How to Win Against the Dangerous Stock Market Investor "Herding Impulse"

Stock-Markets / Learning to Invest Aug 04, 2017 - 12:37 PM GMTBy: EWI

We all love a bargain...

We all love a bargain...

...Except when it comes to stocks.

The reason boils down to uncertainty. We know what our fruits and vegetables should cost at the grocer's -- but we're far less certain about how much to pay for a blue-chip stock or shares in an S&P 500 Index fund.

So how does our mind work in decisions that involve certainty vs. uncertainty?

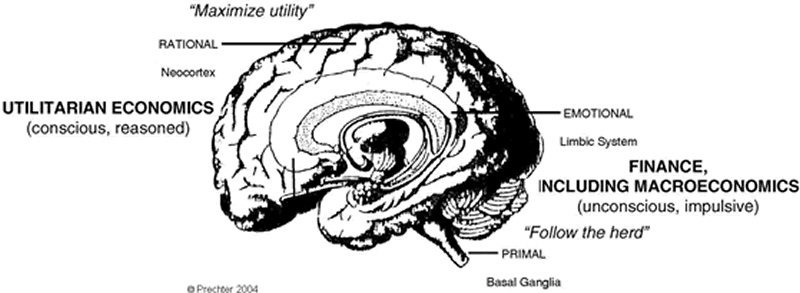

Robert Prechter and Wayne Parker, co-authors of the paper, The Financial/Economic Dichotomy in Social Behavioral Dynamics: The Socionomic Perspective” (Journal of Behavioral Finance, Vol. 8, No. 2, pp. 84-108, 2007) explain that in each situation, very different regions of the brain take over -- literally.

When we spend money as consumers, we depend on the neocortex region of the brain, where our ability to reason resides.

For example, if we shop for groceries and see our favorite fruit on sale at a 40 percent discount, we think "That's a good deal. I make the best use of my money by buying it now." And, if we hang around to watch how other shoppers behave, we see that particular item sell out sooner than usual. In other words: The demand for consumer goods rises as the price falls.

But when we spend money as investors, our brain relies on the more primitive region -- the basal ganglia -- which drives unconscious behavior such as herding.

Let's say that 30 minutes after the stock market opens, we see that the blue-chip stock we own is down 20 percent. We know that shareholders are fleeing the stock. The basal ganglia screams, "They know something I don't. I'd better sell too." In this case, demand for the asset FALLS as the price falls. Why?

Because in speculative markets, assets have no true utility. An investor buys it today in the hope that it will be worth more to another investor tomorrow. But that future value is uncertain, so the brain defaults to herding.

The sketch of the brain shows the locations of the conscious, reasoning neocortex and the unconscious, impulsive lower areas:

In other words, herding impulses force you to "buy high -- and sell low," precisely the opposite of what you should be doing.

Can you win? Yes.

Instead of getting wrapped up in the day's news, when you study the collective psychology of market participants, you see the markets objectively -- and separate yourself from the herd.

You can see the market's psychology shift right before your eyes -- when you look at price charts. The trends you see are not random; they are patterned according to the Elliott Wave Principle: 5 waves in the direction of the trend, and 3 waves against it.

When you know these patterns, you can make probability-based forecasts.

|

If you are prepared to take the next step in educating yourself about the basics of the Wave Principle -- access the FREE Online Tutorial from Elliott Wave International. The Elliott Wave Basic Tutorial is a 10-lesson comprehensive online course with the same content you'd receive in a formal training class -- but you can learn at your own pace and review the material as many times as you like! Get 10 FREE Lessons on The Elliott Wave Principle that Will Change the Way You Invest Forever. |

This article was syndicated by Elliott Wave International and was originally published under the headline How to Win Against the Dangerous "Herding Impulse". EWI is the world's largest market forecasting firm. Its staff of full-time analysts led by Chartered Market Technician Robert Prechter provides 24-hour-a-day market analysis to institutional and private investors around the world.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.