Here Comes the Stock Market Retest

Stock-Markets / Stock Markets 2018 Oct 20, 2018 - 06:05 PM GMTBy: Troy_Bombardia

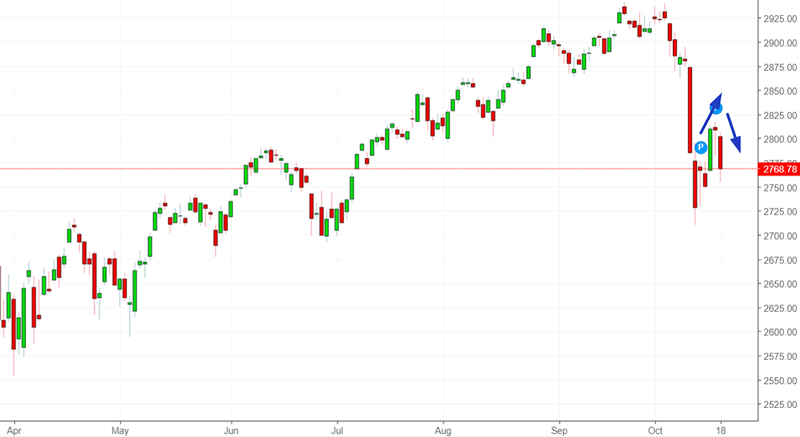

Over the past 2 days I’ve been demonstrating quantitative studies about why the U.S. stock market will probably retest its lows (here and here).

The retest wave is happening right now.

With that being said, here’s why the retest wave probably isn’t over yet (i.e. more short term selling), but why you should increasingly focus on risk:reward.

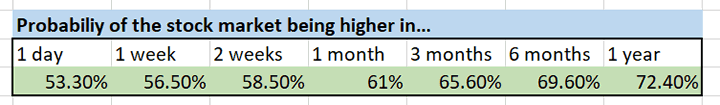

*For the sake of reference, here’s the random probability of the U.S. stock market going up on any day, week, or month.

The selloff has been intense

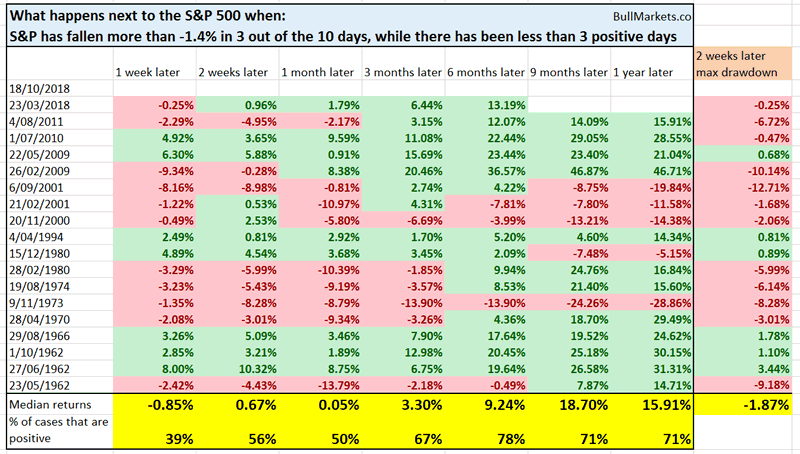

The U.S. stock market’s selloff in the past 2 weeks has been intense. The S&P has only gone up 2 out of the past 10 days, and 3 out of the past 10 days have seen a daily selloff more than -1.4%.

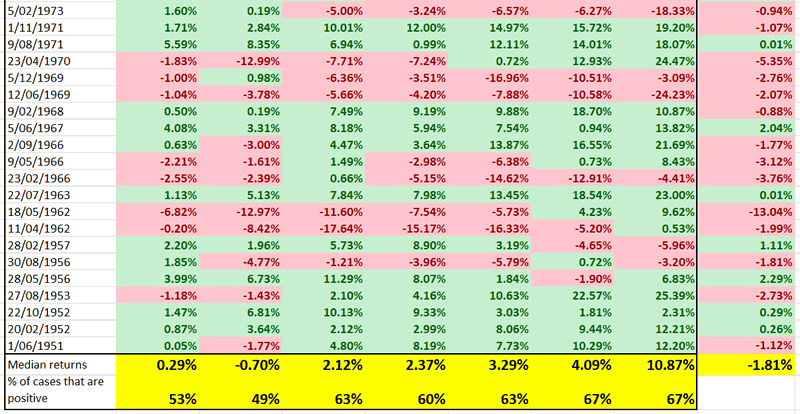

Here’s what happens next to the S&P 500 (historically) when the S&P falls more than -1.4% in 3 out of the past 10 days, while there has been 2 or less “up” days in the past 10 days (i.e. less up days than big down days)

As you can see, the stock market tends to fall even more over the next 1 week.

