Corporate Earnings Q2 2018 Will Probably be Strong. What This Means for Stocks

Stock-Markets / Stock Markets 2018 Jul 12, 2018 - 03:23 PM GMTBy: Troy_Bombardia

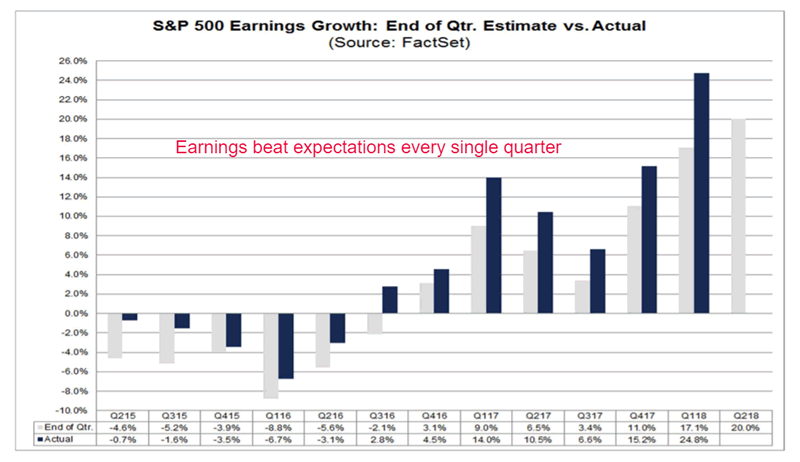

Earnings expectations for Q2 2018 are high. Analysts expect the S&P 500’s earnings to grow 20% year-over-year. This leaves some investors and traders “worried” that the bar has been set too high, setting up for a disappointment.

Earnings expectations for Q2 2018 are high. Analysts expect the S&P 500’s earnings to grow 20% year-over-year. This leaves some investors and traders “worried” that the bar has been set too high, setting up for a disappointment.

I think that this earnings season will be strong and continue to beat expectations.

Why?

Because companies (on balance) almost ALWAYS beat their earnings expectations.

Look at the following chart. S&P 500 companies have beat their earnings expectations EVERY SINGLE QUARTER over the past 3 years.

This is because companies and analysts know how to play the Earnings Game. When companies give analysts “earnings guidance” (which is used in the analysts’ expectations), companies generally know that they can beat these expectations.

Actual earnings were better than expected even during 2015-2016 when corporate earnings fell (thanks to oil’s crash).

Remember what I said before: corporate earnings is a medium-long term indicator for the stock market. It isn’t a short term indicator. The S&P 500’s short term reaction to “better than expected” earnings growth is mostly random. Don’t read too much into the price action during earnings season. It’s perfectly normal for stocks to not go up in the short term when earnings are strong.

What the stock market does on “better than expected” earnings releases cannot be used to predict the stock market’s future performance.

Q1 2018

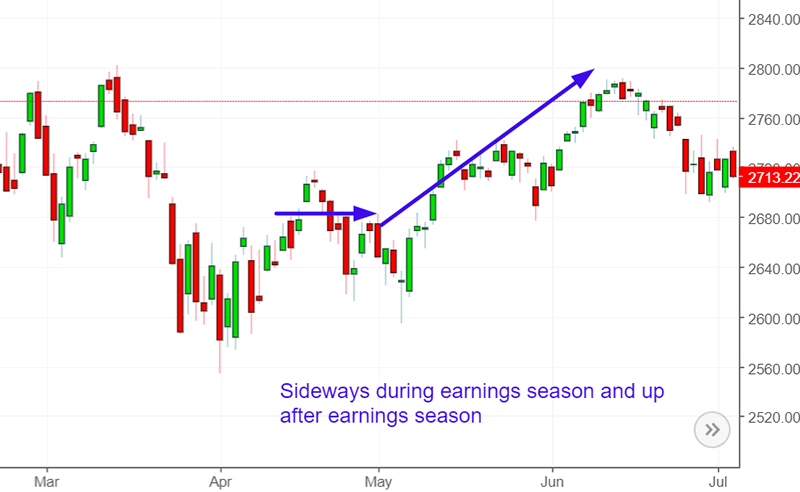

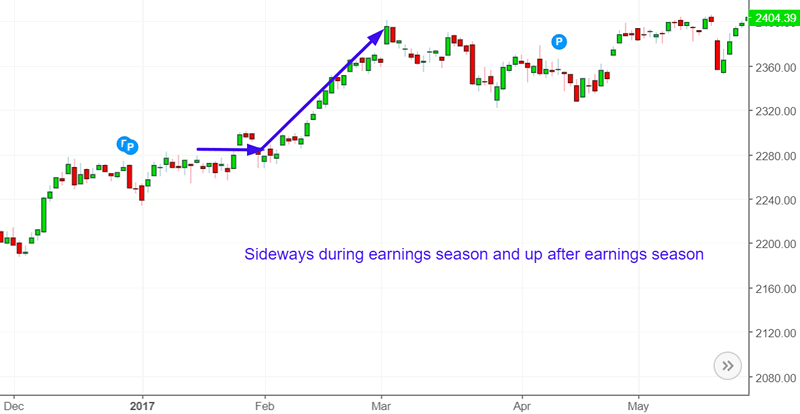

Earning were “stronger than expected”. The stock market went sideways during earnings season and up after earnings season.

