Sweden Ends Its Experiment with Negative Interest Rates. Should Gold Be Worried?

Commodities / Gold & Silver 2020 Mar 01, 2020 - 06:29 PM GMTBy: Arkadiusz_Sieron

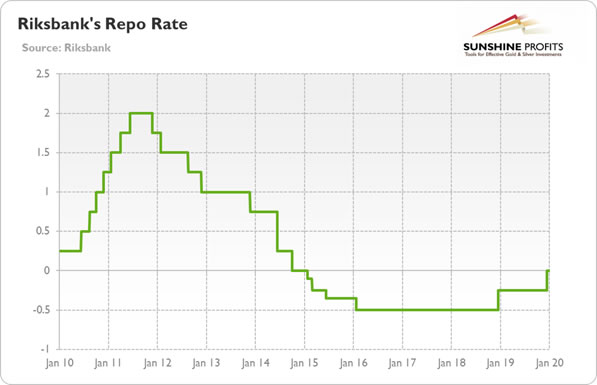

In December, the Sveriges Riksbank, the world’s oldest central bank, has raised the main interest rate from -0.25 percent back to zero, ending its experiment with the negative interest rate policy, as the chart below shows.

Chart 1: Riksbank’s repo rate from January 2010 to January 2020.

This is a huge change. As a reminder, Riksbank was a pioneer of negative interest rates. As early as in 2009, it moved the overnight deposit rate below zero. Then, in 2015, the Swedish central bank cut its main interest rate, the repo rate, to -0.10, worried about the repercussions of the sovereign debt crisis in the euro zone. In 2016, Riksbank was forced to go further, setting the interest rates as low as -0.50 percent, to prevent a Japanese-style deflationary spiral in Sweden.

And now, after all these years, Riksbank abandons the negative interest rates, again being in the avant-garde of central banking, as policy interest rates are still negative in the euro zone, Japan, Denmark, Switzerland and Hungary.

Why Riksbank has ended the NIRP? One explanation is that Sweden’s inflation rate is close to the target, so the monetary tightening was necessary. In other words, the NIRP did its job and was not needed any longer. As we read in the Riksbank’s press release,

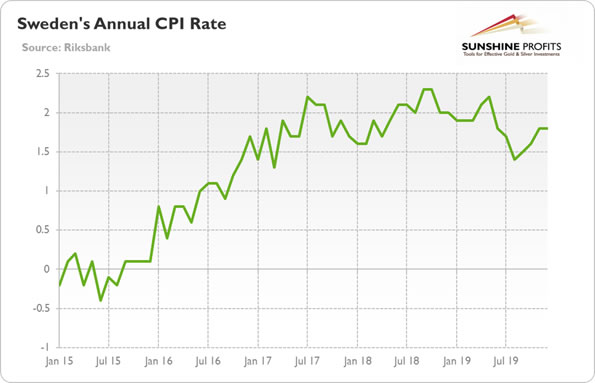

Inflation has been close to the Riksbank’s target of 2 per cent since the start of 2017, and the Riksbank assesses that conditions are good for inflation to remain close to the target going forward.

It sounds plausible, but the truth is that inflation has been hovering around the target for a few last years, as the chart below shows. So why did the Riksbank decide to hike interest rates only now – and in face of weaker economic activity?

Chart 2: Sweden’s annual CPI rate from January 2015 to December 2019.

The answer is that Sweden’s central bank has finally acknowledged what we were writing from the very beginning of the NIRP, i.e., that the costs of this policy outweigh the benefits, euphemistically speaking. Indeed, Riksbank admitted itself that concerns about the side-effects of the negative interest rates on the economy contributed to its decision. As we read in the minutes from the December meeting,

a long period of negative interest rates may have negative side effects on the economy, as the draft Monetary Policy Report commendably describes. This is a parameter that we should take into account.

In particular, the Sweden’s central bank is worried about the health of the housing market and households’ level of debt. As Governor Stefan Ingves noted,

Let me add, as I often do, that the long-term development of the Swedish housing market entails a risk to the Swedish economy in both the short and long term. There are a number of structural problems in the Swedish housing market. This creates both imbalances and risks, in the form of high indebtedness among households, and economic inefficiency, in that it will be more difficult for people to move in connection with finding a new job.

Indeed, the real estate price index has increased 33 percent since 2015 (from 180 points to 240) and doubled since the Great Recession, while the household debt-to-GDP ratio has risen from 65 percent in 2008 and 82 percent in 2015 to 88 percent in 2019. Please note that the whole Swedish private-sector debt has climbed to 285.7 percent of GDP, one of the highest rates in the OECD.

What does it all mean for the gold market? Well, the Riksbank’s recent hike confirms that the ultra loose monetary policy in general and the negative interest rates in particular do not support the real economy, but they rather zombify it instead. They also boost asset prices and debt, increasing the risk of a financial crisis.

Sweden is relatively small economy, but the ECB or the Bank of Japan are not likely to follow suit and also end their romance with the negative interest rates anytime soon. The Fed claims that it does not want to go below zero, but Trump supports this policy, so who knows…

So, the fact that Riksbank ended its NIRP should not upset the gold bulls. They still can count on other, more systematically important, central banks. One day, the unexpected negative shock arrives and it will expose the fragility of the current financial situation, so carefully cultivated under the strange world of negative interest rates. Investors would then also rediscover the safe-haven allure of gold.

If you enjoyed the above analysis, we invite you to check out our other services. We provide detailed fundamental analyses of the gold market in our monthly Gold Market Overview reports and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. If you’re not ready to subscribe yet and are not on our gold mailing list yet, we urge you to sign up. It’s free and if you don’t like it, you can easily unsubscribe. Sign up today!

Arkadiusz Sieron

Sunshine Profits‘ Market Overview Editor

Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Arkadiusz Sieron Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.