Silver Investors Big Trend Analysis for – Part I

Commodities / Gold & Silver 2020 Jan 13, 2020 - 05:51 AM GMTBy: Chris_Vermeulen

Everyone seems to be focused on Gold recently and seems to be ignoring the real upside potential in Silver. With all the global economic issues, military tensions, geopolitical issues, and other items continually pushed into the news cycles, it is easy to understand why traders and investors may be ignoring Silver.

Silver has really not started to move like the other precious metals. Gold is up over 45% since 2016. Palladium is up over 350% since 2016. Silver is up only 29% since 2016. The Gold to Silver ratio is currently at 86.7 – very near to the highest level on record going back over 25 years.

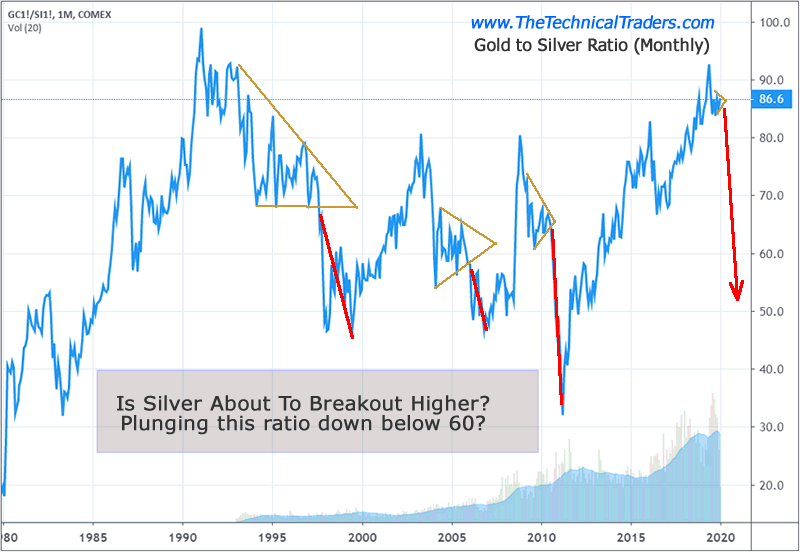

Historically, Silver rallies 6 to 12+ months after Gold begins a price rally. The big break in the Gold to Silver ratio comes at a time when Gold rallies by more than 30% to 60% faster than the price of Silver. In other words, when a major disparity sets up in the price of Gold compared to the price of Silver, then Silver explodes higher – which results in a drop in the Gold to Silver ratio.

Currently, the relative price of Gold to Silver is over 200%. Considering this fact and considering the under-performance of Silver recently, our researchers believe Silver is setting up a massive basing pattern in preparation for an explosive upside move.

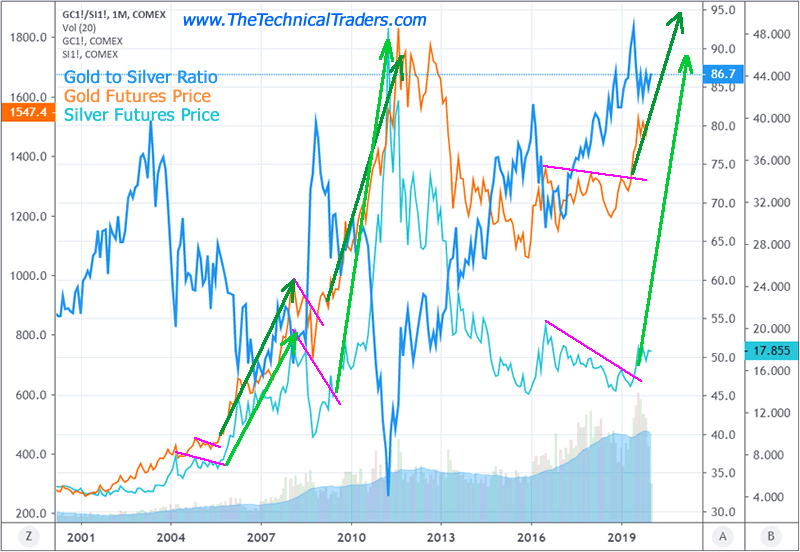

Our research team put together this chart to help illustrate the real upside potential in Silver. This Monthly chart highlights the Gold to the Silver ratio (Darker BLUE), the price of Gold (Gold) and the price of Silver (light BLUE) over the past 20 years.

