Gold Hedging the Decline and Fall of a Currency

Commodities / Gold & Silver 2020 Mar 10, 2020 - 04:49 PM GMTThe baseline case for gold 320 AD

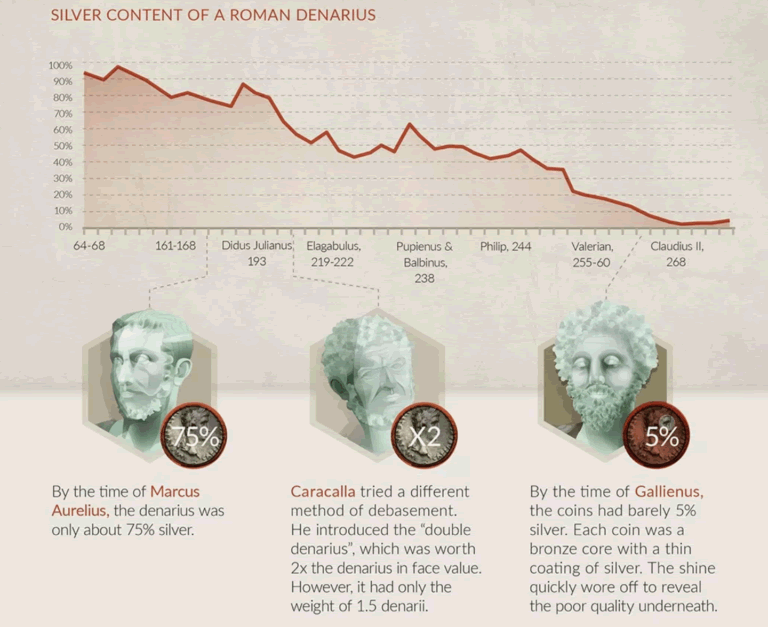

We sometimes forget that inflation is a process rather than an event. One of the better-known examples of that axiom is the nearly two centuries-long debasement of Rome’s silver denarius – an inflationary episode Jack Whyte, a writer of historical fiction, skillfully addresses in his latest novel, The Burning Stone.

Set in Great Britain in the fourth century AD during the Roman occupation, The Burning Stone is a prequel to Whyte’s engaging, seven-book series on King Arthur – The Camulod Chronicles. Throughout the series, Whyte juxtaposes the rise of Arthur’s Camelot against Rome’s decline. This particular story is told through the lens of a young Roman from a wealthy family with banking, political and military interests who flees to Britain after his immediate family is murdered for reasons that remain a mystery for most of the novel.

After a series of fateful events involving his future wife, he becomes a blacksmith forging and fashioning the highest quality swords. Even as he assumes the life of tradesman-entrepreneur, he keeps contact with the Roman military in Britain and goes about the business of reordering his affairs as an expatriate Roman citizen albeit one who wishes to keep a low profile. The young blacksmith, Quintus Publius Varrus, one day receives a scroll from his uncle, an admiral in Rome’s navy, advising him to expect an important shipment from the continent in the near future.

After a series of fateful events involving his future wife, he becomes a blacksmith forging and fashioning the highest quality swords. Even as he assumes the life of tradesman-entrepreneur, he keeps contact with the Roman military in Britain and goes about the business of reordering his affairs as an expatriate Roman citizen albeit one who wishes to keep a low profile. The young blacksmith, Quintus Publius Varrus, one day receives a scroll from his uncle, an admiral in Rome’s navy, advising him to expect an important shipment from the continent in the near future.

This is where Whyte’s tale takes a turn toward monetary economics and an insightful commentary on Rome’s currency debasement as a symptom of, if not a catalyst for, the empire’s ultimate demise. The inflationary process extended over the reigns of several emperors and went on for more than two centuries (See graphic below). The Roman citizen who had the wisdom to hedge that process ended up preserving and building his or her wealth. Those who did not, at some point along the way, suffered the debilitating effects of the resulting inflation.

