2018 US Stock Market Rally Is Just Starting

Stock-Markets / Stock Markets 2018 Jan 04, 2018 - 03:16 PM GMTBy: Chris_Vermeulen

Last week, we posted our research showing that the US markets were setting up for a 2018 Q1 rally based on our research using our advanced predictive analysis modeling tools – the Adaptive Dynamic Learning model. This model attempts to find unique price, technical and indicator patterns in past price bars and then attempts to find similar patterns in newer price bars. When multiple price bars with similar pattern structures are found, it maps these as “unique genomic structures” and attempt to learn from the future price activities. This unique modeling system was created by our team of skilled market researchers in an attempt to provide accurate insight into the markets future price swings.

Last week, we posted our research showing that the US markets were setting up for a 2018 Q1 rally based on our research using our advanced predictive analysis modeling tools – the Adaptive Dynamic Learning model. This model attempts to find unique price, technical and indicator patterns in past price bars and then attempts to find similar patterns in newer price bars. When multiple price bars with similar pattern structures are found, it maps these as “unique genomic structures” and attempt to learn from the future price activities. This unique modeling system was created by our team of skilled market researchers in an attempt to provide accurate insight into the markets future price swings.

In doing so, our predictive analysis modeling systems can attempt to tell us what is the highest likelihood of price activity going out 10, 15 and even 20 daily bars into the future. The forecasted highs and lows you should focus on are the yellow lines. The closer together these yellow lines are (predicted high/predicted low, the more confident we can be that prices should follow this path. The farther apart they are, the more likely we will see increased volatility and the potential for larger swings in price range.

The article we posted last week was titled “2018 First Quarter Rally” for your reference.

As of this week, only a few days into the new 2018 trading year, the US markets are already up between 1~2.5% and likely have another 1~3% more upside activity before finding any resistance. Let’s take a look at some charts.

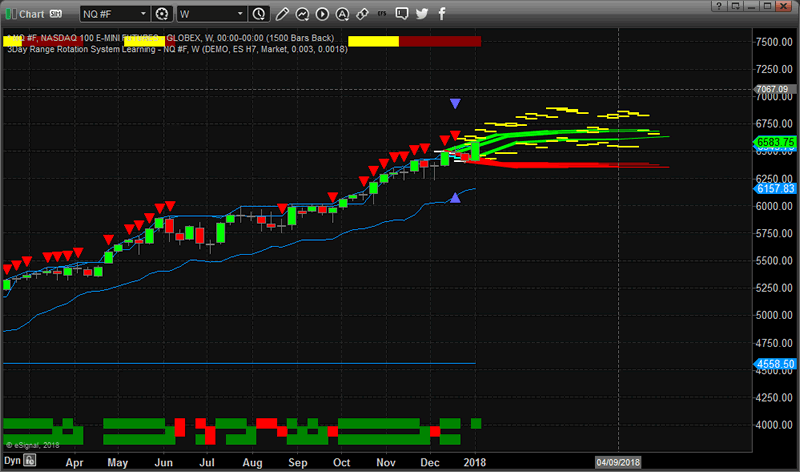

This Weekly chart of the Nasdaq (NQ) clearly shows the expected future price levels and ranges going out nearly three months into the future. You can see from this chart that the YELLOW LINES are predicting generally higher price levels through the end of February 2018 when a sudden price consolidation is expected. This will likely result in a 2~5% price decline sometime between February 21 and March 26, 2018. After this brief rotation, the Adaptive Dynamic Learning modeling system is predicting further price advancements in the range of 2~3% or more before stalling again in late April 2018. So pay attention, any lows in the NQ below 6485 are likely very strong BUY TRIGGERS.

Now, let’s take a look at the SPY on a Weekly basis.