Every time Gold broke a sideways Flag formation and began to rally substantially higher, Silver followed Gold higher 5 to 12 months after with an incredible upside price rally. In 2005, Silver rallied over 100%. In 2009, Silver rallied almost 400%. Now, in 2020, could Silver rally 100%, 200%, 300% or more?

In the recent past, we’ve authored numerous articles about Gold, Silver and precious metals highlighting our expectations going forward. Our incredible research from October 8, 2018, floored many institutional traders and researchers because we were able to accurately predict the future price moves in Gold 9+ months into the future. Take a little time to read some of our earlier research posts

Metals & Miners Prepare for 2020 Liftoff – https://www.thetechnicaltraders.com/metals-miners-prepare-for-an-early-2020-liftoff/

ADL Trading System Confirms Gold Targets – https://www.thetechnicaltraders.com/adl-gold-prediction-confirms-targets/

VIX Is Set to Spike And What It Means for Gold – https://www.thetechnicaltraders.com/metals-vix-are-set-to-launch-dramatically-higher/

We believe the current setup in Gold and Silver is almost identical to previous setups where Gold rallied on economic or global concerns, prompting a massive disparity ratio between Gold and Silver. We believe Silver is setting up in a massive basing pattern that may be an incredible opportunity for skilled traders.

In Part II of this research post, we’ll highlight why we believe all skilled traders and investors should be paying very close attention to the metals markets, Miners and, in particular, Silver.

As a technical analysis and trader since 1997 I have been through a few bull/bear market cycles, I have a good pulse on the market and timing key turning points for both short-term swing trading and long-term investment capital. The opportunities are massive/life-changing if handled properly.

I urge you visit my Wealth Building Newsletter and if you like what I offer, join me with the 1 or 2-year subscription to lock in the lowest rate possible and ride my coattails as I navigate these financial markets and build wealth while others lose nearly everything they own.

Chris Vermeulen

www.TheTechnicalTraders.com

Chris Vermeulen has been involved in the markets since 1997 and is the founder of Technical Traders Ltd. He is an internationally recognized technical analyst, trader, and is the author of the book: 7 Steps to Win With Logic

Through years of research, trading and helping individual traders around the world. He learned that many traders have great trading ideas, but they lack one thing, they struggle to execute trades in a systematic way for consistent results. Chris helps educate traders with a three-hour video course that can change your trading results for the better.

His mission is to help his clients boost their trading performance while reducing market exposure and portfolio volatility.

He is a regular speaker on HoweStreet.com, and the FinancialSurvivorNetwork radio shows. Chris was also featured on the cover of AmalgaTrader Magazine, and contributes articles to several leading financial hubs like MarketOracle.co.uk

Disclaimer: Nothing in this report should be construed as a solicitation to buy or sell any securities mentioned. Technical Traders Ltd., its owners and the author of this report are not registered broker-dealers or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer. Never make an investment based solely on what you read in an online or printed report, including this report, especially if the investment involves a small, thinly-traded company that isn’t well known. Technical Traders Ltd. and the author of this report has been paid by Cardiff Energy Corp. In addition, the author owns shares of Cardiff Energy Corp. and would also benefit from volume and price appreciation of its stock. The information provided here within should not be construed as a financial analysis but rather as an advertisement. The author’s views and opinions regarding the companies featured in reports are his own views and are based on information that he has researched independently and has received, which the author assumes to be reliable. Technical Traders Ltd. and the author of this report do not guarantee the accuracy, completeness, or usefulness of any content of this report, nor its fitness for any particular purpose. Lastly, the author does not guarantee that any of the companies mentioned in the reports will perform as expected, and any comparisons made to other companies may not be valid or come into effect.

Chris Vermeulen Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.