Commodities, CRB, Oil & Gas, Gold, Silver... Markets Big Picture Update

Commodities / Commodities Trading Dec 31, 2017 - 04:17 PM GMTBy: Gary_Tanashian

Some monthly charts of interest in the commodity sector, including precious metals.

Some monthly charts of interest in the commodity sector, including precious metals.

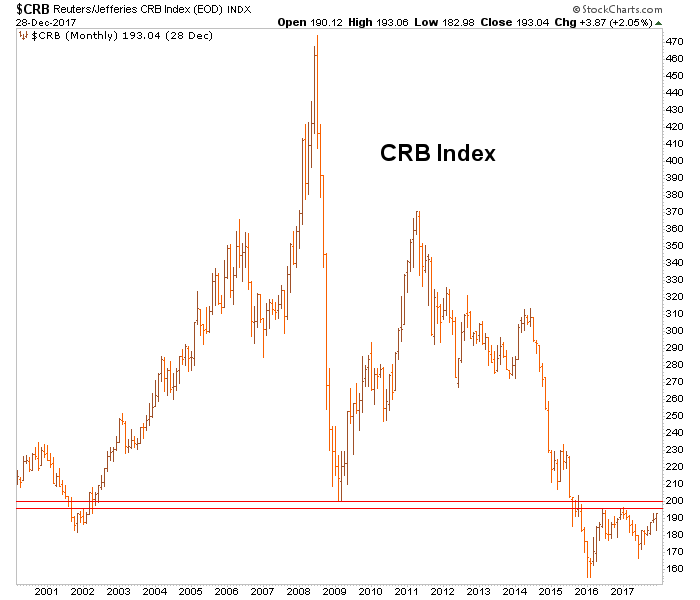

CRB Index dwells below key resistance. A break of 200 would target around 250 in 2018.

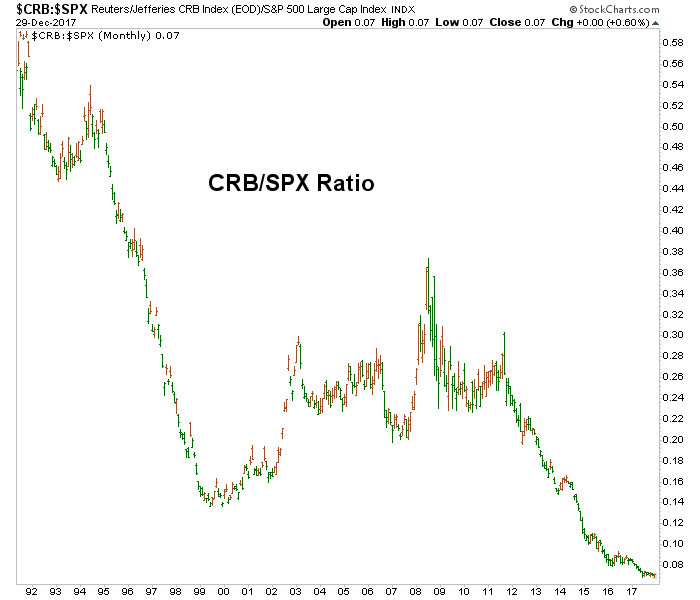

CRB/SPX Ratio shows the utter devastation of the Goldilocks era of Central Bank inflation with no apparent consequences. This is not likely to last.

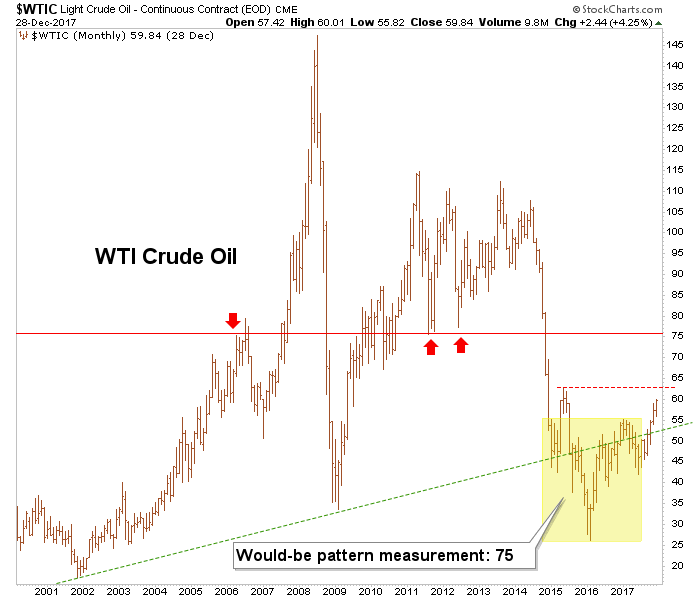

WTI Crude Oil sits below resistance at 62-63, with a target of 75.