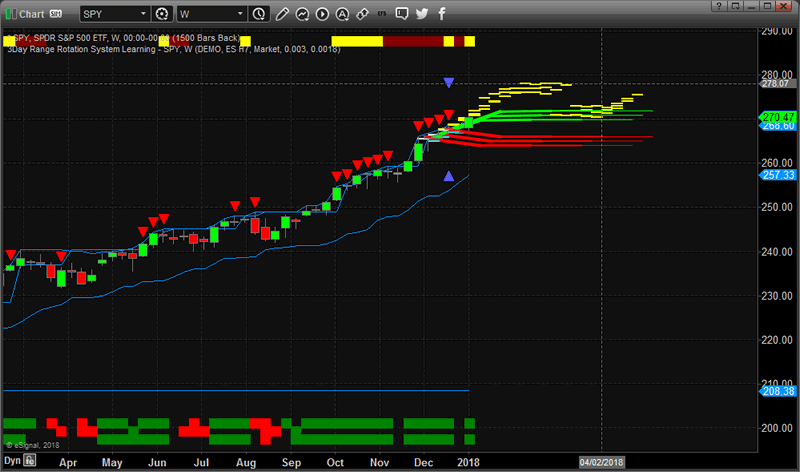

The SPY chart is more uniform in structure and alignment with the ADL predictive modeling system. This tells us that the price volatility for this symbol will be more muted than the NQ Futures chart. It also tells us that we may not see the same level of volatility enter the SPY till after January 22, 2018 – which is when the first real measurable divergence in predictive price levels happens.

The first measurable rally in the SPY in 2018 should be about 2.5~3% from 2017 closing price levels and end near February 12th or so. This move will be followed by a very short downside price correction of about -1~2% ending near March 10th~16th. The next leg higher could be relatively large with a 3~5% rally through the end of April 2018.

We are predicting that this first Quarter in 2018 will see a continued market rally with a brief pause/stall in price near the end of February or early March. We believe the Q1 final results will be the NQ ending 3~5% higher than the 2017 closing price and the SPY ending 5~6% higher than the 2017 closing price. Are you ready for this move? Do you know which stock or ETF you should trade for maximum return? We can help you!

So far, our predictions about 2018 have been very accurate with this modeling system and you should be able to see the value of “being able to see into the future” with our various forecasting modeling system. Our team of researchers and professionals at Technical Traders Ltd. are here to assist you in finding and executing profitable trades each week with our unique research, modeling tools and trade alerts. Imagine how much more successful 2018 would be for you if you knew what the rest of the year would look like?

Visit www.TheTechnicalTraders.com to learn how we can assist you in finding and executing successful strategies during the next two years as the major trends start to shift and new strategies will be required to profit from elevated volatility and falling prices. Join today and make 2018 one of your best trading years yet.

Chris Vermeulen

www.TheGoldAndOilGuy.com – Daily Market Forecast Video & ETFs

www.ActiveTradingPartners.com – Stock & 3x ETFs

Chris Vermeulen is Founder of the popular trading site TheGoldAndOilGuy.com. There he shares his highly successful, low-risk trading method. For 7 years Chris has been a leader in teaching others to skillfully trade in gold, oil, and silver in both bull and bear markets. Subscribers to his service depend on Chris' uniquely consistent investment opportunities that carry exceptionally low risk and high return.

Disclaimer: Nothing in this report should be construed as a solicitation to buy or sell any securities mentioned. Technical Traders Ltd., its owners and the author of this report are not registered broker-dealers or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer. Never make an investment based solely on what you read in an online or printed report, including this report, especially if the investment involves a small, thinly-traded company that isn’t well known. Technical Traders Ltd. and the author of this report has been paid by Cardiff Energy Corp. In addition, the author owns shares of Cardiff Energy Corp. and would also benefit from volume and price appreciation of its stock. The information provided here within should not be construed as a financial analysis but rather as an advertisement. The author’s views and opinions regarding the companies featured in reports are his own views and are based on information that he has researched independently and has received, which the author assumes to be reliable. Technical Traders Ltd. and the author of this report do not guarantee the accuracy, completeness, or usefulness of any content of this report, nor its fitness for any particular purpose. Lastly, the author does not guarantee that any of the companies mentioned in the reports will perform as expected, and any comparisons made to other companies may not be valid or come into effect.

Chris Vermeulen Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.