Will Stocks Lead the Way Lower for Gold Miners?

Commodities / Gold and Silver Stocks 2020 May 15, 2020 - 09:38 PM GMTBy: P_Radomski_CFA

The precious metals market did almost nothing yesterday, and consequently we have relatively little to comment on today. There are two subtly bearish signs that we would like to feature, nonetheless.

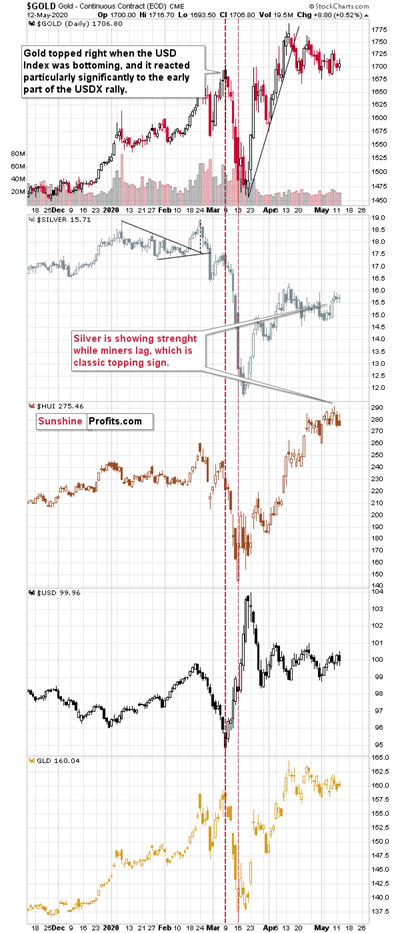

The first subtly bearish sign is the change in the way the USD Index “topped” this month. In early April, and then in late April, the USDX reversed close to the 101 level and then moved lower in a decisive way, until declining below 99. This time has already proved to be different.

In early May, the USDX reversed and declined a bit, but instead of continuing its decline in the following days as it used to do in April, the US currency moved back up, and touched its previous highs. The shape of the decline is clearly different, so perhaps the outcome will be different as well. Perhaps instead of a move below 99, we’ll finally see a confirmed breakout above 101.

Again, it’s a relatively subtle indication, but still something that we noticed yesterday. Other factors that we discussed in the previous days are more important.

The second small sign is the mining stocks’ weakness. Even though gold, and the GLD ETF moved higher yesterday, the HUI Index – proxy for gold stocks – was practically flat. The GDX ETF - another proxy for the miners - closed lower.

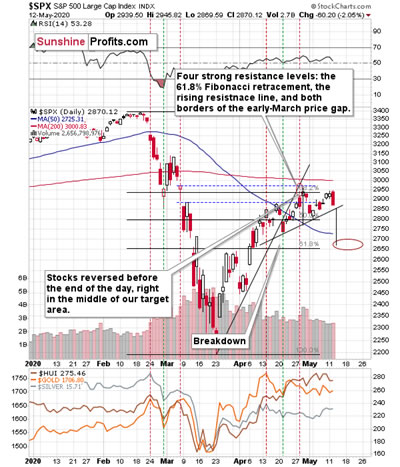

This would normally be an important sign – not a small one – but yesterday’s weakness could be explained by a quite significant daily decline in the main stock indices.

The daily slide in the S&P 500 was likely to affect miners – and it did. Consequently, it’s no wonder that yesterday, miners disappointed relative to gold.

Still, let’s keep in mind that the stocks traded higher previously, and miners lagged, while silver leaped the gold price, so the bearish implications of the relative performance analysis remain intact. It’s just that yesterday’s session was not as meaningful as the previous ones were.

If stocks decline more and break below the 2850 level, they will create a bearish head-and-shoulders top pattern, with the target slightly below 2700. We don’t think that this level would stop the decline for long, but a decline – if it is to follow at all – has to start in some way. A move to 2700 or so based on the head-and-shoulders pattern seems a quite likely way for this move to start.

Let’s keep in mind that back in 2008 (and the current situation is still very similar to 2008 due to the sudden nature of the crisis) the final slide in gold started when the USD Index rallied decisively, breaking above the previous highs.

The USD Index has been trading back and forth for several weeks now without a meaningful breakout whatsoever. Perhaps the confirmed breakout above the 101 level will be what triggers the first part of what we think is going to be the final washout slide in the precious metals market.

All in all, gold’s outlook for the next few years is very bullish, but the outlook for the next several weeks remains bearish.

Thank you for reading today’s free analysis. In the full version of the analysis, we also feature our preferred way of taking advantage of the current situation and the analogies to the previous price moves. If you’d like to read those premium details, we have good news. As soon as you sign up for our free gold newsletter, you’ll get 7-day access of no-obligation trial of our premium Gold & Silver Trading Alerts. It’s really free – sign up today.

Thank you.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Tools for Effective Gold & Silver Investments - SunshineProfits.com

Tools für Effektives Gold- und Silber-Investment - SunshineProfits.DE

* * * * *

About Sunshine Profits

Sunshine Profits enables anyone to forecast market changes with a level of accuracy that was once only available to closed-door institutions. It provides free trial access to its best investment tools (including lists of best gold stocks and best silver stocks), proprietary gold & silver indicators, buy & sell signals, weekly newsletter, and more. Seeing is believing.

Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Przemyslaw Radomski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.