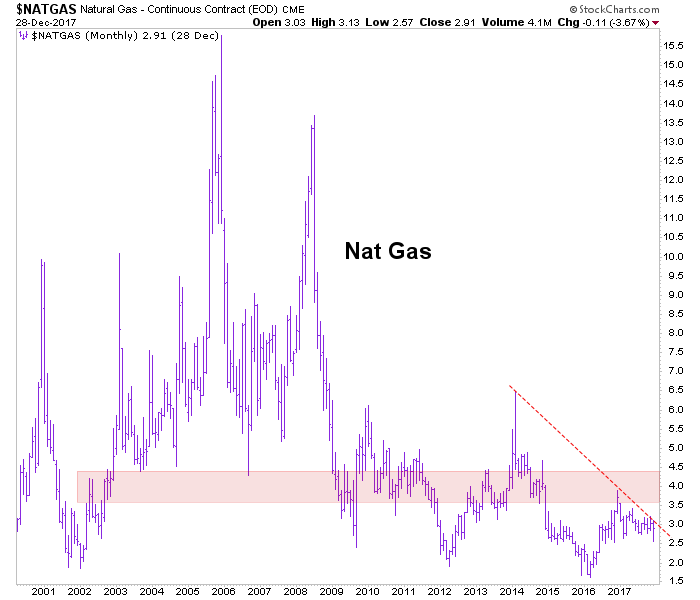

NatGas is a basket case non-starter. The first step would be to break the red dashed line. After that, lots of overhead.

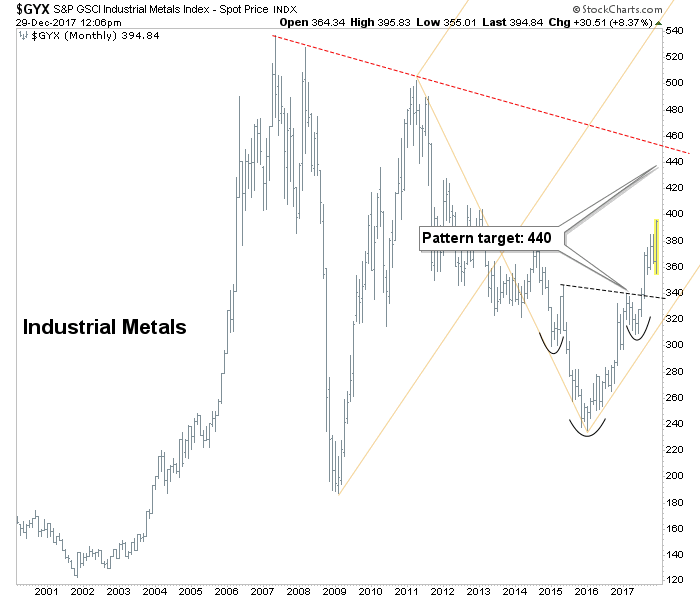

Industrial Metals have been a favored area for a would-be inflation phase in 2018. The chart explains why.