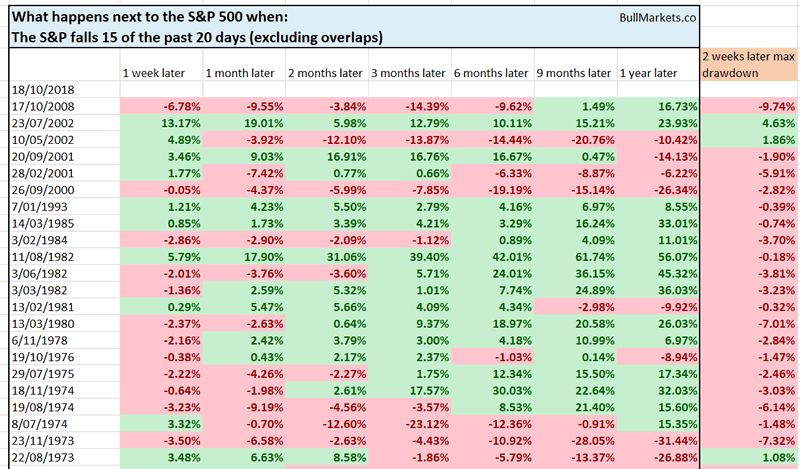

Here’s another way to look at this. The U.S. stock market (S&P 500) has fallen 15 out of the past 20 days. Historically, this led to more choppiness in the next 1 month.

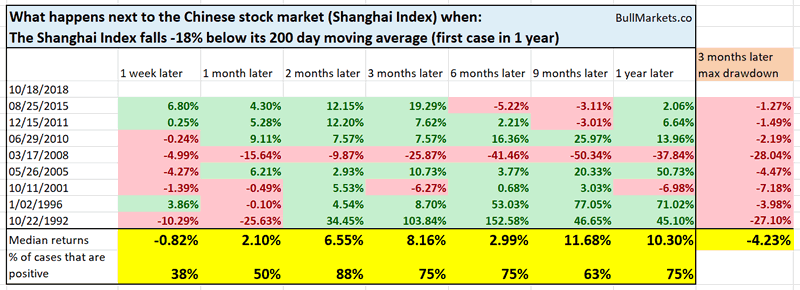

Meanwhile, the Chinese stock market has absolutely crashed. It is now below more than -18% below its 200 dma for the first time in 1 year.

Historically, this meant that:

- The Chinese stock market would fall some more in the short term.

- The Chinese stock market would soon make a medium term rebound.

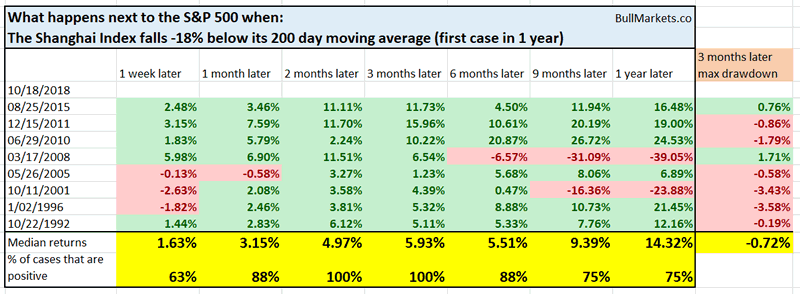

Are you afraid that the recent Chinese stock market crash will lead to end-of-the-world “contagion” in the U.S.?

When the Chinese stock market crashes as it has now, the U.S. stock market always goes higher in 2-3 months.

