Gold, Silver, Mining Stocks Teeter On The Brink Of A Breakout

Commodities / Gold & Silver 2020 May 21, 2020 - 05:48 PM GMTBy: Chris_Vermeulen

This week has been a wild and emotional one and it’s just started!

With Monday’s big pop in the stock indexes, the big rally was based on vaccine news and bullish comments from the fed, convincing most traders and investors to be overly bullish this week.

My volume flow indicator showed a reading of 10 all day yesterday, which means ten shares were being bought on the NYSE at the ask, to everyone share being sold at the bid. Any reading over 3 is considered bearish short term, so ten was extreme. After the pop on Monday, stocks/indices closed lower by 1-2% on the session respectively the following session.

I have reiterated over and over, big moves (and gaps) in the price in the stock indexes that occur from the news are generally given back within a few days. This is still what I feel is going to happen in the coming days, albeit the last hour on Tuesday may have started that retracement.

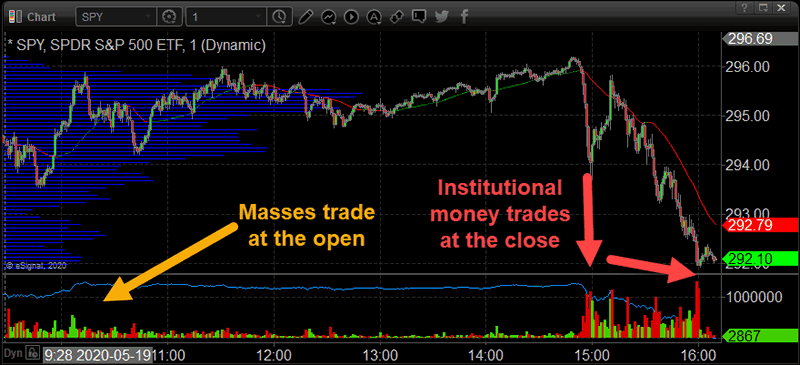

The saying in the trader’s world is that novice traders typically trade at the open and experienced players trade at the close. This continues to hold true. The chart below shows you what the BIG money payers are doing, which is selling/distributing shares to the masses, evidenced by the volume in the final hour. It is this theory why we always base our new trades to have their stop loss triggered on the closing price, and not intraday swings. Utilizing this strategy has saved many trades over the years from being stopped out, and subsequently to turn into profitable winners. It is where the price closes that counts.

Precious Metals & Gold Miners

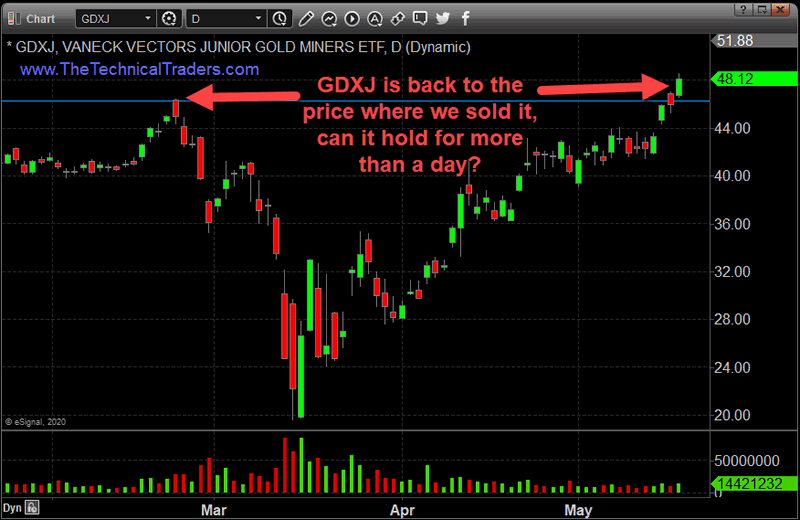

Metals and miners have been coming to life. In February, we sold our GDXJ position at the opening bell on the high of the day to lock in gains. We saw weakness in the market and took action to avoid any temporary selling, which ended up turning into a 57% market collapse. Tuesday for the first time, GDXJ is trading back to where we sold it for a nice profit with our Swing Trading ETF Trading service, and I’m getting excited again for this group of stocks.

