The Next Catalyst for Gold

Commodities / Gold & Silver 2020 Jan 23, 2020 - 03:26 PM GMTBy: Jordan_Roy_Byrne

The precious metals sector remains in a correction, and as long as the 200-day moving averages hold, a bullish consolidation that began last September.

Sure, Gold made a new high and is still holding around the previous high, but the rest of the sector has not confirmed that strength. When Gold is outperforming Silver and the gold stocks, it is not a bullish signal for the short-term.

With that in mind, we can look ahead to anticipate potential catalysts that could push the sector into breakout mode and to new highs.

Real interest rates must decline for Gold to rise. A bullish catalyst requires an acceleration in inflation or inflation expectations or lower interest rates.

From a macro-market perspective, keep an eye on the interplay between the US Dollar, the stock market, and the 10-year yield.

The correlations are neither perfect nor instant, but they have been and could continue to be constructive.

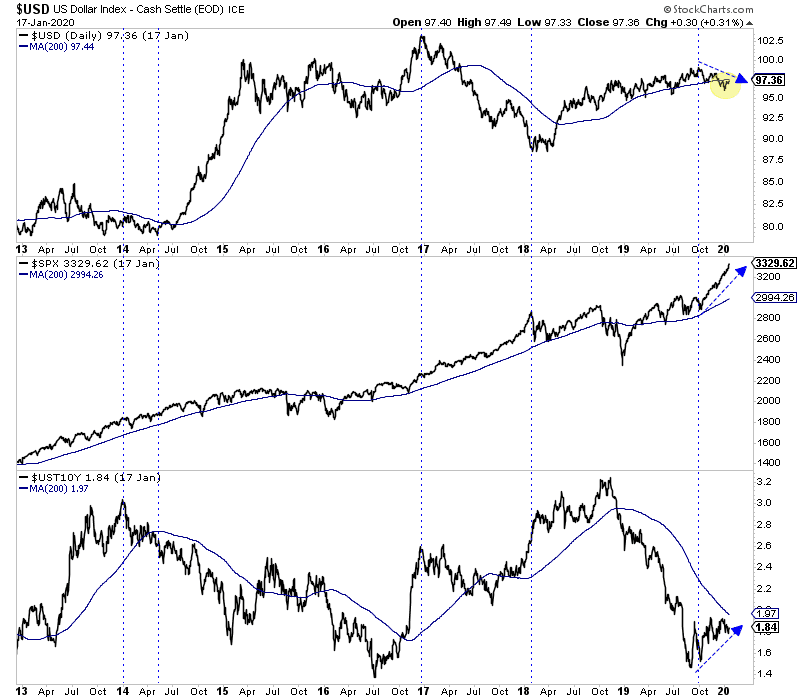

Over the past six years, we’ve generally witnessed that a rising US Dollar or US Dollar maintaining a high level can slow down the stock market and lead to lower bond yields. Take a look at the following chart.

US dollar Index, S&P 500, 10-Year Yield

Note that since the end of September 2019, when the US Dollar peaked, the stock market has surged higher while the 10-year yield has also pushed higher.

Until a week or so ago, the greenback was on the cusp of a technical breakdown. However, it held support and rebounded.

If this rebound is sustained, it could impact an overbought stock market, which is ripe for a correction, which would also lead to lower yields.

Depending on how long and how sustainable that scenario is, it could force the Fed to resume its rate cuts. That is your catalyst.

However, if the rebound in the US Dollar loses steam and reverses course, then bond yields would rise, the yield curve would steepen, and precious metals and other hard assets would benefit.

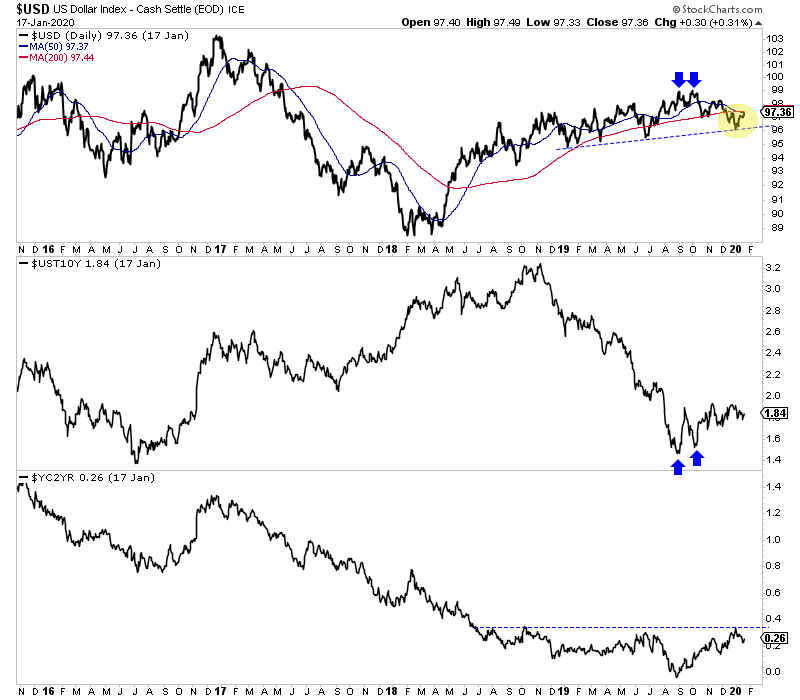

Below we plot the US Dollar, the 10-year yield (middle), and the yield curve (bottom), which has a chance to steepen considerably if it breaks past 0.35.

US Dollar Index, 10-Year Yield, Yield Curve

It is too early to predict which catalyst will drive Gold higher, and for the time being, neither scenario is imminent. Hence, the precious metals sector should continue to consolidate.

Keep your eye on the action in the US Dollar as well as the stock market and bond market. Intermarket developments could precede the next leg higher in the precious metals sector.

If we are right and the consolidation in the sector continues, then the weeks ahead could be one of your last best chances to position at excellent prices.

We continue to focus on identifying and accumulating the juniors with significant upside potential in 2020.

To learn the stocks we own and intend to buy during the next correction that have 3x to 5x potential, consider learning more about our premium service.

Good Luck!

Bio: Jordan Roy-Byrne, CMT is a Chartered Market Technician, a member of the Market Technicians Association and from 2010-2014 an official contributor to the CME Group, the largest futures exchange in the world. He is the publisher and editor of TheDailyGold Premium, a publication which emphaszies market timing and stock selection for the sophisticated investor. Jordan's work has been featured in CNBC, Barrons, Financial Times Alphaville, and his editorials are regularly published in 321gold, Gold-Eagle, FinancialSense, GoldSeek, Kitco and Yahoo Finance. He is quoted regularly in Barrons. Jordan was a speaker at PDAC 2012, the largest mining conference in the world.

Jordan Roy-Byrne Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.