What to not worry about

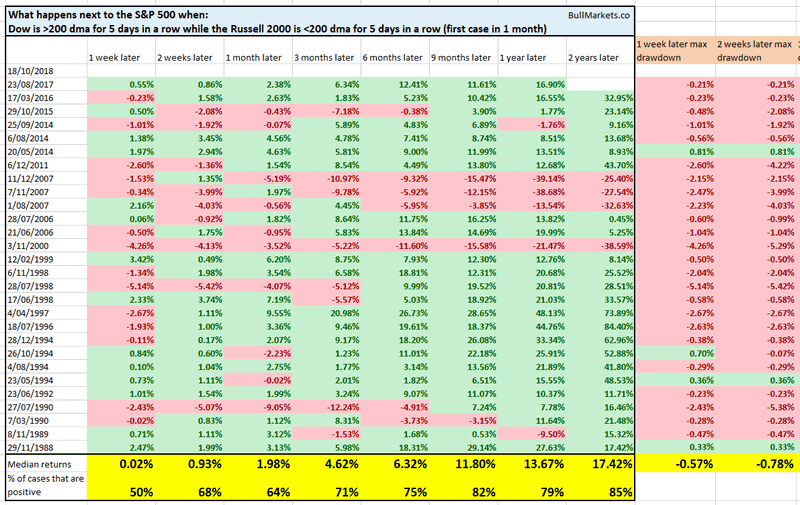

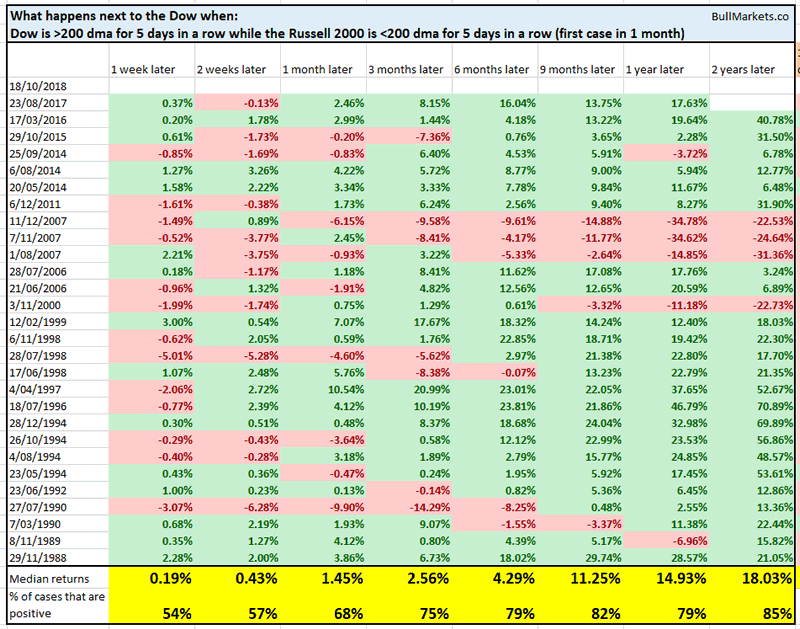

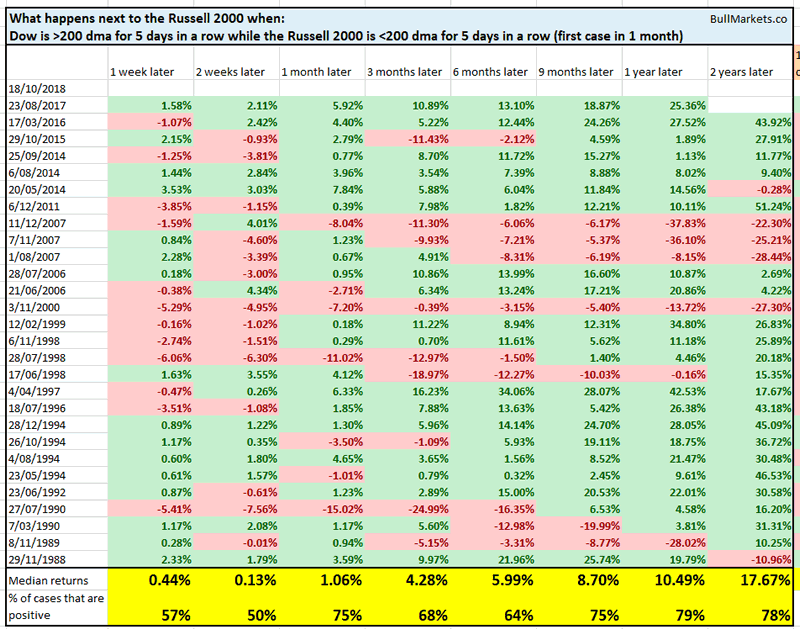

As you probably know, large caps (Dow) have outperformed small caps (Russell 2000) in the recent selloff.

