U.S. Dollar Stall is Good for Commodities

Commodities / Commodities Trading Jun 11, 2019 - 06:38 AM GMTBy: Donald_W_Dony

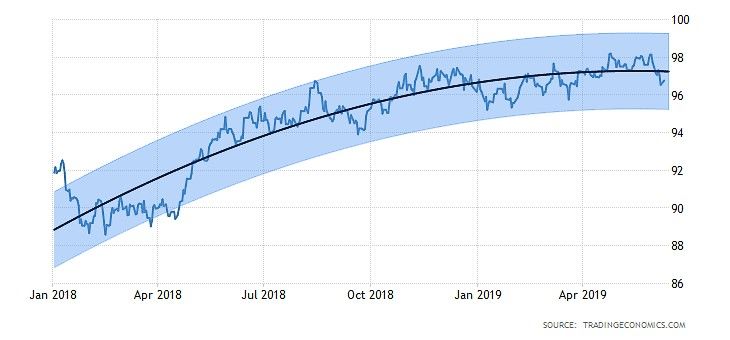

After months of advancing, the U.S. dollar's climb is showing signs of weakness.

Over the last five years, the greenback has risen almost 20 percent, whereas other world currencies have not been so lucky.

For example, the Euro has declined by 19 percent. The Yen has dropped over 6 percent and the Swiss Franc has descended over 11 percent, all during the same time frame.

The U.S. economy has hit some headwinds lately. With Trump's tariffs, the sharp decline in manufacturing sector growth and a steady slowdown in industrial production, the Fed is currently reexamining its interest rate program.

All of this has U.S. dollar bulls rethinking their long positions.

All of this has U.S. dollar bulls rethinking their long positions.

But a stall in the advance of the Big dollar is generally good news for commodity traders.

The natural resource that is most sensitive to the dollar's movement is gold.

Since the US$ stopped it's rise in April, spot gold has risen 6 percent.

Silver only started to advance in late May, yet it has kept pace with gold, climbing nearly 6 percent over the last few weeks.

Copper prices have yet to respond to the dollar's weakness. However, a base appears to be building at $2.60-$2.55.

Light crude oil (WTI) prices have not responded to the U.S. dollar. Oil prices are more of a function of geopolitical pressures rather then the dollar's movement.

Bottom line: As the issues that are causing weakness in the U.S. economy are not likely going away anytime soon, models for the U.S. dollar indicate a flatter range-bound trend is developing. This pattern should continue into Q3.

In response, gold prices are expected to advance up to the next resistance level of $1399. Should that line be broached, $1475 is the next target.

Silver prices are expected to rise in June and reach $15.35. Should that level be passed, $15.75 is the next target.

Copper prices are still base-building. Models indicate that a rise over $2.67 would point to $2.85 and potentially to $2.90.

WTI prices still have substantial selling pressure. Model indicate that $56 will likely halt any upside bounce. The outlook remains negative for Light crude oil prices.

By Donald W. Dony, FCSI, MFTA

www.technicalspeculator.com

COPYRIGHT © 2018 Donald W. Dony

Donald W. Dony, FCSI, MFTA has been in the investment profession for over 20 years, first as a stock broker in the mid 1980's and then as the principal of D. W. Dony and Associates Inc., a financial consulting firm to present. He is the editor and publisher of the Technical Speculator, a monthly international investment newsletter, which specializes in major world equity markets, currencies, bonds and interest rates as well as the precious metals markets.

Donald is also an instructor for the Canadian Securities Institute (CSI). He is often called upon to design technical analysis training programs and to provide teaching to industry professionals on technical analysis at many of Canada's leading brokerage firms. He is a respected specialist in the area of intermarket and cycle analysis and a frequent speaker at investment conferences.

Mr. Dony is a member of the Canadian Society of Technical Analysts (CSTA) and the International Federation of Technical Analysts (IFTA).

Donald W. Dony Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.