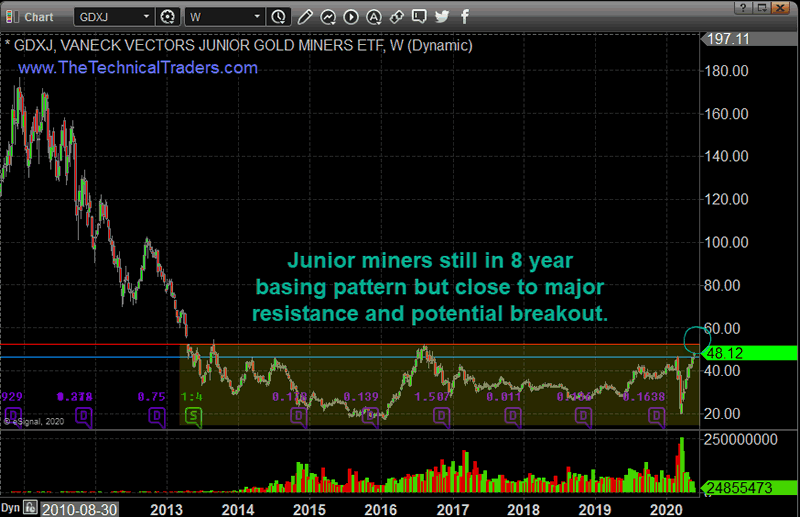

Junior Gold Stocks (GDXJ) Close To Breakout

The Junior gold stocks (GDXJ) is showing signs that they are headed to test the major breakout level of this 8-year base. The price still has to run a little higher, and it could be met with some strong selling once touched. Be aware that junior gold miners are not in the clear, just yet. Once they clear resistance they are a long-term investment position.

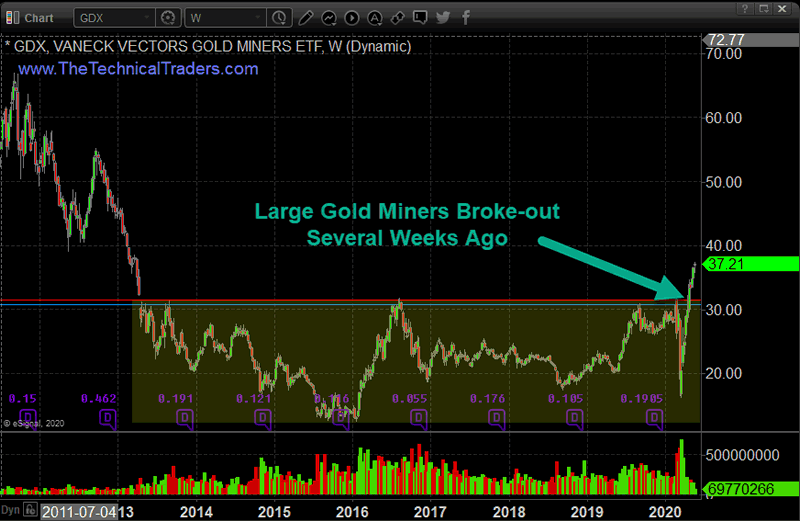

Large-Cap Gold Miners (GDX) Already Broke Out

If you take a closer look at the large-cap gold miners (GDX), they have already broken out and started to rally. This is a new bull market for this particular group of stocks. We got long this new bull market a few weeks ago in my Technical Investor Portfolio which focused on long term position with a much wider stop loss than swing trading positions.

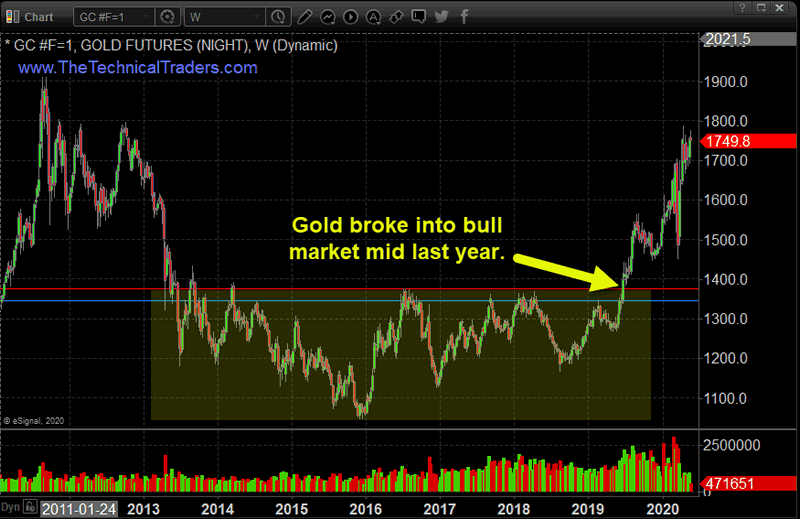

Gold Bullion in Full Blown Bull Market

Gold also broke out and started a new bull market mid last year. We are also long gold in our Technical Investor portfolio as well. Gold has completed its initial move but is on the verge of popping to the $2000 market if we get just the right market conditions over the next couple of months.

We are in what many consider unprecedented times for businesses and survival. As a long-time trader, I consider these exciting stages for stocks, and commodities. Lots of things are happening and they will be erratic and volatile I expect. How the world functions are changing more rapidly than many of us realize.

The last ten years of investing in stocks have been incredible. We all experienced a Super Cycle Bull Market, and those invested in stocks and who also bought homes early have made a fortune with very little effort. But I fear this may be coming to an end sooner than most people think and feel.

The fundamentals for stocks no longer make any sense with earnings way down and still falling. The Fed is printing money faster than at any time in history as well as paying everyone and everything to keep the lights on and the music playing. They could certainly keep things going for a while and drive the markets higher with loose money policies and prop everything up (including lower-rated corporate bonds).