Over the past 5 days, the Dow has spent 5 days above its 200 daily moving average while the Russell has spent 5 days below its 200 daily moving average.

This kind of divergence is neither bullish nor bearish for the S&P, Dow, and Russell. It’s neutral.

Medium Term Bottoms are a process

The key question is obvious: what should you do now?

- The medium term risk:reward is bullish

- Short term probabilities are lean bearish.

At this point, I like to focus on risk:reward (i.e. focus on the medium term). While the stock market will probably have 1 more leg down before making a medium term bottom, that isn’t guaranteed. Our recent studies have shown that even in the worst case scenario, the stock market will rally over the next 2-3 months.

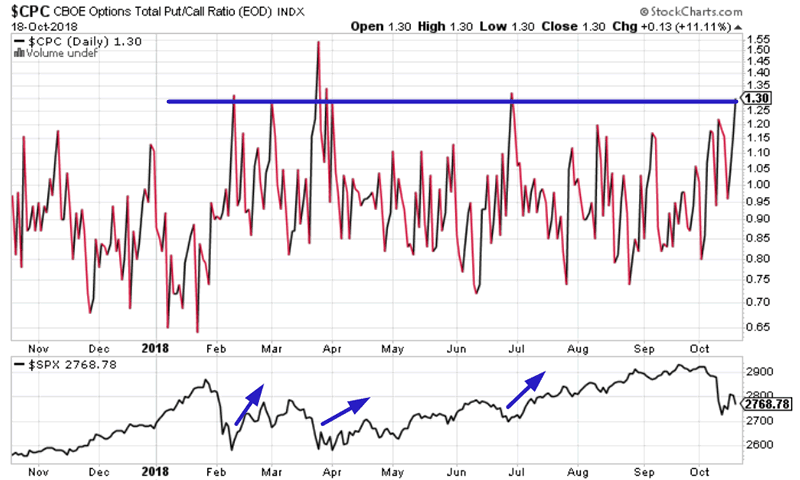

The Total Put/Call Ratio spiked to 1.3 yesterday. When Put/Call reached 1.3 in 2018, the stock market was at a short term bottom.

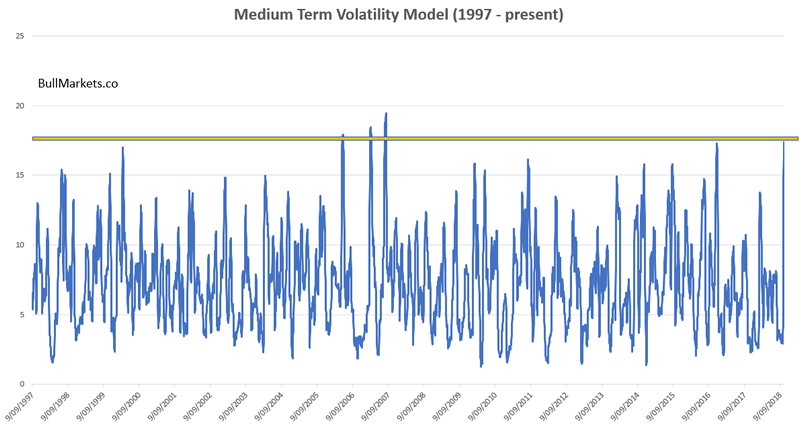

With that being said, here’s our Medium Term Volatility Model. You can see that the U.S. stock market’s medium term volatility is very high. Volatility is mean-reverting.

Click here for more market studies

*Our Short Term Trading Model shorted the S&P 500 on Wednesday and closed that short position on Thursday.

Click here for more market studies.

By Troy Bombardia

I’m Troy Bombardia, the author behind BullMarkets.co. I used to run a hedge fund, but closed it due to a major health scare. I am now enjoying life and simply investing/trading my own account. I focus on long term performance and ignore short term performance.

Copyright 2018 © Troy Bombardia - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.