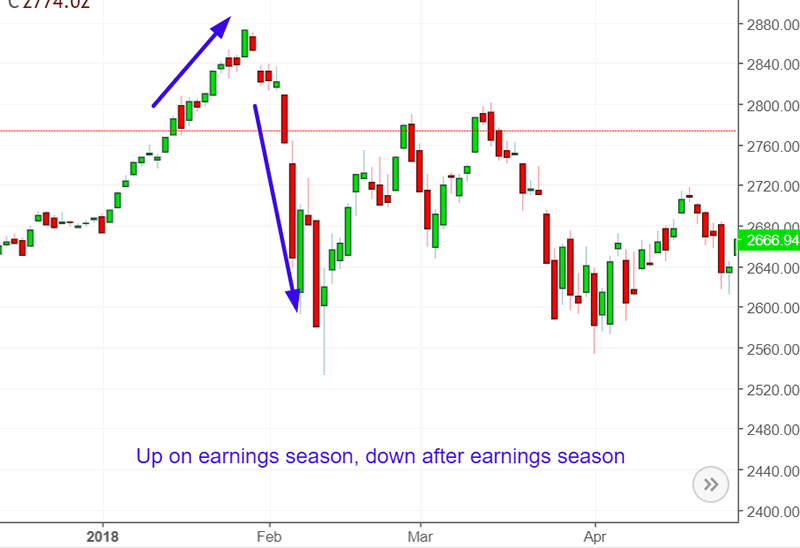

Q4 2017

Earning were “stronger than expected”. The stock market went up during earnings season and fell after earnings season.

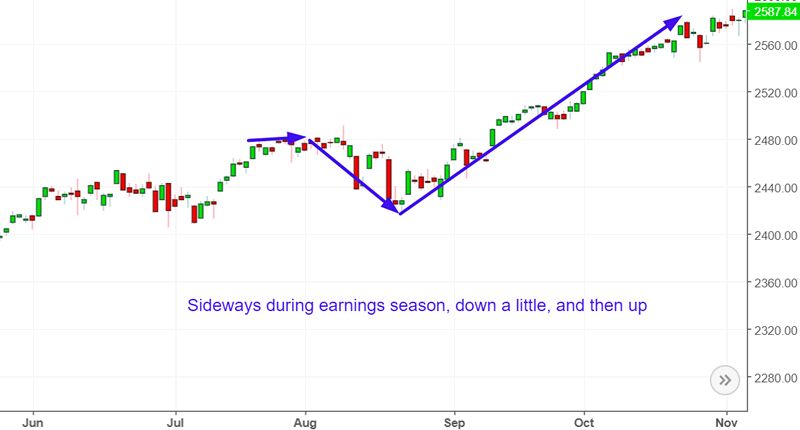

Q3 2017

Earning were “stronger than expected”. The stock market went up during earnings season and up after earnings season.

Q2 2017

Earning were “stronger than expected”. The stock market went sideways during earnings season and up after earnings season.

Q1 2017

Earning were “stronger than expected”. The stock market went up during earnings season and up after earnings season.

Q4 2016

Earning were “stronger than expected”. The stock market went sideways during earnings season and up after earnings season.

Q3 2016

Earning were “stronger than expected”. The stock market went down during earnings season and up after earnings season.

Q2 2016

Earning were “stronger than expected”. The stock market went sideways during earnings season and down after earnings season.

Conclusion

As you can see, earnings season is almost always “better than expected”. Moreover, what the stock market does during earnings season is not indicative of what the stock market will do after earnings season. This is not “price action”.

Rising earnings = medium-long term bullish for the S&P 500.

With that being said, here’s why you shouldn’t make short term trades based on earnings season.

Click here for more market studies.

By Troy Bombardia

I’m Troy Bombardia, the author behind BullMarkets.co. I used to run a hedge fund, but closed it due to a major health scare. I am now enjoying life and simply investing/trading my own account. I focus on long term performance and ignore short term performance.

Copyright 2018 © Troy Bombardia - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.