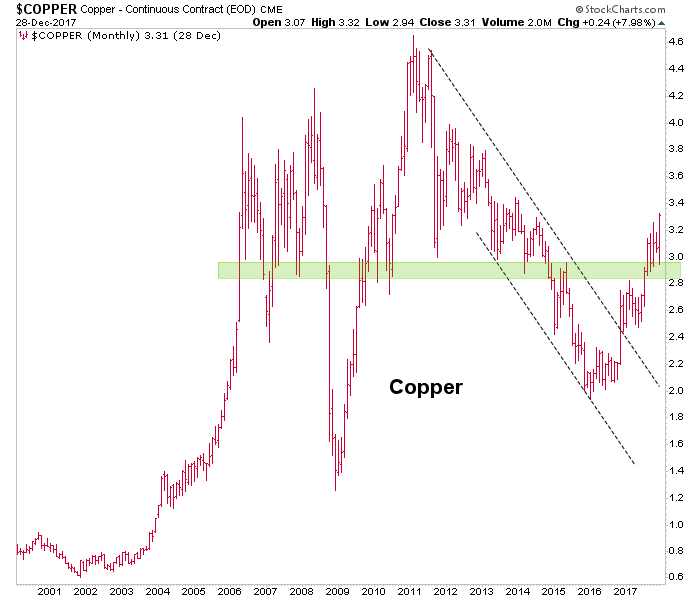

Copper broke through resistance and turned it green through multiple tests of the 2.90 area. It measures to approximately 3.80/lb.

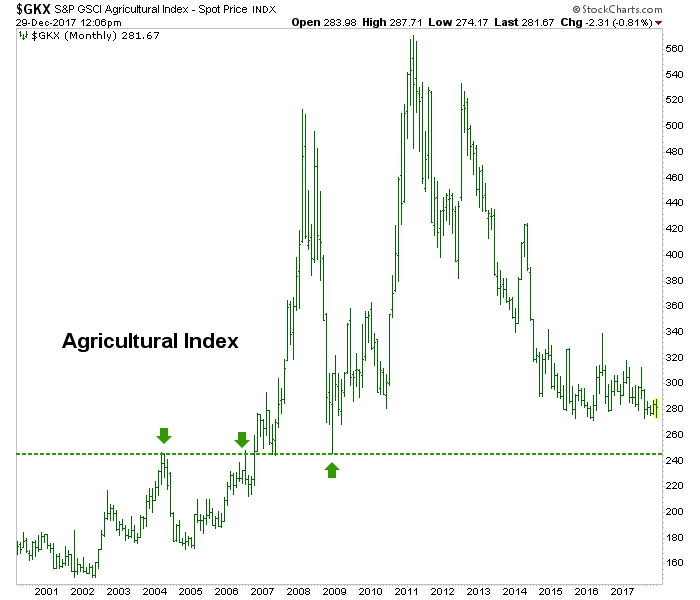

GKX could bounce with the sector but there is no technical sign that it is preparing to do so. Our long-held support (buy) target is 240 for Agri.

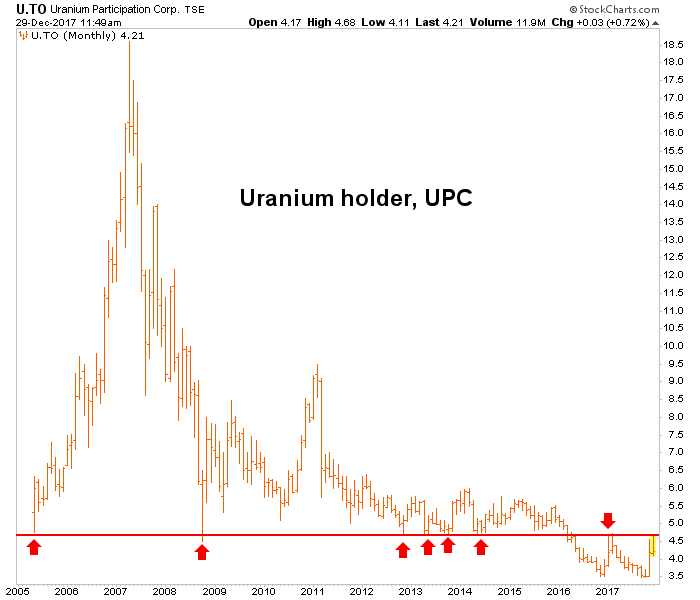

Uranium Participation, which holds u3o8, bounced on supply cut news but is at massive long-term resistance.

