Silver Tops Gold in May, Setting up a Summer Surge

Commodities / Gold & Silver 2020 Jun 17, 2020 - 11:59 AM GMTBy: The_Gold_Report

Although the gold to silver ratio has tightened a bit, it remains elevated and could indicate more upside for silver, according to McAlinden Research Partners.

Silver and silver miners popped in May on the back of a rebound in industrial activity around the world. Ultra-low interest rates and expectations of a weaker dollar have compounded several political pressures that begun popping up at the end of the month. Though the gold to silver ratio has tightened a bit, it remains elevated and could indicate more upside for silver.

Silver futures capped a gain of nearly 24% for the month of May, the largest monthly gain since 2011. The metal jumped strongly on hopes of an upturn in industrial activity as economies around the world have begun to "reopen" in the aftermath of the COVID-19 pandemic.

As the Wall Street Journal writes, silver has lagged behind gold for years and tends to be more volatile. Silver's industrial uses have held prices back in the past, but now they've provided a short-term boost.

Steve Dunn, Head of Exchange Traded Funds, Aberdeen Standard Investments, told ETF Trends that a large 50% of silver demand comes out of industry and technology sectors, followed by 25% by jewelry. The rest is driven by investments in physical silver or related ETFs.

Silver felt the pull of the downturn in industrials over the months preceding April, particularly in March, when the gold-silver ratio reached an all-time high of 126.43. As Forbes writes, in most periods of economic downturn, the gold-silver ratio tends to rise. This makes sense because gold tends to experience greater inflows as a result of investors seeking safety and industrial uses for silver slow. No better example of this relationship in action was in March when it felt as though the entire global economy stood still. Though both gold and silver were caught up in the downward spiral of nearly every asset class, silver undeniably fell harder.

But, likewise, the gold-silver ratio tends to fall after a recessionary period. Though the U.S. appears to be at the very bottom of its recession, many major economies in Asia and Europe have managed to stoke industrial activity, which has now brought the gold to silver ratio all the way below 95.

Additionally, non-COVID uncertainty has combined with the uptick in global economic activity to help silver close the gap—particularly toward the end of last month.

Massive protests against police brutality and systemic injustice in Minneapolis, which were derailed by looting and rioting, remain ongoing and have spilled over to nearly every major metro areas across the country and beyond. Days of heated protests and other events, combined with a dash of U.S.-China trade tension, has created a premium for safe havens and comparatively cheap silver has seen renewed interest.

In the 3rd week of May, according to Aberdeen's Dunn, "silver ETFs added 33 million ounces which would be its best week since July 2019. The investment demand for physical silver continues to be strong. Governments and central banks continue to inject liquidity into the financial markets to offset the negative economic impact of COVID-19. With nominal rates near zero and expected to remain low, the environment for silver is attractive."

Demand for silver has been stronger than gold lately, said Commerzbank analyst Daniel Briesemann. "The silver ETFs tracked by Bloomberg have registered inflows of 2,479 [metric] tons since the beginning of April, i.e., since the start of the quarter. This has seen holdings rise by 12.3%, allowing silver to overtake gold in this respect… Inflows into silver ETFs since the start of the year now total 3,786 tons (+20%), which equates to almost two months of global silver mining production."

Loose monetary policy around the world bodes well for precious metals, said BMO Capital Markets Friday in updating its gold and silver forecasts. BMO said it was hiking its previous 2020 gold forecast by 5% to an average of $1,732 an ounce for the full year. It also upped its 2021 to 2024 price expectations by 4% to 8% as well as its "long-run forecast" by 17% to $1,400 an ounce from $1,200 previously.

In the case of silver, BMO said it upped its 2020 forecast by 2% to a full-year average of $17.60 an ounce, with the outlooks for 2021 to 2024 increased by 2% to 6%. The bank's "long-run" price view was increased by 6% to $18.25 from $17.25 previously.

These upgrades are especially rare for BMO, as the bank's price assumption for each metal had been static since 2015.

In another move that could chart the way forward for silver and other precious metals, Goldman Sachs wrote in a Sunday note that it was shorting the dollar, expecting the currency to weaken in the face of rising strength in foreign currencies.

Oftentimes, a weaker dollar correlates with stronger precious metals prices. MRP highlighted this relationship a number of times, especially in regard to the effect of real rates and expansion of the monetary base, going back to March 2019 when we released our "Time for Gold" Viewpoint report. Back then, spot prices for the yellow metal were around $1300/oz. Since then, gold has surged to about $1740/oz, a gain of about 34%. Recently, real rates in the U.S. plummeted and went negative, while multi-trillion dollar stimulus packages have undoubtedly pushed the monetary base to new heights.

