Gold Amid Epidemiological and Economical Update

Commodities / Gold & Silver 2020 Jul 15, 2020 - 12:46 PM GMTBy: Arkadiusz_Sieron

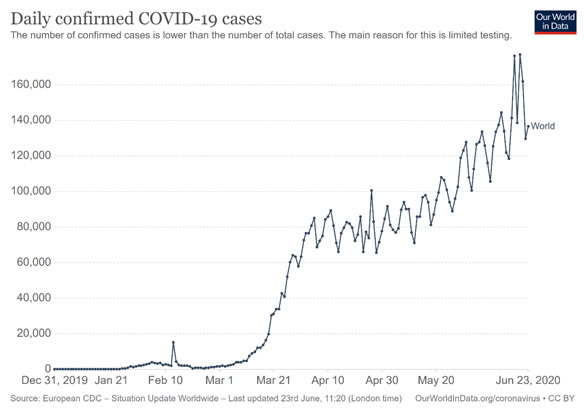

Sometimes when we observe people on the streets, when we see crowded restaurants and pubs, it seems like the pandemic has ended. But is the global epidemic really over? Not at all. Please look at the chart below. As one can see, the daily number of confirmed cases of COVID-19 in the world is still in an upward trend.

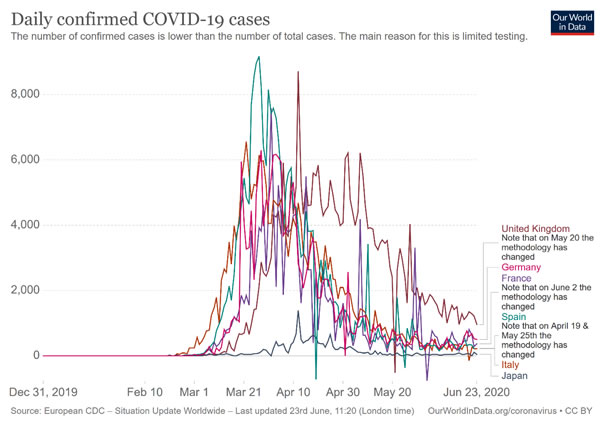

However, in the developed countries the number of daily new cases has declined and stabilized at very low levels, as one can see in the chart below. So, although the pandemic is not over, it has been contained in the West. And remember that global capital markets focus on developments in major economies and financial centers, which are precisely rich countries.

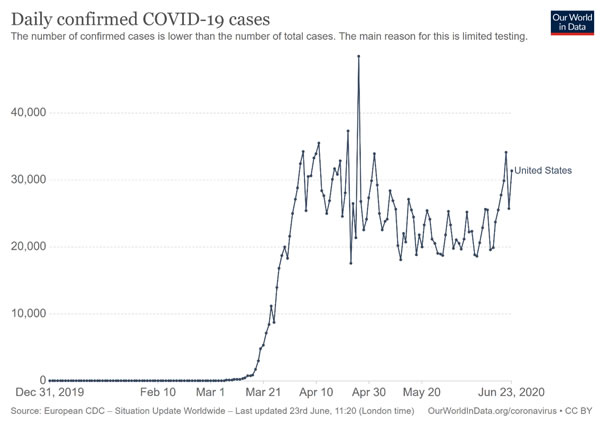

The only possible exception is the U.S., where the number of new cases has also peaked, but it stabilized at not so low level, as the chart below shows. Actually, the number of new cases is at level from the turn of March and April – and it has been even rising recently.

However, people’s reaction is different. So, although the pandemic is not over, the fear is over. At the beginning of the epidemic, people panicked (rightly or not), but after two months in quarantine, they got used to the new epidemiological situation. After all, the virus has not mutated (so far), the healthcare systems have not collapsed (luckily and partially thanks to the adopted containment measures), the mortality rates have not surged, and the world has not ended. People quickly adapted to new circumstances and they learnt how to live with the coronavirus threat.

This is very important as markets are driven not by facts and the number of daily new cases of Covid-19, but by people’s emotions and reactions to these facts and to the epidemiological threat. And now it seems that many people stopped to fret about the coronavirus.

Rightly or not. We mean here that there are some important arguments for not worrying and be optimistic about the epidemic. The worst is probably behind us and we are now better prepared to handle the pandemic (the shortages of equipment have been remedied). Moreover, in June, the scientists at Oxford University in the United Kingdom reported that the dexamethasone could be the first drug able to save the lives of Covid-19 patients (however, the study results were presented only in press release without any scientific paper).

On the other hand, the threat of the resurgence of the coronavirus is real. Many American states noted a record number of new cases (or new hospitalizations) of coronavirus in June, and Florida could be the next epicenter of the pandemic.

Meanwhile, on the other side of the Pacific, China faces the new coronavirus outbreak in Beijing. In consequence, several communities in the Chinese capital are back on lockdown. The surge in new cases in Beijing, and in other Asian cities (like Tokyo) or American states, is a clear warning to the U.S. and other Western countries: the second wave is possible.

This is, of course, positive for the gold market, as the risk of resurgence of the coronavirus and the reintroduction of the economic lockdowns supports the safe-haven demand for gold and its prices. However, investors should remember that the number of new cases within the second waves are so far limited. The autumn wave could be worse, but the situation is not out of control yet (and wearing masks can help reduce the size of a possible second wave of infection). And the key issue is that even the second wave will not trigger rally in the gold market, unless it spurs fear in the marketplace and it diminishes confidence in the US economy.

So far, the market is not worried about a large outbreak in the fall. It seems that investors believe that there will by the fall enough testing, contact tracing, drugs and R&D on vaccines. And that we will not shut down economies as deeply as we did in spring, if there is the second major outbreak in fall. This time the market might be right – however, at the beginning of the year, Mr. Market was clearly too optimistic, so correction in the risky asset markets is possible at some point this year.

Luckily, the bullish perspective for gold does not depend solely on the second wave. After all, the price of gold has not collapsed amid the optimism about the end of epidemic and economic revival. The key is what the Fed has recently said: it would take nearly two years to fully recover from the coronavirus recession. The subdued economic growth, the dovish U.S. central bank and ultra low real interest rates should support the gold prices (unless they surge suddenly).

Thank you.

If you enjoyed the above analysis and would you like to know more about the gold ETFs and their impact on gold price, we invite you to read the April Market Overview report. If you're interested in the detailed price analysis and price projections with targets, we invite you to sign up for our Gold & Silver Trading Alerts . If you're not ready to subscribe at this time, we invite you to sign up for our gold newsletter and stay up-to-date with our latest free articles. It's free and you can unsubscribe anytime.

Arkadiusz Sieron

Sunshine Profits‘ Market Overview Editor

Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Arkadiusz Sieron Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.