Some Traders Hit. Some Traders Miss. Here's How to be Part of the 1st Group

InvestorEducation / Company Chart Analysis Nov 22, 2017 - 03:32 PM GMTBy: EWI

Also, watch Jeffrey Kennedy identify two high-confidence trade set-ups in Johnson & Johnson (NYSE: JNJ)

Also, watch Jeffrey Kennedy identify two high-confidence trade set-ups in Johnson & Johnson (NYSE: JNJ)

'It's the most wonderful time of the year,' goes the famous holiday song. Except on Black Friday morning, that is, when a deadly stampede of shoppers at the big-name box store runs Granny down in the dry goods aisle.

But, if you think about it, a Black Friday stampede is not that different from a trading 'stampede' when thousands of trades all rush into the same hot stock.

When the trading "doors" open and a throng of people are all angling for the same opportunity as you, the clock is ticking. Under pressure, many traders race headlong into that market, palms sweating, heart racing, with no secure trading plan in place.

Have you ever been part of that crowd? That's OK. All traders have.

Our very own master analyst Jeffrey Kennedy describes this tendency in his newest educational resource '12 Real Life Techniques That Will Make You a Better Trader Now.' It's a collection of 5 video tutorials, and in the third one Jeffrey nails the 'stampede' impulse on the head:

"The reason is because people are running on a 'lack' mentality. Everybody's knocking each other down, fighting to get to the front of the pack because again, they're thinking there's a limited supply of whatever items, say flat-screen TV's.

Well, ever since they made flat-screen TV's, I don't think there has ever, in reality, been a single day that I couldn't go out and buy whatever flat-screen TV I've wanted. I could buy five a week if I wanted to because the supply is out there.

Likewise, there's plenty of opportunity in the markets. Literally, there is more opportunity than you actually have money in your trading account. By understanding that, you begin to discard the 'lack' mentality, and embrace an abundant one."

That's 1 lesson of 12: "Wait for the market to commit to you before you commit to the market" because no matter what, there is always another opportunity waiting just around the corner.

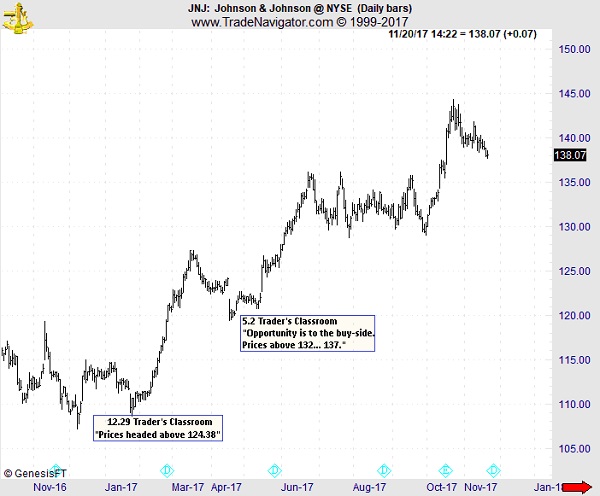

It helps, of course, to know exactly what you're waiting for. In the second video of this five-video series, Jeffrey catalogs the "four critical elements of a high-confidence trade set-up," using the price chart of Johnson & Johnson stock (NYSE: JNJ)

JNJ Opportunity #1: December 29, 2016 Trader's Classroom lesson. There, Jeffrey identified recent selling as a corrective fourth wave and called for the resumption of the larger uptrend in a fifth wave rally "above $124.38."

JNJ Opportunity #2: May 2, 2017 Trader's Classroom video lesson, where Jeffrey showed subscribers how, if they missed the big JNJ rally from December, there was another "opportunity to the buy side" -- one that would take prices to $132, or even $137.

The chart below shows how Jeffrey's objective criteria kept his subscribers one step ahead of two major opportunities in this popular stock:

Want to watch Jeffrey's actual video forecast where he analyses JNJ in real-time?

Press play and enjoy!

Some traders hit. Others, miss. Learn to be part of the first group today with Jeffrey's five-video educational resource, "12 Real Life Techniques That Will Make You a Better Trader Now."

Let our own Master Instructor Jeffrey Kennedy share with you 5 videos with 12 battle-tested trading tips. These free lessons will make you understand the steps you should always take to capitalize on new market opportunities.

This article was syndicated by Elliott Wave International and was originally published under the headline Some Traders Hit. Some Traders Miss. Here's How to be Part of the 1st Group. EWI is the world's largest market forecasting firm. Its staff of full-time analysts led by Chartered Market Technician Robert Prechter provides 24-hour-a-day market analysis to institutional and private investors around the world.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.