Natural Gas Got Bomb Cyclone in the New Year

Commodities / Natural Gas Jan 07, 2018 - 02:26 PM GMTBy: EconMatters

Natural gas is the dog that got its day in the New Year trading at $175/MMBtu spot in New York. Less than a month ago, Gas Exporting Countries Forum expected lower natural gas prices “over the next two decades” mostly due to a surge in supplies from unconventional sources.

Natural gas is the dog that got its day in the New Year trading at $175/MMBtu spot in New York. Less than a month ago, Gas Exporting Countries Forum expected lower natural gas prices “over the next two decades” mostly due to a surge in supplies from unconventional sources.

With the sever winter storm hitting much of North America, temperatures have been tumbling since the start of the New Year. Meteorologists dubbed this arctic winter storm "bomb cyclone" because of the extreme drops in pressure over a short period of time. This unusual freezing cold weather has also had a major impact on U.S. commodity markets, natural gas, in particular.

Not Even Texas Can Stay Above Freezing

CNN reported that on New Year's Day, temperatures across 90% of the United States didn't even get up to 32 degrees. In Texas, cities like Dallas have seen lows below freezing during the recent Arctic blast. Weather forecast says by Friday some parts of the U.S. Northeast could “feel as cold as 30 degrees below zero". This frigid cold snap is sending increase in heating demand and an uptick in the price of natural gas.

World’s Most Expensive Natural Gas

Natural Gas Intelligence reported yesterday that natural gas spot price traded as high as $175/MMBtu in New York City where NYMEX futures have been averaging below $3/MMBtu.

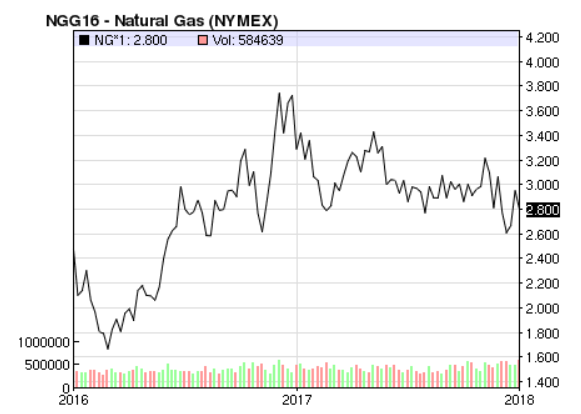

| Data as of Jan. 5, 2018 am |

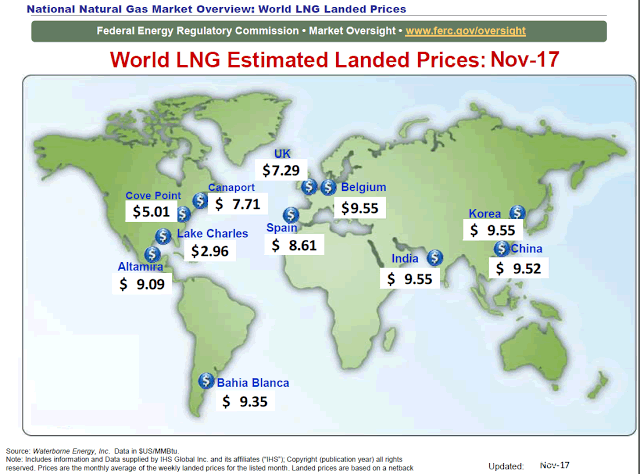

This price disparity underscores the inadequate energy infrastructure at the U.S. Northeast region. The current gas transporting capacity is not enough to haul gas from gas producing basins to meet the sudden spike of heating demand in the region. Bloomberg reported that gas in Northeast region is the world’s priciest, commanding 14 times more than U.K. futures price and about nine times more expensive than Asian LNG imports.

Gas Well Freeze-offs

The freezing temperature is also causing headaches for the producers due to gas well freeze-offs. Freeze-off is an industry term describing a phenomenon where gas wells become frozen shut due to a severe drop in temperatures.

Freeze offs s helped limit gas supplies while demand spiked. Genscape reported production freeze-offs in Texas impacting about 1.2 Bcf/d of Permian Basin production month-to-date versus the previous two-week average. Alberta also reported gas well freeze-offs driving AECO, Alberta’s natural gas price benchmark to soar 72% Between Christmas and New Year.

Weather Dependent

The National Weather Service (NWS) predicted the heavy snow will begin to wane by the end of this week. Despite the $175/MMBtu seen in New York, natural gas futures pulled back to today's $2.80 levels due to lower-than-expected inventory draw and long-range warmer weather outlook.

Region Bound

Unlike crude oil which is traded on global markets, natural gas is still quite regional with demand mainly driven by weather. Many have high hopes for the LNG to propel natural gas into a global commodity. However, it seems most people were too optimistic that Asian LNG prices remain in the double-digit territory, underestimated the new global LNG capacity coming online, and overestimate the pace and volume of coal-to-gas switch.

A report published by International Gas Union (IGU) cited that some markets that typically rely heavily on spot and short-term LNG volumes experienced a "significant decline" in demand in 2016. For example, the LNG demand drop of Brazil was due to improved hydro-power availability. The same IGU report also noted that Northeast Asian LNG spot price averaged only $5.52/MMBtu in 2016.

A look at FREC latest world LNG landed prices should give a more realistic picture that LNG cargo from the U.S. are not as profitable as people initially thought when most of the world's mega LNG projects got sanctioned.

From that perspective, I agree with the outlook by Gas Exporting Countries Forum that natural gas/LNG prices could be expected to remain lower for longer due to ample supplies, while the price movement would be driven mainly by regional weather or other demand factors.

The author and EconMatters have no position in the aforementioned commodity markets and related stocks. The views and opinions expressed in this article are author's own.

By EconMatters

The theory of quantum mechanics and Einstein’s theory of relativity (E=mc2) have taught us that matter (yin) and energy (yang) are inter-related and interdependent. This interconnectness of all things is the essense of the concept “yin-yang”, and Einstein’s fundamental equation: matter equals energy. The same theories may be applied to equities and commodity markets.

All things within the markets and macro-economy undergo constant change and transformation, and everything is interconnected. That’s why here at Economic Forecasts & Opinions, we focus on identifying the fundamental theories of cause and effect in the markets to help you achieve a great continuum of portfolio yin-yang equilibrium.

That's why, with a team of analysts, we at EconMatters focus on identifying the fundamental theories of cause and effect in the financial markets that matters to your portfolio.

© 2018 Copyright EconMatters - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

EconMatters Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.