Stock Market on FOMC Day

Stock-Markets / Stock Markets 2018 May 02, 2018 - 03:19 PM GMT SPX futures are trading in a narrow range around yesterday’s closing value. The FOMC concludes its meeting today and only leaves a policy statement for its trouble. It is possible that the policy statement may be used to shape expectations about the course of future rate hikes.

SPX futures are trading in a narrow range around yesterday’s closing value. The FOMC concludes its meeting today and only leaves a policy statement for its trouble. It is possible that the policy statement may be used to shape expectations about the course of future rate hikes.

Be prepared for more upside as the Cycles Model suggests a “bump” higher before turning down. Short-term resistance at 2664.73 may be the target for today’s action, but a run at the 50-day Moving Average at 2688.85 isn’t out of the question.

The simple 200-day Moving Average at 2573.77 is key in maintaining the long-term trend. Mike Shedlock’s article on TheMaven gives us some insight into the dynamics of this observation.

ZeroHedge observes, “As Asian and European traders return from holiday, sentiment is generally risk on, with Asia mixed and European markets and US equity futures in the green, rallying from the open as the DAX outperforms, the mining sector is well supported thanks to a metals rally in Asia while tech stocks rise following Apple's earnings last night.”

NDX futures are a bit more positive than SPX. It appears more likely that the NDX may challenge its 50-day Moving Average at 6749.44.

ZeroHedge reports, “Critics of President Trump's tax reform plan said corporations would just use the massive piles of cash repatriated under the new tax law to buy back more stock. And, as it turns out, Apple has proven them right.

During the first quarter, the iPhone maker bought back $23.5 billion of its shares, a record amount for any US company. And, the reason why the stock is higher this morning, is that the company isn't nowhere close to being finished, as in its quarterly report Apple announced that it would earmark $100 billion for a new share-repurchase program.”

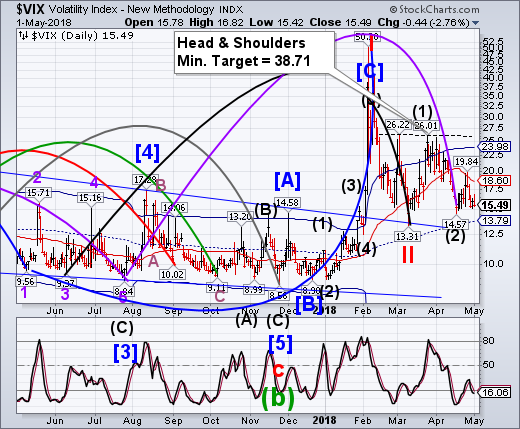

VIX futures held near the flat line this morning. Considering the FOMC meeting today and its consequent statement, it would not be out of the ordinary to see VIX revisit its April 17 low.

Bloomberg opines, “Last week, the Chicago Board Options Exchange (CBOE) responded to a research report into manipulation of the monthly settlement of the VIX, sometimes referred to as the stock market’s fear index, and attempted to assure participants that the process was not rigged. “The academic paper’s analysis and conclusions are based upon a fundamental misunderstanding about how VIX derivatives are traded and settled,” the CBOE wrote. I was an author of the research paper. The CBOE’s most recent response has left my "fundamental misunderstanding" still very much unresolved.”

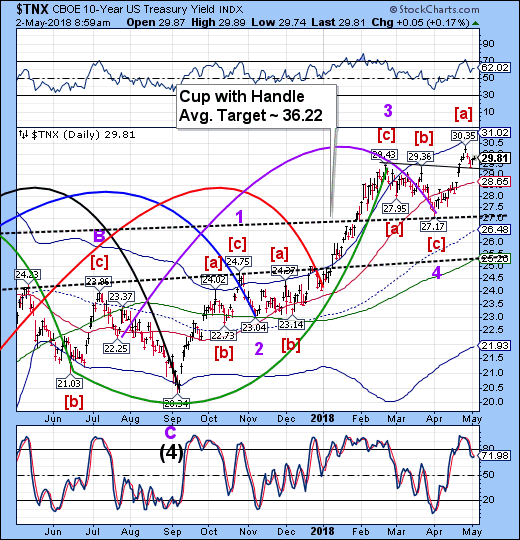

TNX is also flat-lined this morning.

Bloomberg reports, “The U.S. Treasury Department will boost the amount of long-term debt it sells to $73 billion this quarter as President Donald Trump’s administration seeks to finance budget deficits set to widen further because of tax cuts and higher spending.

In its quarterly refunding announcement on Wednesday, the department again lifted the auction sizes of coupon-bearing and floating-rate debt after doing so last quarter for the first time since 2009. It again left inflation-linked security sizes unchanged. Treasury also announced plans to issue a new two-month bill later in 2018.”

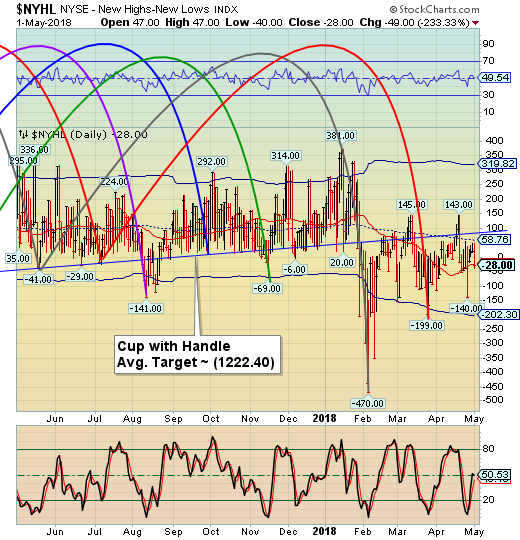

The NYSE Hi-Lo Index closed beneath its 50-day Moving Average at -24.37 yesterday. This tells us that there is an erosion in the participation in the rallies, despite the afternoon save in the SPX yesterday. It is possible that a good share of yesterday’s rally may have been from a judicious buyback from Apple.

Regards,

Tony

Our Investment Advisor Registration is on the Web.

We are in the process of updating our website at http://mrpracticalinvestor.com/ to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinve4stor.com .

Anthony M. Cherniawski, President and CIOhttp://mrpracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals.

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.