Can the Fed and other central banks support the global economy? Remember, it’s not just North America under pressure, but every other country and nearly everyone and their business are enduring financial stress.

The bottom line is that no matter which way the markets go, we will be positioned on the right side with technical analysis and sound advice as to what actions, if any, to take. And both active trading and long-term investment portfolio positions are more critical now than they have been in the last ten years. The days of just buying every dip and holding will be over in a couple of months.

So far it has been a crazy, unprecedented period. Add to that, over 1,000,000 new trading accounts opened this year and many new novice traders who have entered the markets. These people are frantically buying up stocks thinking they are going to make a lot of money. We believe they are going to have a very rude awakening when/if the bear market takes hold over the next 3-8 months.

Trading this year has been slow for our subscribers but our trading accounts continue to make new high watermark levels every couple weeks, and that is all that matters. The market crash shook things up, and during an unexpected crisis the best play, in our opinion, was to step back and cherry-pick only low-risk trades until price action returns to some normal level, which the market is finally beginning to do.

However slow, I am proud that we did not take any undue risk and that our model account has remained positive throughout 2020 and we are up when most other services, including the best hedge funds in the world, have negative returns thus far this year.

My staff and I are always scouring for new trading opportunities. Right now, the XLF ETF, which is the financial sector, is breaking down and may present a short opportunity. As you know, we also like silver, gold, and both the junior and large-cap miners, but we will first wait to see if this wave of buying is met with sellers in the near future. Until then, we will keep you posted.

The next few years are going to be full of incredible opportunities for skilled traders and investors. Huge price swings, incredible revaluation events, and, eventually, an incredible upside rally will start again.

I’ve been trading since 1997 and I’ve lived through numerous market events. The one thing I teach my members is that risk is always a big part of trading and that’s why I structure all of my research and trading signals around “finding profits while reducing overall risks”. Sure, there are fast profits to be made in these wild market swings, but those types of trades are extremely risky for most people – and I don’t know of anyone that wants to risk 50 or 60% of their assets on a few wild trades.

I’m offering you the chance to learn to profit, as I do with my own money, from market trends that I hand-pick for my own trading. These are not wild, crazy trades – these are simple, effective, and slower types of trades that consistently build wealth. I issue about 4 to 8+ trades a month for my members and adjust trade allocation based on my proprietary allocation strategy– the objective is to gain profits while managing overall risks.

You don’t have to spend days or weeks trying to learn my system. You don’t have to try to learn to make these decisions on your own or follow the markets 24/7 – I do that for you. All you have to do is follow my research and trading signals and start benefiting from my research and trades. My new mobile app makes it simple – download the app, sign in and everything is delivered to your phone, tablet, or desktop.

I offer membership services for active traders, long-term investors, and wealth/asset managers. Each of these services is driven by my own experience and my proprietary trading systems and modeling systems. I have a small team of dedicated researchers and developers that do nothing but research and find trading signals for my members. Our objective is to help you protect and grow your wealth.

Please take a moment to visit www.TheTechnicalInvestor.com to learn more. I can’t say it any better than this… I want to help you create success while helping you protect and preserve your wealth – it’s that simple.

Chris Vermeulen

www.TheTechnicalTraders.com

Chris Vermeulen has been involved in the markets since 1997 and is the founder of Technical Traders Ltd. He is an internationally recognized technical analyst, trader, and is the author of the book: 7 Steps to Win With Logic

Through years of research, trading and helping individual traders around the world. He learned that many traders have great trading ideas, but they lack one thing, they struggle to execute trades in a systematic way for consistent results. Chris helps educate traders with a three-hour video course that can change your trading results for the better.

His mission is to help his clients boost their trading performance while reducing market exposure and portfolio volatility.

He is a regular speaker on HoweStreet.com, and the FinancialSurvivorNetwork radio shows. Chris was also featured on the cover of AmalgaTrader Magazine, and contributes articles to several leading financial hubs like MarketOracle.co.uk

Disclaimer: Nothing in this report should be construed as a solicitation to buy or sell any securities mentioned. Technical Traders Ltd., its owners and the author of this report are not registered broker-dealers or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer. Never make an investment based solely on what you read in an online or printed report, including this report, especially if the investment involves a small, thinly-traded company that isn’t well known. Technical Traders Ltd. and the author of this report has been paid by Cardiff Energy Corp. In addition, the author owns shares of Cardiff Energy Corp. and would also benefit from volume and price appreciation of its stock. The information provided here within should not be construed as a financial analysis but rather as an advertisement. The author’s views and opinions regarding the companies featured in reports are his own views and are based on information that he has researched independently and has received, which the author assumes to be reliable. Technical Traders Ltd. and the author of this report do not guarantee the accuracy, completeness, or usefulness of any content of this report, nor its fitness for any particular purpose. Lastly, the author does not guarantee that any of the companies mentioned in the reports will perform as expected, and any comparisons made to other companies may not be valid or come into effect.

Chris Vermeulen Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.