Natural Gas Moves Into Basing Zone

Commodities / Natural Gas Jun 11, 2019 - 07:11 AM GMTBy: Chris_Vermeulen

After an incredible rally in Natural Gas that our researchers called perfectly in November 2018, another opportunity for an upside price move appears to be setting up for later this year. We believe the current price lows, near $2.30, are setting up for a bounce and then will drop and form a basing pattern near $2.00 before rocketing higher. It is this last move to the downside which will set up the incredibly deep price base and oversold conditions for the upside price move in late August/September 2019.

After an incredible rally in Natural Gas that our researchers called perfectly in November 2018, another opportunity for an upside price move appears to be setting up for later this year. We believe the current price lows, near $2.30, are setting up for a bounce and then will drop and form a basing pattern near $2.00 before rocketing higher. It is this last move to the downside which will set up the incredibly deep price base and oversold conditions for the upside price move in late August/September 2019.

We’re issuing this research post to alert all of our followers to our research and to allow for proper price rotation for this base to set up and conclude before jumping into any false triggers that may occur on the Daily or Weekly charts.

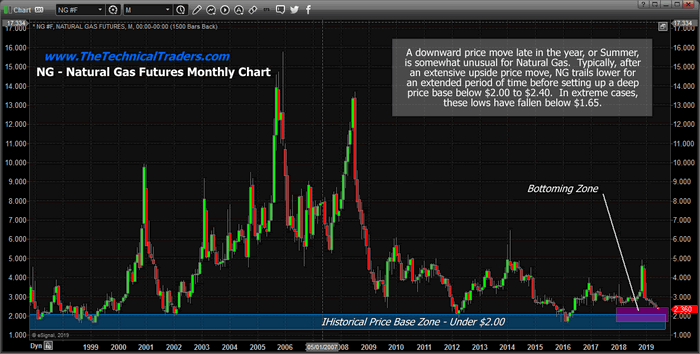

Start by taking a look at this Monthly NG chart showing how extended high price peaks are usually followed by extended price declines. It is very unlikely that any upside price move will begin before late August or early September 2019.

In fact, our data mining utilities confirm this by suggesting that June, July, and August are all typically lower price months by a factor of 1.5:1 and 2:1 mostly over the past 24 years. September is the first monthly data point to break this cycle with a positive historical price bias of nearly 9:1.

Therefore, the closer we get to September 2019, the more likely we are going to see a basing in price near $2.00 (or below) and traders would be wise to prepare for this move before it happens.

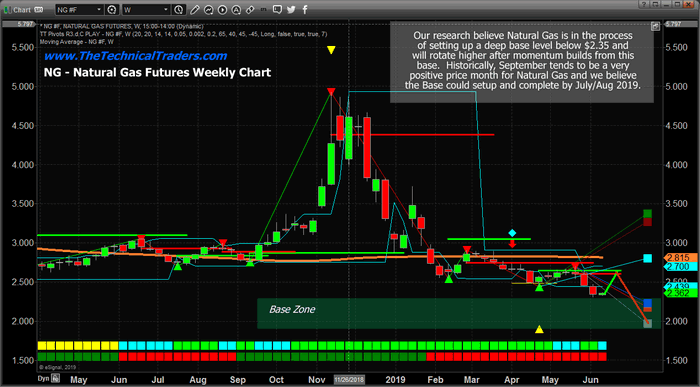

Our Weekly Fibonacci price modeling system is suggesting a moderate move upward of about $0.25 is likely over the next few weeks before price may rotate lower, again, and attempt to fall below the $2.25 level as it continues to rotate towards the ultimate base.

Our researchers believe the ultimate price base will be near $2.00 (roughly between $1.85 and $2.15) as our Weekly Fibonacci modeling tool is suggesting. After price establishes the new price peak in late June, we’ll have more data to compare for the proper location of the ultimate price base.

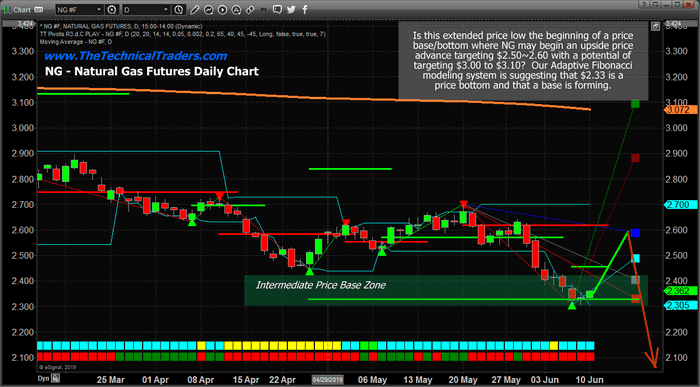

This Daily chart highlights our expectations for NG over the next few weeks – fairly strong potential for a move higher, above $2.50, where the price will stall and reverse back to the downside. Ultimately, this peak will turn out to be nothing more than required price rotation to support the ultimate base pattern setup later in August or September 2019.

Don’t get too excited about Natural Gas just yet. The setup and future trade are in the process of creating a deep price base that will likely end near late August or early September 2019. We believe September 2019 will be the breakout month for NG as a price advance really takes hold. If historical data is any guide, the 9:1 upside bias of September following the 1.4:1 downside bias of August suggests that the September upside price move could push NG prices well above $3.50 or $4.00 very quickly.

If you wanna become a technical trader with use and trade ETFs then be sure to join our Wealth Building Newsletter today and get our daily video analysis and swing trade alerts. In the past 17 months, our newsletter trade signals have generated 91% ROI for its subscribers, be sure to join before the markets start making new big moves and profit with us!

Chris Vermeulen

www.TheTechnicalTraders.com

Chris Vermeulen has been involved in the markets since 1997 and is the founder of Technical Traders Ltd. He is an internationally recognized technical analyst, trader, and is the author of the book: 7 Steps to Win With Logic

Through years of research, trading and helping individual traders around the world. He learned that many traders have great trading ideas, but they lack one thing, they struggle to execute trades in a systematic way for consistent results. Chris helps educate traders with a three-hour video course that can change your trading results for the better.

His mission is to help his clients boost their trading performance while reducing market exposure and portfolio volatility.

He is a regular speaker on HoweStreet.com, and the FinancialSurvivorNetwork radio shows. Chris was also featured on the cover of AmalgaTrader Magazine, and contributes articles to several leading financial hubs like MarketOracle.co.uk

Disclaimer: Nothing in this report should be construed as a solicitation to buy or sell any securities mentioned. Technical Traders Ltd., its owners and the author of this report are not registered broker-dealers or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer. Never make an investment based solely on what you read in an online or printed report, including this report, especially if the investment involves a small, thinly-traded company that isn’t well known. Technical Traders Ltd. and the author of this report has been paid by Cardiff Energy Corp. In addition, the author owns shares of Cardiff Energy Corp. and would also benefit from volume and price appreciation of its stock. The information provided here within should not be construed as a financial analysis but rather as an advertisement. The author’s views and opinions regarding the companies featured in reports are his own views and are based on information that he has researched independently and has received, which the author assumes to be reliable. Technical Traders Ltd. and the author of this report do not guarantee the accuracy, completeness, or usefulness of any content of this report, nor its fitness for any particular purpose. Lastly, the author does not guarantee that any of the companies mentioned in the reports will perform as expected, and any comparisons made to other companies may not be valid or come into effect.

Chris Vermeulen Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.