Will Trump’s Free Cash Help the Economy and Gold Market?

Commodities / Gold & Silver 2020 Mar 23, 2020 - 07:09 PM GMTBy: Arkadiusz_Sieron

Economic data shows that the coronavirus crisis will be severe. To soften the blow, Trump announced his support plans for the economy. Will the stimulus package help? And when will gold finally rise?

Economic data shows that the coronavirus crisis will be severe. To soften the blow, Trump announced his support plans for the economy. Will the stimulus package help? And when will gold finally rise?

COVID-19 Hits the US Economy

The global epidemic of COVID-19 has already hit the US economy. We start to see evidence how bad this crisis might be. First, retail sales dropped 0.5 percent in February. That’s the biggest drop in a year. But it will change quickly – just think about the number in March or April!

Second, the US consumer sentiment fell from 101 in February to 95.9 in March. Again, expect much worse readings in the future, as the number covers only the beginning of the month when Americans just started to acknowledge the coronavirus threat.

Third, the Philadelphia Fed manufacturing index fell from 36.7 in February to -12.7 in March, the lowest reading since June 2012. So, forget about recovery in the manufacturing recession.

Fourth, initial jobless claims surged from 211,00 last week to 281,000 yesterday. It means that more Americans applied for unemployment benefits. So, prepare for the rise in the unemployment rate!

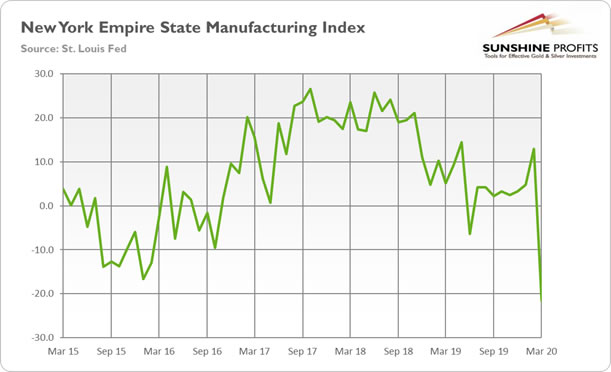

Fifth, as you can see on the chart below, the New York Fed’s Empire State business conditions index fell record 34.4 points to -21.5, the lowest level since the global financial crisis. As the COVID-19 epidemic in the US was still in its early stages during the survey, the worst seems yet to come.

Chart 1: New York Empire State Manufacturing Index from March 2015 to March 2020

Trump To The Rescue

On Tuesday, U.S. President announced a plan to send money to Americans as soon as possible to ease the negative economic shock from the coronavirus crisis. Trump said some people should get $1,000 as help with their living expenses because they cannot work under quarantine and social distancing. On Wednesday, he wrote on Twitter:

For the people that are now out of work because of the important and necessary containment policies, for instance the shutting down of hotels, bars and restaurants, money will soon be coming to you.

I also want one grand, can you send it to me as well, Mr. President?

The administration is also talking about a new stimulus package of around $850 billion to cover payroll tax cut, small business loans, and bailouts for airlines struggling from plummeting demand. However, Democrats, who control the House, prefer refundable tax credits for self-employed workers and ensuring that sick workers can get longer-term leave if needed rather than a cut in a payroll tax. It would be actually the third coronavirus aid plan to be considered by Congress just this month. Trump signed the first $8.3 billion package to battle the coronavirus two weeks ago, and he signed on Wednesday the second $100 billion package that would expand paid leave and unemployment benefits. Anyway, one thing is certain: the US government stimulus will be large!

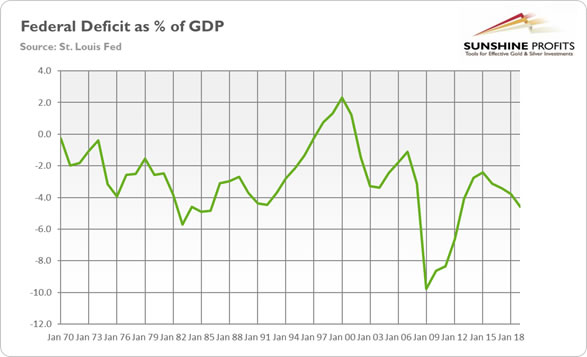

As you can see in the chart below, the fiscal deficit for 2019 is $984 billion, or 4.6 percent of GDP. Before the COVID-19 pandemic, the budget deficit for 2020 was projected to be $1 trillion. It means that the stimulus will balloon the fiscal deficit to $1.9 trillion, or to staggering 8.8 percent of GDP, the level not seen since the Great Recession.

Chart 2: Federal deficit as a percent of GDP from 1970 to 2019

But that’s not all. To make matters worse, the tax revenue will plummet, while the GDP is likely to shrink this year. Nobody knows how much, but let’s follow Goldman Sachs and assume that the annual GDP growth will decline 0.4 percent in 2020. So, the deficit will be even higher, definitely more than 9 percent of GDP! As a result, the federal debt will increase from $23 trillion, or 106 percent of GDP, in 2019 to almost $25 trillion in 2020, or 116 percent of GDP. Oops, we have a debt problem here!

Implications for Gold

What does it all mean for the gold market? Well, we are in a recession. The economy will be hit severely, especially in the first half of the year. The White House and Congress announced the stimulus package. But it did not help and calm the stock market – which is not surprising given the level of fear. What it will do, is to balloon the public debt and raise the likelihood of introducing the universal basic income in the future. All this means higher government expenditure, higher deficits and higher indebtedness. Soaring debt, combined with increasing money supply, very low real interest rates and global recession, is another fundamentally positive factor for the gold market. When the blood dries on the trading floor, investors will cease to sell gold in order to raise cash – and then we get the fundamental reason for the rally in gold to start. The similar dynamic occurred after the collapse of the Lehman Brothers – gold fell initially before rebounding sharply amid the loose monetary policy.

If you enjoyed the above analysis and would you like to know more about the gold ETFs and their impact on gold price, we invite you to read the April Market Overview report. If you're interested in the detailed price analysis and price projections with targets, we invite you to sign up for our Gold & Silver Trading Alerts . If you're not ready to subscribe at this time, we invite you to sign up for our gold newsletter and stay up-to-date with our latest free articles. It's free and you can unsubscribe anytime.

Arkadiusz Sieron

Sunshine Profits‘ Market Overview Editor

Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Arkadiusz Sieron Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.