shows a bearish divergence forming at last year's high and this is the yearly chart no less.

The Stochastic indicator is now bearish and the last time this occurred was in 2008 and price subsequently fell over 60%. I expect a similar sized drop although the pattern for that drop should be slightly different and a significant bear rally now will see to that.

Summing up, I expect 2016 to be the last hurrah for the bulls in Bombay.

By Austin Galt

Austin Galt is The Voodoo Analyst. I have studied charts for over 20 years and am currently a private trader. Several years ago I worked as a licensed advisor with a well known Australian stock broker. While there was an abundance of fundamental analysts, there seemed to be a dearth of technical analysts. My aim here is to provide my view of technical analysis that is both intriguing and misunderstood by many. I like to refer to it as the black magic of stock market analysis.

Email - info@thevoodooanalyst.com

© 2016 Copyright The Voodoo Analyst - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Austin Galt Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.