Image courtesy of Visual Capitalist

In Whyte’s telling, Varrus’ grandfather, an advisor to Emperor Diocletian and a member of the ultra-wealthy Seneca banking family through marriage, was among those who chose to accumulate gold coins as a hedge against the on-going debasement of the silver denarius.* When Varrus opens the shipment from his uncle, he finds it to contain a very large hoard of Roman imperial gold coins and a letter describing his grandfather’s rationale for forming the accumulation.

“His heroes,” the uncle writes, “included giants like Cincinnatus and Cato the Elder, both revered for their unswerving loyalty, integrity, and civic duty. More humorously, and with genuine irony, he distrusted banks and bankers – unsurprisingly, perhaps, given that he wed into the wealthiest banking family in Rome… In keeping with that distrust, he was assiduous in hoarding his money, keeping its whereabouts unknown.”

“There are five thousand aureii in the box,” he goes on, “the oldest of them dating from the time of Octavian, Caesar Augustus, and the newest of them, in the fourth level down, minted during the reign of Marcus Aurelius. After that time the value of the aureus declined from year to year as the intrinsic value was degraded by unscrupulous speculators, so your grandfather refused to deal in anything more recent than the mintings of Marcus Aurelius.”

“The bottom layer of coins, though,” he says concluding his description of the chest’s contents, “contains nothing but golden solidi minted during the lifetime of Diocletian. There can be no deception there. The solidus is minted of pure gold, and though few of them were issued, there can be no doubt of there validity in real terms, and my father valued them highly. That layer contains one thousand Diocletian solidi. There is no more valuable coin in existence, and I know of no one other than yourself, among all the people I know, who can claim to have a thousand genuine Diocletian solidi in their possession. Any one of the other coins in the box could fetch ten times their nominal value from a sharp-eyed trader.”

The baseline case for gold 2020 AD

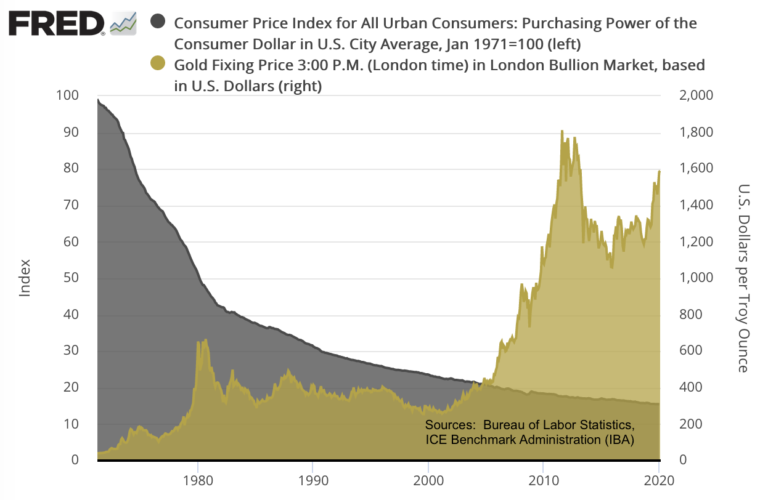

Fast forward 1700 years and we find that not much has changed. Since 1971, when the United States detached the dollar from gold and ushered in a new era of fiat money, the dollar, as shown in the chart below, has lost 84.5% of its purchasing power. The 1971 dollar is now worth 15.5¢. Gold in the meanwhile has risen from $35 per ounce then to nearly $1700 today (with a stop at $1900/oz in 2011.)

Over the long run, gold in the modern era has maintained its purchasing power as it did in Roman times, while the dollar, like the denarius, has been steadily debased. So it is by the circuitous route just taken, you now know how Jack Whyte’s depiction of the Roman inflation in The Burning Stone reinforces the argument for gold ownership today. It also explains why we went to the trouble of presenting a review of this intriguing book in our monthly newsletter.

We should be careful not to drop our guard on the prospects of future inflation because of the lull we have encountered in recent years. In the inflationary process, the line between cause and effect is not always a straight one. History teaches us, though, that when runaway price inflation does arrive, it can come suddenly, without notice, and with a vengeance. Rome’s inflation and currency debasement, as Whyte points out in The Burning Stone, proceeded in fits and starts and unfolded over centuries. When runaway price inflation struck, however, it delivered its ill-effects emphatically during individual lifetimes – sometimes within a few short years. That is why it pays, as shown in the chart, to view gold as a permanent and constantly maintained aspect of the investment portfolio like Quintus Publius Varrus’ grandfather did in Whyte’s novel.