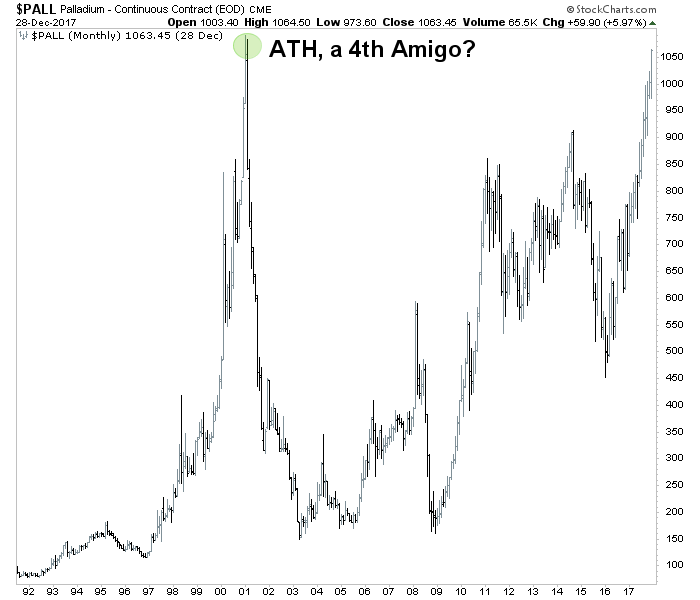

Palladium approaches all time highs. Is this a 4th Horseman? The other 3 Amigos are also riding. You may recall that in early 2013 we cross referenced a bullish Palladium/Gold ratio with bullish fundamental signs in the Semi Equipment sector to project a firming economy. Voila… and now we wait for all the happy stuff to finish up.

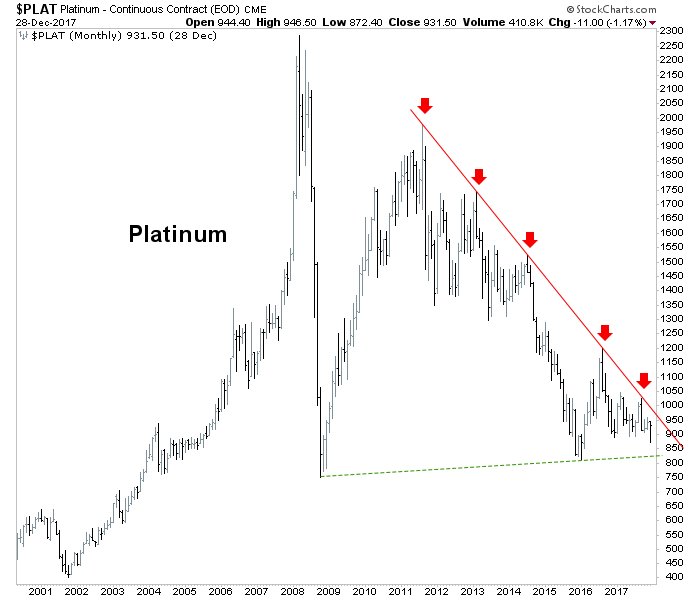

Platinum has been in lock down since the last commodity cycle blew out in 2011. This precious commodity could be a good play for 2018.

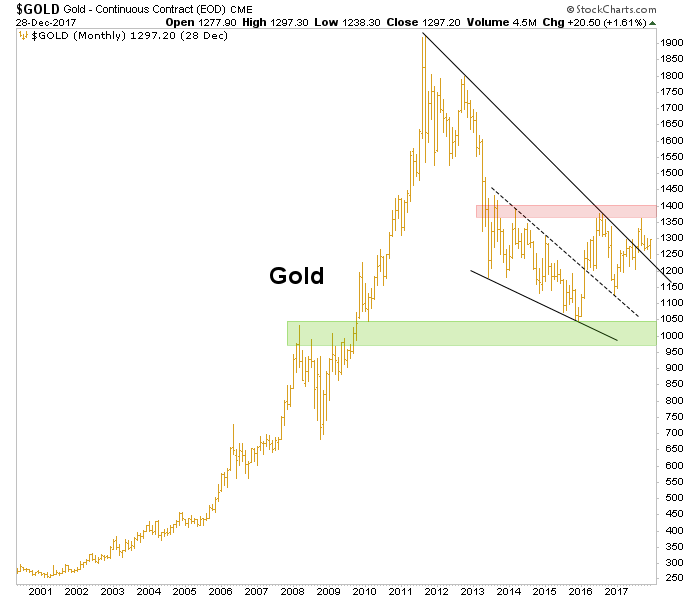

Gold stopped at the resistance that should have stopped it (that would be the gateway to a confirmed bull phase) and has inched back down the wedge. Ho hum… gold is fine.

