Why Doesn’t Janet Yellen Resign?

Politics / US Federal Reserve Bank Sep 27, 2017 - 06:28 PM GMTBy: Raul_I_Meijer

You would think, certainly if you were as naive and innocent as I am, that when you get offered the job of Chair of the Federal Reserve, you must be sure, before accepting, that you have the credentials and the knowledge required. If you don’t, it looks as if you don’t take the job seriously. Janet Yellen, who’s been Chair since January 2014, doesn’t seem to agree.

You would think, certainly if you were as naive and innocent as I am, that when you get offered the job of Chair of the Federal Reserve, you must be sure, before accepting, that you have the credentials and the knowledge required. If you don’t, it looks as if you don’t take the job seriously. Janet Yellen, who’s been Chair since January 2014, doesn’t seem to agree.

In a speech Tuesday for the National Association for Business Economics Yellen ‘honestly’ admitted that she doesn’t understand inflation, control of which is the Fed’s no.1 task (it’s debatable whether that’s a good idea). She doesn’t understand a bunch of other issues either. Those are her own words, not mine. Here are these own words:

“My colleagues and I may have misjudged the strength of the labor market, the degree to which longer-run inflation expectations are consistent with our inflation objective, or even the fundamental forces driving inflation..”

Clear enough, you would think. But she didn’t offer her resignation. And for an important post like Fed chair, that is a major problem. As she undoubtedly does. So why is she keeping her job? Doesn’t she realize that when you don’t understand the issues you deal with, you’re prone to make disastrous mistakes?

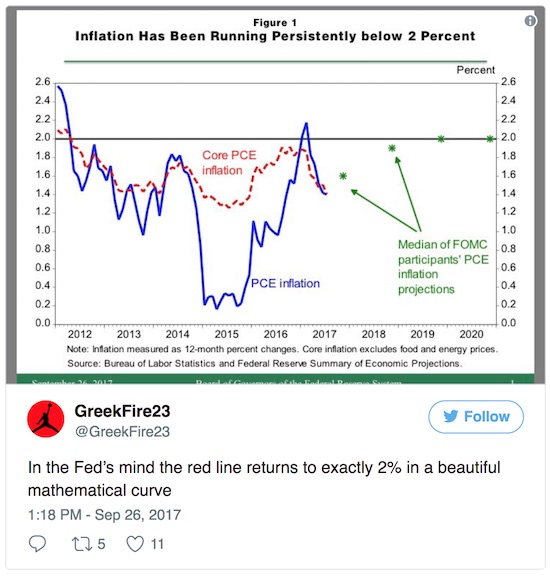

Yellen and her colleagues work with models, and the models are wrong. The Fed’s predictions for things like inflation are ridiculously off, all the time. That may be news to her, but it’s old hash for many people in her field. So that she’s surrounded solely by people who don’t understand these things either is not an excuse.

So what does she expect now? That she will start to understand them all of a sudden, after years and years of not being able to? That reality will change to comply with her models? We can discount the option that she will suddenly begin using entirely different models, they’re all she has. But what then?

Under her predecessor Ben Bernanke, who never conceded he had no idea either but still didn’t, the Fed lowered interest rates to near zero Kelvin and bought trillions of dollars in bonds and securities. Now Yellen for some reason thinks it’s time to get rid of the stuff.

But on what basis does she make such a decision, if she self-admittedly doesn’t even understand the fundamental forces in play? How is that different from handing a box of matches to a 3-year old? Isn’t she really simply an academic dropped in a casino? From CNBC:

Yellen said a regular pace of rate hikes ahead is likely still warranted, though Fed officials are looking closely at the assumptions underlying those projections. While conceding that the Fed may need to slow the removal of accommodation, she also said the central bank “should also be wary of moving too gradually.”

There comes a point when naive innocent me starts asking: what does that even mean? Rate hikes are warranted but we don’t know why? Accommodative policies have been going too fast but they shouldn’t be too slow? Based on what? It can only be based on models that have proven faulty, can’t it, because they have no others.

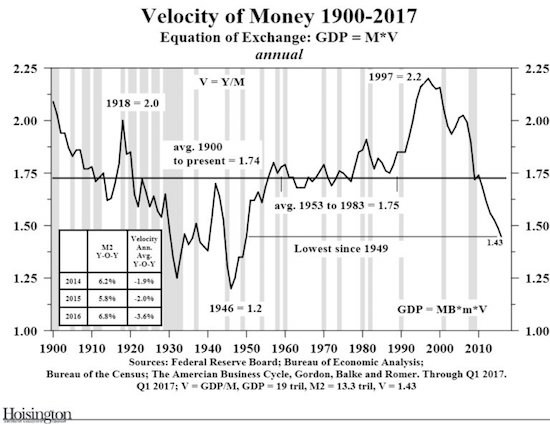

Here are a few pointers for the occupants of the Marriner S. Eccles Federal Reserve Board Building. Inflation is money velocity multiplied by money and credit supply. MV = PY. M is money supply, V is velocity, P is price level and real GDP is Y.

Velocity of money means consumer spending. 70% of US GDP is consumer spending. But American consumers are neck deep in debt and have very little money left to spend. Much of what they spend, they must borrow.78% of Americans live paycheck to paycheck. So forget about money velocity.

Moreover, as for the Fed’s second mandate after inflation, full employment, they don’t get that one either. They seem to act on the presumption that any one job is just like the other. And then bleat: “My colleagues and I may have misjudged the strength of the labor market”.

But America has turned into a nation where the gig economy (the natural successor to first the knowledge economy, then the service economy), waiters, greeters and people working 3 jobs just to make ends meet have become the norm. When in the present circumstances you claim to have almost ‘achieved’ full employment, as Yellen and the Fed do, you must really be blind as a bat.

The other side of the equation is money supply. Interestingly, the Fed has issued tons of it, but handed it all to its owner banks. If they had spent it inside the economy itself, we could have been looking at a whole other picture. If those trillions would have gone to investment, manufacturing etc., instead of propping up banks and companies buying their own shares, Yellen might have actually seen some inflation.

If Americans have no money to spend, there can not be inflation. Simple. But the same stupid faulty predictions just keep coming:

So why is anybody still paying attention to Janet Yellen? Well, because she has her finger on the biggest financial trigger on the planet. No matter how shaky and uneducated that finger may be. Or do we pay attention exactly because we know what’s behind that shaky finger? Do we all put everything on red just because grandma does it too?

The craziest thing of all is that in reactions in the media to Yellen’s speech, she’s praised for admitting she has no clue what she’s doing. That takes the cake. And eats it too. Praised for admitting you’re terribly unfit for your job. That’s just great. That’s Bizarro world.

It’s well past best before time to get rid of Janet Yellen, and all the intellectual but idiots who work at the Fed. What is it, 1,000 PhDs, or was that 10,000? But the only thing that makes any real sense of course, the only thing that can save the nation, is to get rid of the Fed and its braindead mandates, interests and occupants altogether.

Hedgeye got this one painfully right:

And yeah, I know Yellen could be fired too if she doesn’t resign, but with Goldman Sachs all over the White House, what are the odds? And who would come in when she goes? She’s ideal, who’s going to get angry at a barely 5′ grandmother even is she clearly out of her depth and league?

By Raul Ilargi Meijer

Website: http://theautomaticearth.com (provides unique analysis of economics, finance, politics and social dynamics in the context of Complexity Theory)

© 2017 Copyright Raul I Meijer - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Raul Ilargi Meijer Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.