Stock Market Watch Out For Monday!

Stock-Markets / Stock Markets 2018 Apr 30, 2018 - 02:07 PM GMTBy: Brad_Gudgeon

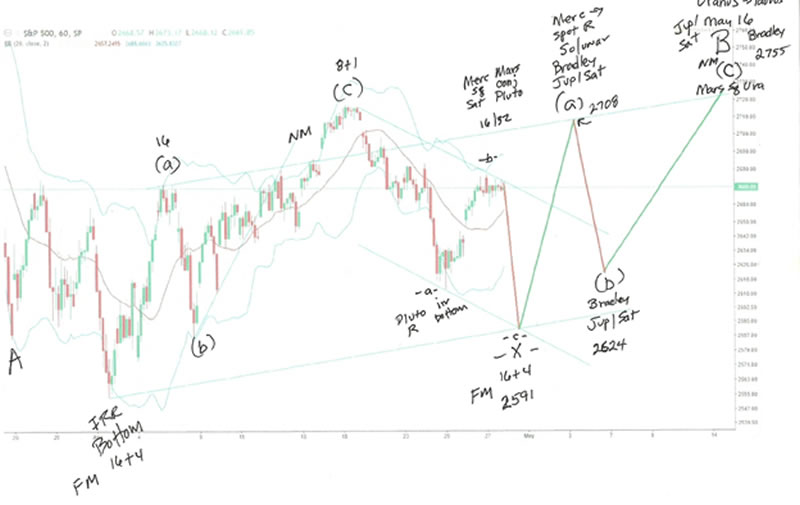

The stock market is ripe for a sudden plunge on Monday the 30th. Mars conjuncted Pluto on the 26th and this is very war-like. On the 25th Mercury squared Saturn. Friday was a Gann 16/32 TD top and the Sun trines Saturn on the full moon Sunday. This combination along with an irregular bottom early on the 25th suggested a ‘b’ wave rally with ‘a’ finishing on the April 24.

The stock market is ripe for a sudden plunge on Monday the 30th. Mars conjuncted Pluto on the 26th and this is very war-like. On the 25th Mercury squared Saturn. Friday was a Gann 16/32 TD top and the Sun trines Saturn on the full moon Sunday. This combination along with an irregular bottom early on the 25th suggested a ‘b’ wave rally with ‘a’ finishing on the April 24.

The stock market has been running with the larger lunar cycle of about 29.5 calendar days or 20 trading days. Gann cycles run about 16 TD’s 4. The next 16 + 4 is due April 30, similar to the April 2 bottom right after the full moon.

A rinse and repeat cycle, into a new moon top on May 15/16th, where Uranus enters Taurus and Mars squares Uranus, repeats the 20 TD cycle. This means a strong move up into the Bradley/Jup-Sat/Mercury retrospot turn on May 3, just like April 5. This means another wild day down just like April 6 on the May 4th non-farm payrolls. Monday and Friday are likely to be about the same % drop, just under 3%. A wild week ahead is expected.

The launch into the expected major top on the 16th unwinds the previous 8 TD drop of March 13-23, which means to me that we likely head higher into June and June should be a bullish month for all intents and purposes. May 29 low to June 27 top my guess SPX 2539-2808, with a couple of pauses especially after the 5th and 13th.

I don’t think we see the down side resolved since the Jan 26 top until July 12, where I believe we could touch the .382 retrace of the Aug 21, 2017 - Jan 26, 2018 bull run near 2468. I’m expecting new highs above 2900 into between late August and late September. Summer Rally?

The chart below shows the SPX hourly into May 14. I’m expecting a May 16 top near 2755 SPX and a low on April 30th near 2591.

GDX and gold continue in their sideways trading motion as I mentioned before, so nothing new to report there.

I’m offering my annual subscription to the BluStar Market Timer for just $499 instead of the normal $639. Just contact me off my website and ask for a special e-invoice. Offer good until April 30, 2018.

Editor of The BluStar Market Timer

The BluStar Market Timer was rated #1 in the world by Timer Trac in 2014, competing with over 1600 market timers. This occurred despite what the author considered a very difficult year for him. Brad Gudgeon, editor and author of the BluStar Market Timer, is a market veteran of over 30 years. The website is www.blustarmarkettimer.info To view the details more clearly, you may visit our free chart look atwww.blustarmarkettimer.com

Copyright 2018, BluStar Market Timer. All rights reserved.

Disclaimer: The above information is not intended as investment advice. Market timers can and do make mistakes. The above analysis is believed to be reliable, but we cannot be responsible for losses should they occur as a result of using this information. This article is intended for educational purposes only. Past performance is never a guarantee of future performance.

Brad Gudgeon Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.