The World’s Biggest Stock Investors Have Lost $436 Billion In 2018

Stock-Markets / Stock Markets 2018 Mar 27, 2018 - 02:07 PM GMTBy: OilPrice_Com

Charles Benavidez: Wall Street is shocked, but it shouldn’t be: Tariffs targeting China should have been a given, and now the market’s tanking on trade war fears as if it just crept up on everyone, but Trump’s been very clear on this.

Charles Benavidez: Wall Street is shocked, but it shouldn’t be: Tariffs targeting China should have been a given, and now the market’s tanking on trade war fears as if it just crept up on everyone, but Trump’s been very clear on this.

Wall Street is known for being short-sighted, though, and allowing itself to get caught up in the euphoria of the day. And now the world’s biggest investors are losing hundreds of billions.

The Dow has lost nearly 1,200 points in three days, and over 424 points on Friday alone:

The S&P 500 lost over 55 points on Friday, and it’s seen its worst week in two years:

The beneficiaries are gold and treasury yields, with gold rallying and treasury yields declining as investors seek safe havens.

As we head into the market open Monday, the Friday statistics make almost any long-term investment plan look impossible.

Disney, GE, Home Depot, 3M, Procter & Gamble, United Technologies, Verizon, Walmart and ExxonMobil all set new year-to-date lows Friday, with GE and Walmart in definitive bear market territory.

The picture is so dire that only five of the big stocks have managed to stay out of correction, including Apple, Cisco, Intel, Nike and Visa.

So, what are the world’s biggest investors doing?

Right now, they’re losing—big.

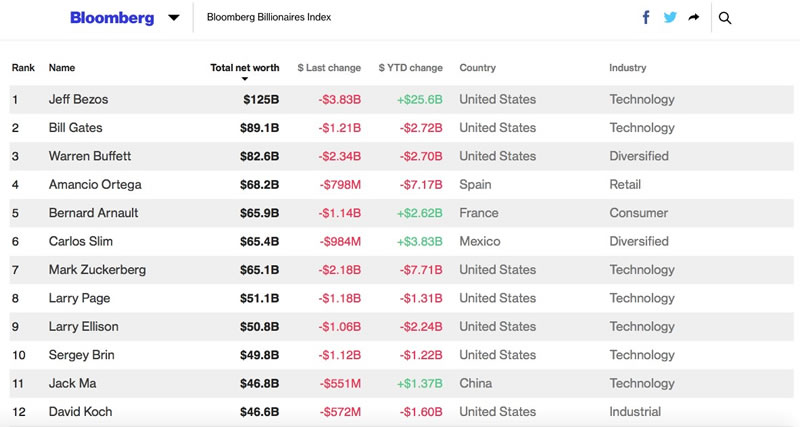

Since January, according to Bloomberg, the combined wealth of the 500 wealthiest people in the world has fallen by $436 billion, while the combined wealth of the top 5 has fallen by $34 billion.

The biggest loser since the beginning of the year has been Mark Zuckerberg, of Facebook fame, who lost $7.71 billion since January, with $2.18 billion of that just last week.

Even without trade war fears, it’s been a week of horrors for Facebook, and the bad news continues to compound.

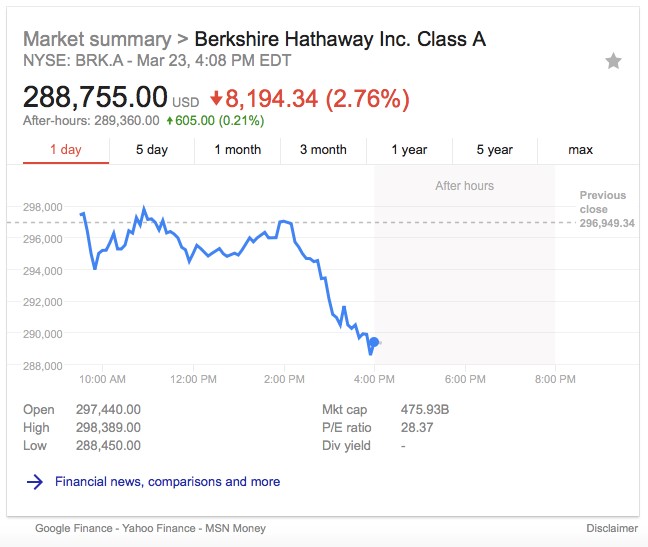

Warren Buffett—the king of long-term investing and buy and hold—has lost $2.7 billion since January, most of that last week as trade war fears consumed Wall Street.

Speaking to CNBC earlier this month, when the market was plunging but Wall Street wasn’t yet in panic mode over trade war fears, Buffett advised investors to stay the course, buy and hold.

Buffett—who was worth $87 billion until recently—is a long-term investor, and isn’t easily scared away by the politics or economics of the day.

"Don't watch the market closely. […] The money is made in investments by investing, and by owning good companies for long periods of time. If they buy good companies, buy them over time, they're going to do fine 10, 20, 30 years from now."

And it’s good that Buffett’s wasn’t watching because his Berkshire Hathaway is one of the biggest victims of Trump’s steel and aluminum tariffs. The conglomerate of over 60 companies includes a hefty portfolio of manufacturing and industrial holdings—all of which will be hit hard by tariffs.

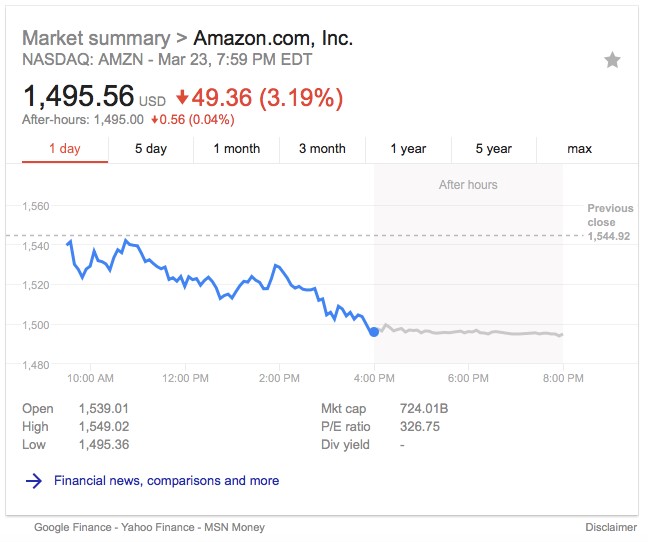

Amazon CEO Jeff Bezos, the richest man in the world, worth $125 billion even now, lost $3.83 billion last week, but year-to-date, he’s up $25.6 billion.

He’s not panicking. Instead, he’s out taking his robotic dog for a walk, secure in the knowledge that he made $107 million a day last year.

Amazon's stock was down over $49 on the Friday close, but it’s still widely viewed as a raging bull; and while the rest of the world’s billionaires are losing hundreds of billions in wealth, Bezos appears to be immune to it all. He’s not the only one who’s up year-to-date, but he’s up over $20 billion more than the few on the list who aren’t in the red.

Link to original article: https://safehaven.com/article/45165/The-Worlds-Biggest-Investors-Have-Lost-436-Billion-In-2018

By Charles Benavidez for Safehaven.com

© 2018 Copyright Safehaven.com - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

OilPrice.com Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.