Will the Fed Going Nuclear Help the Economy and Gold?

Commodities / Gold & Silver 2020 Mar 27, 2020 - 06:28 PM GMTBy: Arkadiusz_Sieron

On Monday, the Fed introduced QE-infinity. What does it imply for the US economy and the gold market?

Fed Drops Bazooka… and Goes Nuclear Instead!

On Monday, the Fed pulled out an even larger bazooka than it did previously. Or, forget about the bazooka. The US central bank has gone nuclear! Indeed, the US central bank announced extensive new measures to support the economy. On March 15, the FOMC had announced it would purchase at least $500 billion of Treasury securities and at least $200 billion of mortgage-backed securities. On Monday, the Fed expanded its asset purchasing program by including purchases of agency commercial mortgage-backed securities in its agency mortgage-backed security purchases. In addition, the FOMC introduced unlimited quantitative easing. Yes, unlimited! The QE-infinity is back!

What is really frightening is that it took just eight days for the Federal Reserve to go from QE of $700 billion to unlimited buying of assets to fight the coronacrisis. The QE3 which followed the Great Recession, was announced in September 2012 – that is four years after the collapse of the Lehman Brothers. Now, the Fed went totally berserk just within one week from the QE1! It means two things. First, the previous measures turned out to be ineffective. Told ya so! You cannot stop the health crisis with monetary policy. Second, the pace and scale of the current crisis is shockingly fast. From March 15 to March 20, the Fed had already spent $340 billion in Treasury and mortgage-backed securities, half of the planned program! It shows how fragile the current monetary system based on the fractional reserve banking and fiat currencies is. It also means the current economic shock is probably the most disruptive crisis since not only the Great Recession but the Great Depression and the Second World War.

Indeed, people all over the world, including the US, simply withdrew from work and economic activity to protect themselves and others against the coronavirus. In wartime, the economic machine still functions – but it simply produces more guns than butter. In Great Depression, banks went bankrupt while the unemployment rate rose to 25 percent, but the rest of the people worked almost as usual. In Great Recession, the financial sector collapsed, while the unemployment rate rose to 10 percent, but the rest of society functioned more or less normally. But now, the economy is frozen. Many people do not work, do not go outside, do not buy stuff. As if someone had pulled out the plug – and the world’s engine stopped working.

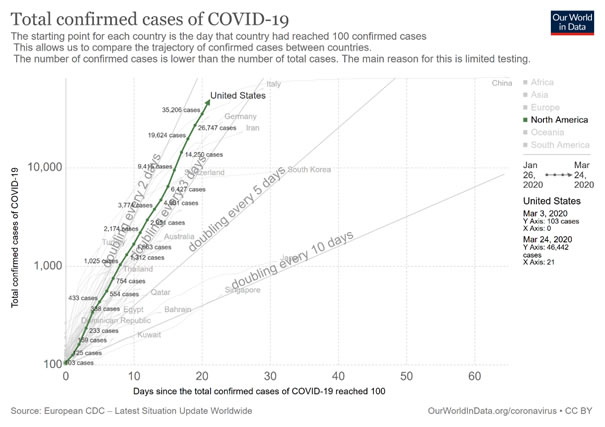

And, we are afraid that the worst is yet ahead of the United States. More state lockdowns have been announced, while the numbers of infected Americans have been rising exponentially. Actually, as one can see in the chart below, the epidemiological curve in the US is very steep, even steeper than in Italy. It means that the real health system crisis and the biggest death toll is yet to come.

Chart 1: Trajectory of total confirmed cases since the 100th case in the United States and other countries

Implications for Gold

What does it all mean for the gold market? Well, from the fundamental point of view, the QE-infinity is positive for the gold prices. It’s true that each subsequent round of the quantitative easing in the aftermath of the Great Recession was less and less positive for the gold prices. And the Q3 turned out negative for the yellow metal. But this situation is really different. The QE-infinity was introduced just several days after the first round of asset purchases. And the level of fear is still high. Investors can question whether the Fed is able to help at all. And whether it still has any ammunition. But what else could he possibly do. For us, the Fed is rather impotent here, but it will still come up with new programs, nevertheless. Prepare for the NIRP, the cap on the interest rates, or the helicopter money or whichever combination thereof!

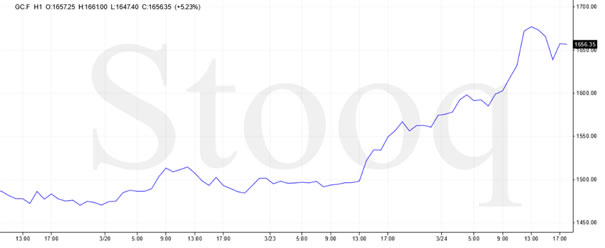

Actually, as one can see in the chart below, the price of gold has already risen in the aftermath of the Fed’s mammoth response. The yellow metal rose more than $100 overnight! What is important here, is that S&P 500 Index’s slide deepened on Monday, which may suggest that gold may be decoupling from the stock market.

Chart 2: Gold prices from March 19 to March 24, 2020

However, if the stock market plunges further, the sell-off in the gold market may continue. But when the dust settles, gold should fundamentally react to the Fed’s ultra easy monetary policy and easy fiscal policy – and go up.

If you enjoyed the above analysis and would you like to know more about the gold ETFs and their impact on gold price, we invite you to read the April Market Overview report. If you're interested in the detailed price analysis and price projections with targets, we invite you to sign up for our Gold & Silver Trading Alerts . If you're not ready to subscribe at this time, we invite you to sign up for our gold newsletter and stay up-to-date with our latest free articles. It's free and you can unsubscribe anytime.

Arkadiusz Sieron

Sunshine Profits‘ Market Overview Editor

Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Arkadiusz Sieron Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.