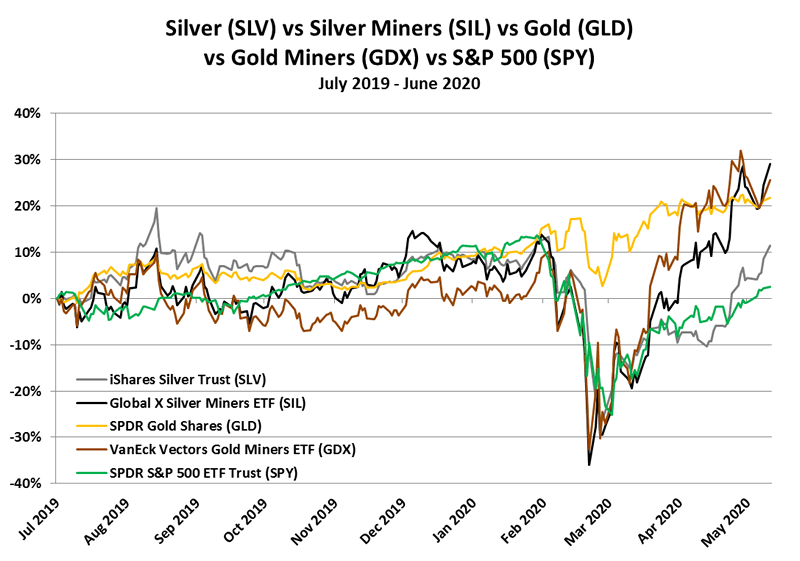

Last summer, we noticed that silver had largely missed out on that rally, becoming historically cheap when compared to gold. As a result we added LONG Silver & Silver Miners to our list of themes on July 22, 2019. Since then, the iShares Silver Trust (SLV) and Global X Silver Miners ETF (SIL) have returned 11% and 29%, respectively, outperforming the S&P 500's 3% over the same period.

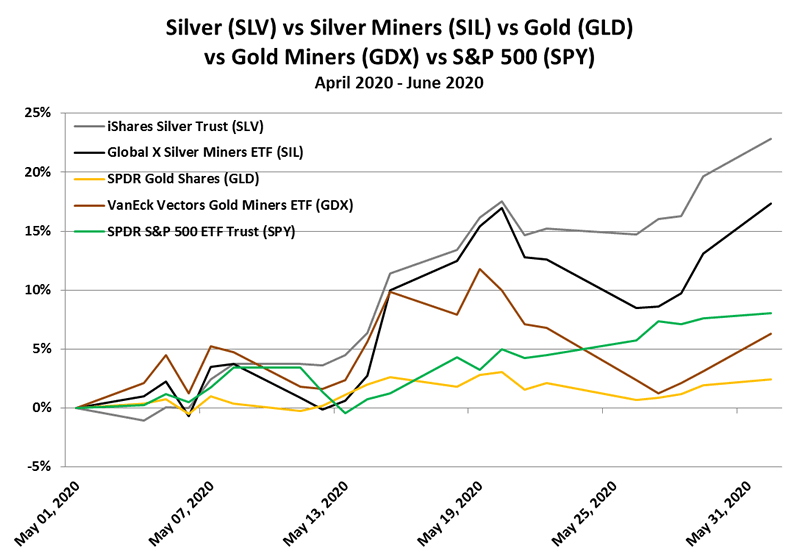

Following a broad rebound in silver prices and miner stocks, the SLV and SIL handily beat out gold and gold miner ETFs, after soaring 23% and 17% on the month. The SPDR Gold Shares (GLD) and VanEck Vectors Gold Miners ETF (GDX) rose just 2% and 6%, respectively.

This content was delivered to McAlinden Research Partners clients on June 2. To receive all of MRP's insights in your inbox Monday - Friday, follow this link for a free 30-day trial.

McAlinden Research Partners (MRP) provides independent investment strategy research to investors worldwide. The firm's mission is to identify alpha-generating investment themes early in their unfolding and bring them to its clients' attention. MRP's research process reflects founder Joe McAlinden's 50 years of experience on Wall Street. The methodologies he developed as chief investment officer of Morgan Stanley Investment Management, where he oversaw more than $400 billion in assets, provide the foundation for the strategy research MRP now brings to hedge funds, pension funds, sovereign wealth funds and other asset managers around the globe.

Disclosure: 1) McAlinden Research Partners disclosures are below. 2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. 3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy. 4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports. 5) From time to time, Streetwise Reports and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

McAlinden Research Partners: This report has been prepared solely for informational purposes and is not an offer to buy/sell/endorse or a solicitation of an offer to buy/sell/endorse Interests or any other security or instrument or to participate in any trading or investment strategy. No representation or warranty (express or implied) is made or can be given with respect to the sequence, accuracy, completeness, or timeliness of the information in this Report. Unless otherwise noted, all information is sourced from public data.

McAlinden Research Partners is a division of Catalpa Capital Advisors, LLC (CCA), a Registered Investment Advisor. References to specific securities, asset classes and financial markets discussed herein are for illustrative purposes only and should not be interpreted as recommendations to purchase or sell such securities. CCA, MRP, employees and direct affiliates of the firm may or may not own any of the securities mentioned in the report at the time of publication.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.