Will Gold Decline As Economies Gradually Reopen?

Commodities / Gold & Silver 2020 May 09, 2020 - 08:29 PM GMTBy: Arkadiusz_Sieron

Half the US States and countries like Italy and Germany are gradually easing lockdowns. Taking measured steps, the moves are broadly cheered. Rightfully so? And what does the reopening mean for the gold market?

Epidemics: Bad, Good, and Ugly

By May 6, 2020, more than total 3.6 million of confirmed cases have been reported in the world and more than 250,000 have already died from the COVID-19. In the United States, about 1.2 million of cases have been identified so far, and more than 71,000 people have died. This is bad news.

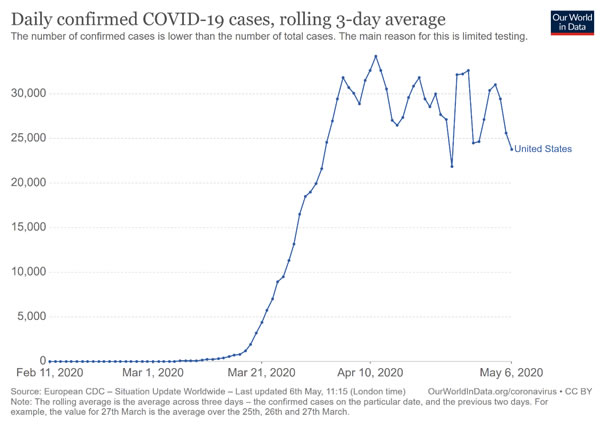

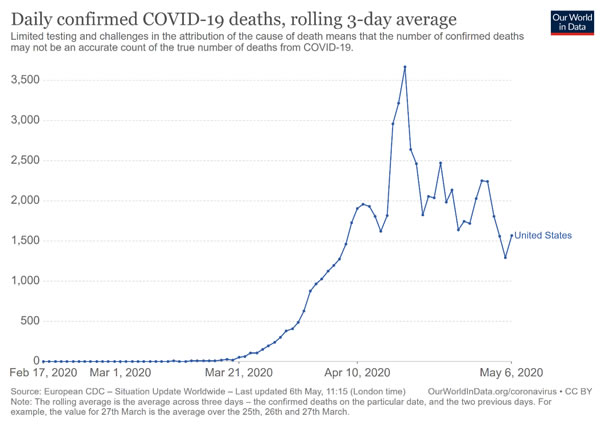

What is good is that the US epidemiological curve has flattened somewhat, which means that the growth pace of infections and deaths, has slowed down. As the charts below shows, the peaks in daily number of both confirmed cases and deaths are beyond us.

Chart 1: Daily confirmed COVID-19 cases (rolling 3-day average) in the US from February to May 6, 2020

Chart 2: Daily confirmed COVID-19 cases (rolling 3-day average) in the US from February to May 6, 2020

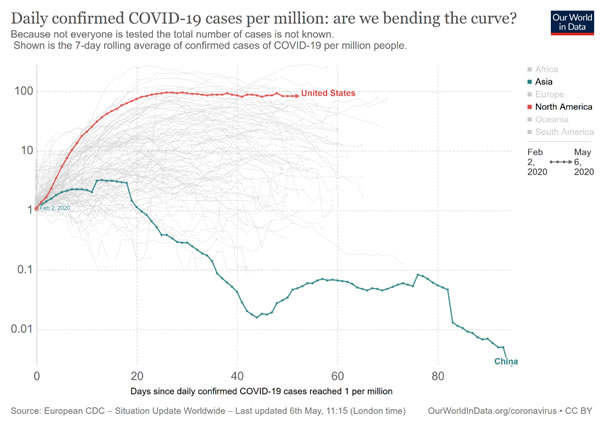

This is really great news, as it means that social distancing worked and we avoided the continuation of the exponential growth. However, the ugly truth is that the epidemic is far from over. As the chart below shows, the US epidemiological curve still remains steeper than for other countries. Indeed, its trajectory does not look still like the curve for China where the epidemic is practically over.

Chart 3: Daily confirmed cases per million people in the US compared to China and other countries.

And what is really disturbing is that the virus is mutating – the new study published by researchers at the Los Alamos National Laboratory found that the coronavirus that emerged in Wuhan, China, has mutated and the new, dominant and even more contagious strain is spreading across the U.S. So, it goes without saying that the virus can mutate further and arrive in autumn as an even more (or less, this is also possible) deadly slash contagious pathogen.

Countries and States Ease Lockdowns

But with flattened curved and the epidemic stabilizing, several European countries and more than a few US states are easing lockdowns. This is great news from the economic point of view. It was clear that economic shutdown could not last forever. However, this move is not without risks. The epidemiologists warn against the possibility of the second wave of infections in autumn, especially unless testing for the virus is expanded dramatically, which has not been done everywhere. Remember the Spanish flu? It attacked in three waves. And do you know why? Because many regions eased the restrictions too soon. We hope that the coronavirus will not return later this year, but, unfortunately, this is a possible scenario given the fact that we have not probably reached herd immunity yet.

Implications for Gold

What does the reopening of economies mean for the gold market? Given that the Great Lockdown took gold prices to about $1,700, does it imply that the Great Reopening will push gold down? Well, not necessarily.

Of course, given that a lot of bad news has been priced into gold prices, the easing of lockdown restrictions could spur optimism and diminish gold’s safe-haven appeal. The recent breaking news that the German high court has challenged the European Central Bank’s bond-buying authority has already weakened the euro against the US dollar, which can create downward pressure on the gold prices. And in our Gold Trading Alerts, we have warned Readers that, based on technical factors (e.g., the speculative interest in the gold market is very high), gold could go lower in the short-term, before it would go much higher.

However, investors should remember that the restrictions will be eased only gradually. And we could see second waves, at least in some places. And social distancing will not disappear during one night, so the economic recovery could be less vigorous than many people hope for. So, a lot of uncertainty will remain in the marketplace, supporting the gold prices (eroding U.S.-China trade relations can also help here). Moreover, when the lockdowns end, investors could shift their attention to the negative consequences of ultra easy monetary and fiscal policies, such as the very low real interest rates and high public debts.

To sum, although the price of gold could drop in the short-term, there is still room for further upward move later this year, as investors should continue to buy gold as an insurance against the huge increase in the money supply and the federal debt, as well as against the geopolitical risks (Trump’s erratic stance on the epidemic changes the presidential race) and against the second wave of coronavirus.

Thank you.

If you enjoyed the above analysis and would you like to know more about the gold ETFs and their impact on gold price, we invite you to read the April Market Overview report. If you're interested in the detailed price analysis and price projections with targets, we invite you to sign up for our Gold & Silver Trading Alerts . If you're not ready to subscribe at this time, we invite you to sign up for our gold newsletter and stay up-to-date with our latest free articles. It's free and you can unsubscribe anytime.

Arkadiusz Sieron

Sunshine Profits‘ Market Overview Editor

Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Arkadiusz Sieron Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.