Tying Gold Miners and USD Signals for What Comes Next

Commodities / Gold and Silver Stocks 2020 Jun 05, 2020 - 07:07 PM GMTBy: P_Radomski_CFA

The precious metals sector was likely to decline, and it did exactly that. And based on what we just saw, it’s likely to decline even more.

Once again, the situation yesterday and so far today developed quite in tune with what we wrote yesterday, so today’s analysis will take form of a broad update. Let’s take a look at the GLD ETF. In yesterday’s and Monday’s analyses, we described it in the following way:

[Monday] As far as the short-term is concerned, we have a good indication from the GLD ETF that the rally is about to end today. This is the case due to the triangle-vertex-based reversal that we have right now. This trading technique has proven to be useful many times in the previous months, so it seems to be worth to pay attention to its indications also this time.

[Tuesday] The GLD ETF has indeed moved higher yesterday (less than 0.5%, though), and gold futures are moving lower in today’s pre-market trading (so far declining by about 0.3%). This might have indeed been the top, especially that silver invalidated its tiny breakout above the previous 2020 highs and gold showed weakness relative to declining USD Index.

GLD ultimately declined by 0.65%, which means that it erased more than Monday’s gains. The triangle-vertex-based reversal technique seems to have worked once again. This is further confirmed by the fact that gold is once again down in today’s pre-market trading – despite lower USD Index values.

In yesterday’s analysis, we emphasized that the length of the current decline is very similar to the length of the February – March decline that we saw right before the big USDX run-up. We also argued that the situation is relatively similar on the fundamental front. To clarify, there are obvious differences, but the key similarity is that it’s relatively clear that the Covid-19 cases are going up and the economic implications are going to be more severe than it is currently perceived in general, but the numbers don’t yet reflect that. Which is probably why the USDX is still not soaring and stocks are not yet declining. Again – it’s a “yet” in my view.

What we would like to add to the above today is that in March, the USDX bottomed on the third day after breaking below the previous important support (the January low). Today is also the third day when the USD Index moved below the important support in the form of the 61.8% Fibonacci retracement. It could be the case that the big run-up is just around the corner. And since gold is already declining despite the lack of USD’s help, such an USDX rally would likely have a devastating effect on the precious metals sector.

As you can see on the above chart, silver is now visibly below the previous highs, and it’s now crystal-clear that silver’s small attempt to break to new 2020 highs was invalidated. This is something that we often see as a confirmation that the top is already in, and it seems that this is the case also this time.

Please note that the huge slide below $12 in silver futures started from almost the same levels and it took less than a month for the white metal to move there. If the first part of the slide is similar to what we saw previously, we can expect to see a decline below $17 shortly.

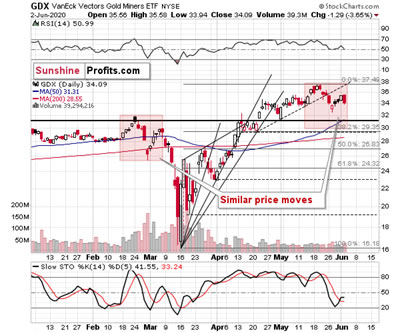

Miners’ performance also suggests that another slide is starting. And it’s not only because of HUI’s profound monthly reversal, or the invalidation of its breakout above the 2016 highs.

Monday’s rally on low volume was followed by a bigger decline on visibly bigger volume. GDX has almost erased three days of gains, declining more on a relative basis than GLD did during the same time. This serves as yet another confirmation that the top is already in.

The thing that we would like to add today is the note about similarity between the price patterns that we saw between mid-February and early March and the last few weeks. The areas marked in red are identical. As you can see the shape of the price moves is very similar, and so is the timing of the price extremes. In fact, the latter is almost identical. “Almost”, as it seems the move lower started one day earlier this time.

It's just like the PMs and miners got fed up waiting for the USD’s rally and stock market’s decline and are moving lower even without them. This is the perfectly bearish situation, because once we do get the above-mentioned signs, the decline is likely to simply accelerate.

Thank you for reading today’s free analysis. There are major trading implications of the new signals that we just got and the full version of our report includes them. That’s the detail, we think you might enjoy, want, and need right now.

Thank you for reading today’s free analysis. Its full version includes details of our currently open position as well as targets of the upcoming sizable moves in gold, silver and the miners. We encourage you to sign up for our free gold newsletter – as soon as you do, you'll get 7 days of free access to our premium daily Gold & Silver Trading Alerts and you can read the full version of the above analysis right away. Sign up for our free gold newsletter today!

Thank you.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Tools for Effective Gold & Silver Investments - SunshineProfits.com

Tools für Effektives Gold- und Silber-Investment - SunshineProfits.DE

* * * * *

About Sunshine Profits

Sunshine Profits enables anyone to forecast market changes with a level of accuracy that was once only available to closed-door institutions. It provides free trial access to its best investment tools (including lists of best gold stocks and best silver stocks), proprietary gold & silver indicators, buy & sell signals, weekly newsletter, and more. Seeing is believing.

Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Przemyslaw Radomski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.