In a recent Daily Reckoning opinion piece, James Ricards argues that investors around the world are now beginning to lose faith in fiat currencies and stockpiling gold as a result. The fact that the metal has achieved all-time highs in a long list of currencies over the past several months supports that conclusion. The incipient demand for gold on a global basis, however, raises a different kind of problem – particularly if we move from crisis watch to crisis reality.

“In the new super-spike,” he warns, “you may not be able to get any gold at all. You’ll be watching the price go up on TV, but unable to buy any for yourself. Gold will be in such short supply that only the central banks, giant hedge funds and billionaires will be able to get their hands on any. The mint and your local dealer will be sold out. That physical scarcity will make the price super-spike even more extreme than in 1980. The time to buy gold is now, before the price spikes and before supplies dry up.”

At the moment, the supply lines in the precious metals business are still functioning smoothly. There could come a time, though, when they are not – a possibility, by the way, that has received scant attention in the context of the coronavirus contagion.

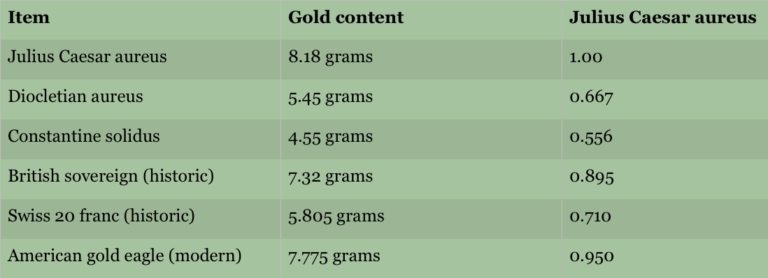

Data from Wikipedia

Editor’s note: The marketplace has always valued the utility and versatility of small gold coins. In this table, we show the declining gold content in the aureus from Julius Caesar’s reign (46-44 BC), to Diocletian (284-305 AD) and finally Constantine (306-337 AD). As a matter of interest, we also list the three coins offered above and their net fine gold content relative to Julius Caesar’s aureus. Though the gold content in these coins is fixed, the currencies in which they are traded can suffer debasement like that experienced by the silver denarius in the time of Imperial Rome – that debasement achieved by reducing net fine metal content and leaving the denomination the same. It is interesting to note how closely the gold content in the historic British sovereign approximates that of Julius Caesar’s original aureus.

* “Now one interesting thing with all this inflation should be a great comfort to us: historians of prices in the Roman Empire have come to the conclusion that despite all of this inflation — or perhaps we should say, because of all of this inflation — the price of gold, in terms of its purchasing power, remained stable from the first through the fourth century. In other words, gold remained, in terms of its purchasing power, a stable value whereas all this other coinage just became increasingly worthless.” – Inflation and the Fall of the Roman Empire, Joseph R. Peden (2017)

By Michael J. Kosares

Michael J. Kosares , founder and president

USAGOLD - Centennial Precious Metals, Denver

Michael J. Kosares is the founder of USAGOLD and the author of "The ABCs of Gold Investing - How To Protect and Build Your Wealth With Gold." He has over forty years experience in the physical gold business. He is also the editor of Review & Outlook, the firm's newsletter which is offered free of charge and specializes in issues and opinion of importance to owners of gold coins and bullion. If you would like to register for an e-mail alert when the next issue is published, please visit this link.

Disclaimer: Opinions expressed in commentary e do not constitute an offer to buy or sell, or the solicitation of an offer to buy or sell any precious metals product, nor should they be viewed in any way as investment advice or advice to buy, sell or hold. Centennial Precious Metals, Inc. recommends the purchase of physical precious metals for asset preservation purposes, not speculation. Utilization of these opinions for speculative purposes is neither suggested nor advised. Commentary is strictly for educational purposes, and as such USAGOLD - Centennial Precious Metals does not warrant or guarantee the accuracy, timeliness or completeness of the information found here.

Michael J. Kosares Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.