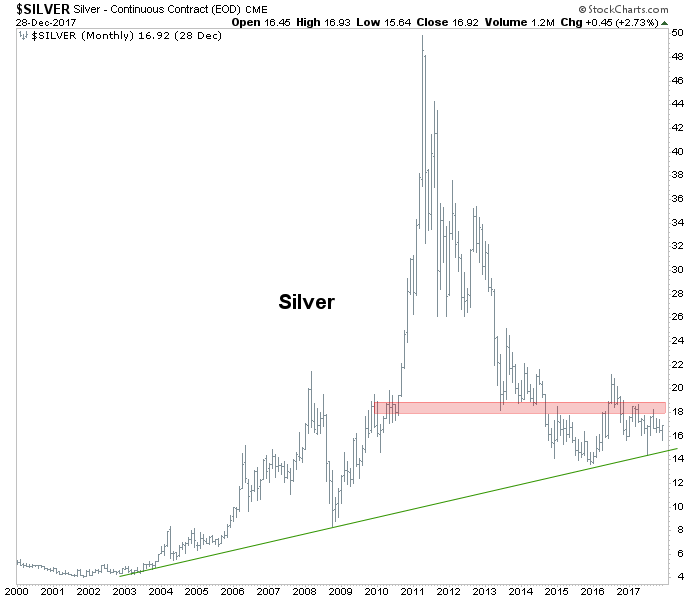

Silver is fine too, in that it has not gone anywhere yet and held the trend line (which I expect to remain the case if a firm commodity view plays out in first half 2018).

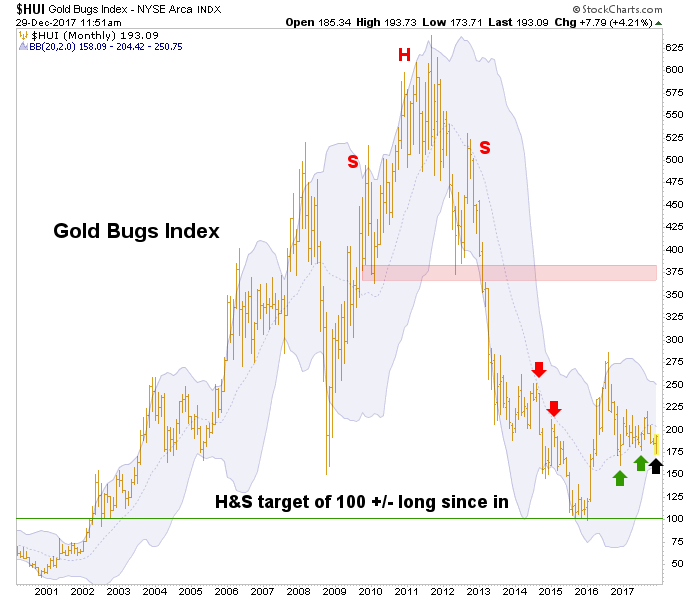

Gold Miners are and have been in a process. Remember gold bugs, the sector does not distinguish itself as unique until the commodity items above eventually flame out along with the broad markets. So for now, it’s ‘inflation trade’ and this sector is not special. The ongoing consolidation in HUI is interesting though, and this will be the sector in waiting when things fall apart.

Happy New Year folks! 2018 is going to be interesting at least, and potentially very rewarding. Whatever awaits us, I look forward to continuing to interpret and manage it successfully for NFTRH subscribers’ consideration and benefit.

Subscribe to NFTRH Premium for your 40-55 page weekly report, interim updates and NFTRH+ chart and trade ideas or the free eLetter for an introduction to our work. Or simply keep up to date with plenty of public content at NFTRH.com and Biiwii.com. Also, you can follow via Twitter ;@BiiwiiNFTRH, StockTwits, RSS or sign up to receive posts directly by email (right sidebar).

By Gary Tanashian

© 2017 Copyright Gary Tanashian - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Gary Tanashian Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.