Silver Price Trend Forecast

Commodities / Gold & Silver 2020 Jan 29, 2020 - 02:57 PM GMTBy: Nadeem_Walayat

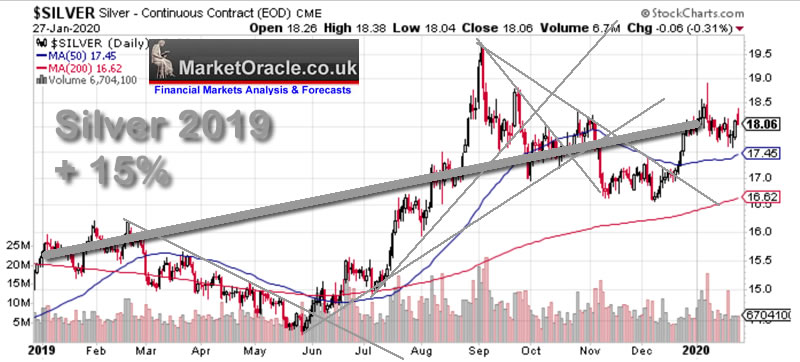

We can all dream about Silver outpacing Gold. However the truth about Silver is that it tends to under perform during precious metals bull markets, and only really coming alive in the bull markets final stages when it tends to spike. So Silver for 2019 did what Silver tends to do which is to under perform against Gold. Though in reality maybe investors tend to set their hopes too high, as a gain of 15% for the year is still pretty good going against Gold up 19%.

Two things stand out about Gold's more volatile cousin -

1. Silver actually trended well during the year, that's normally not the case i.e. Silver is prone to giving lots of false signals. But not for 2019, we got a clear signal early June on break of the main down trend line. Similarly the break of support trendline late September signaled weakness ahead, though followed by a fake break higher during Late October, with the actual break pending until Mid December.

2. That Silver's December rally was a lot weaker than Gold's which set new bull market highs, whilst Silver has yet to break it's 2019 high of $19.75. Which reminds that the norm is to expect Silver to under perform the Gold price most of the time, regardless of what the ratio and indicators are saying about how cheap Silver is.

Still 15% IS a good return for buy and hold investors. Whilst traders need to be aware of Silvers volatile nature that makes Silver a tough market to trade.

Recap of my 3 Silver forecasts of 2019.

Analysis of 11th June concluded in updated expectations for 2019 Silver Investing Trend Analysis and Price Forecast 2019 for a bull run to at least $18.50.

Silver Price Trend Forecast Conclusion

Therefore my forecast conclusion is for the Silver price to continue to trade in a volatile trading range with an upward bias towards a target of $18.50 later in 2019 as it steps higher into each successive trading range i.e. $15.25 to $16.25, then $16.25 to $17.30, then $17.30 to $18.50, which would represent a 25% gain on it's current price of $14.74. Whilst a spike to at $35+ remains a longer term objective.

Whilst my update of late July Silver Investing Trend Analysis and Price Forecasts 2019 Update expected a volatile bull run to continue along with the Gold price for Silver to at least target $19 and then $21. With the subsequent $19.75 high placing Silver mid-way between my 2 targets for 2019.

Silver Price Trend Forecast

The Silver price continues to target my 2 primary resistance targets for 2019 of $19 and $21. Once we reach and break those levels then we will know what to expect beyond $21. With the following graph illustrating the expected central trend trajectory for the Silver price, baring in mind it is a volatile commodity.

(Charts courtesy of stockcharts.com)

Whilst my last look at Silver on the 31st of October (Silver Trend Forecast 2019 Update - Nov to Dec 2019) expected the then correction to resolve in a sharp rally following the Gold price to new highs for the year.

Silver Price Trend Forecast

The Silver price having achieved my first primary target of $19 for 2019, now continues to target my 2nd primary target of $21 before the end of this year. Once we reach and break that level then we will know what to expect beyond $21. With the following graph illustrating the expected central trend trajectory for the Silver price, baring in mind this is a volatile commodity.

Subsequently Silver only just managed to rally to end 2019 to $18 after slumping to a early December low of $16.57, greatly under performing the Gold price.

The rest of this Silver analysis that concludes in a detailed trend forecast for 2020 has first been made available to Patrons who support my work (Silver Price Trend Forecast 2020).

- Silver Price Trend 2019

- Silver Investing Strategy

- Gold Price Trend Forecast Implications for Silver

- Gold / Silver Ratio

- Long-term Trend Analysis

- Trend Analysis

- MACD

- Elliott Waves

- Formulating a Trend Forecast

- Silver Price Trend Forecast 2020

So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $3 per month. https://www.patreon.com/Nadeem_Walayat.

Recent analysis includes :

- Gold Price Trend Forecast 2020

- British Pound GBP Trend Forecast 2020

- AI Stocks 2019 Review and Buying Levels Q1 2020

Scheduled Analysis Includes:

- Stock Market Multi Month Trend Forecast 2020

- UK Housing market series

- Machine Intelligence Investing stocks sub sector analysis

- Bitcoin trend forecast

- Euro Dollar Futures

- EUR/RUB

- US House Prices trend forecast update

Your Analyst

And ensure you are subscribed to my ALWAYS FREE newsletter for my next in-depth analysis.

By Nadeem Walayat

Copyright © 2005-2020 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 30 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.