The Silver Bull Gateway is at Hand

Commodities / Gold & Silver 2020 Jul 24, 2020 - 02:50 PM GMTBy: Gary_Tanashian

We’ve been micro-managing silver lately in NFTRH and NFTRH+ updates and that is for a reason. The reason is that gold’s wild little bro has been rallying – in what is turning out to be 5 clear waves – since the March crash.

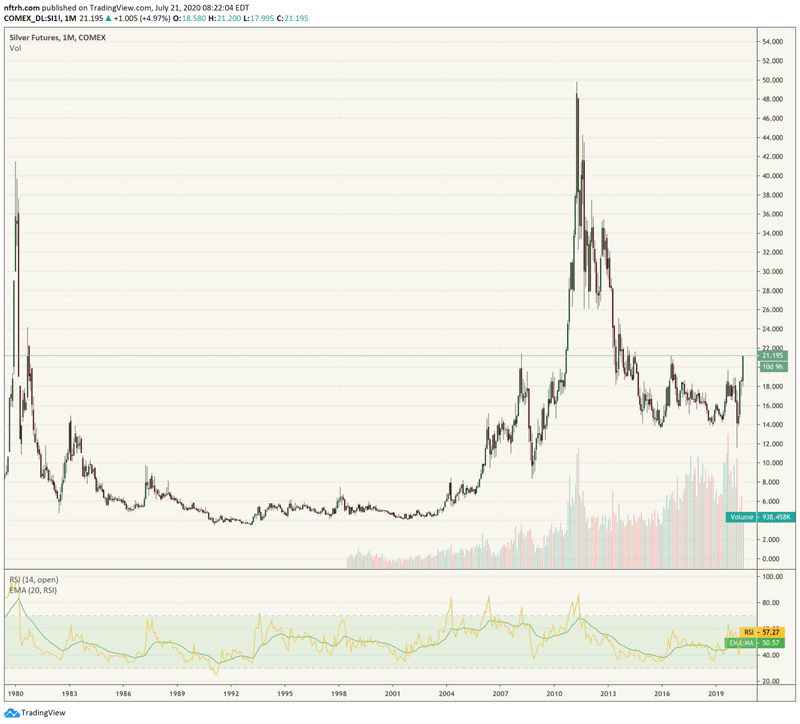

When that crash reversed, my view, and hence the NFTRH view was that it was likely to have been a horrifying shakeout of the silver bulls that due to its violence may well have sparked a bull market of some kind on the flush. We noted in real time that silver and precious metals mining stocks often make dramatic crash lows immediately preceding significant new rallies or bull markets. Silver was in an uptrend before the crash and that was a significant factor to a bullish view, post-crash.

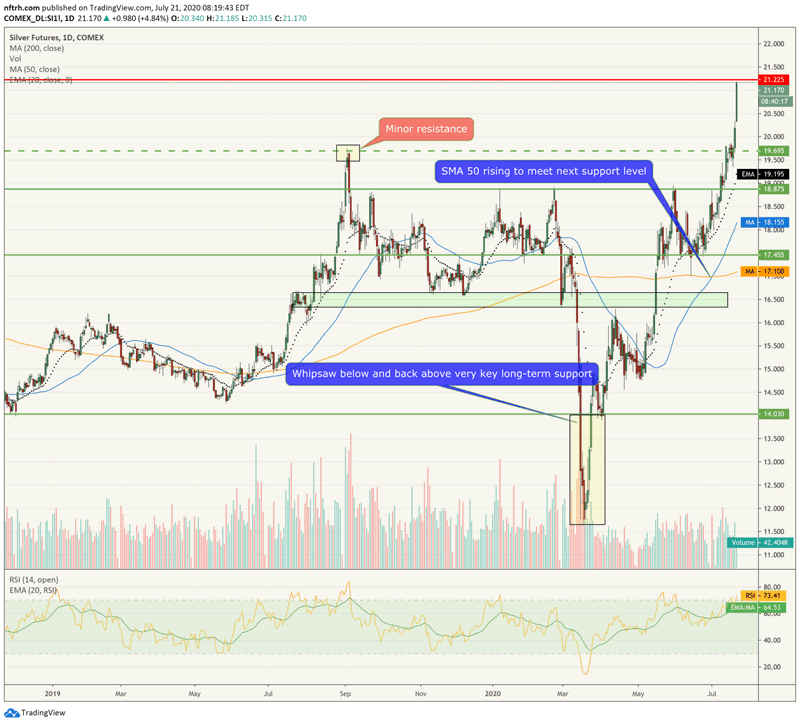

Here is the daily chart we used in yesterday’s subscriber update showing that silver was taking out a resistance point we’ve noted was not formidable (boy, it sure wasn’t).

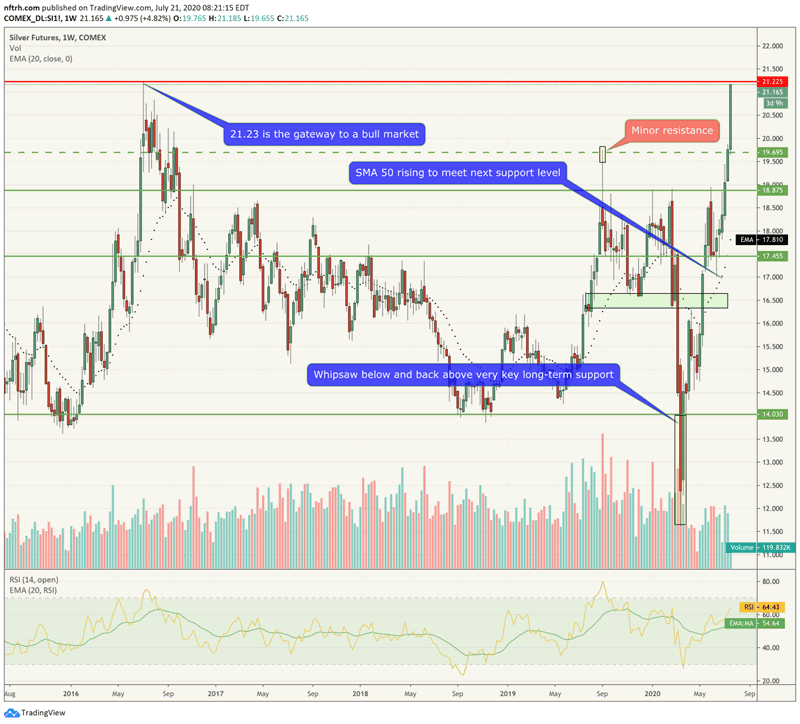

The chart above shows a resistance line but no context for it. Well, here is context. The label we have had for 21.23 is that of gatekeeper. In and of itself, it too is minor resistance, but it’s significance as the 2016 high that needs to be crossed in order to signal a cyclical bull market is great (much like 1378 was for gold in 2019). I would not be surprised if silver halts there for a while. Nor would I be surprised if it cuts through it like warm butter.

The target of the daily and weekly chart patterns is 24+. We have had this loaded in much the same way and for the same technical reasons we’ve had an initial target of 375 loaded on the HUI gold stock index since last year. Much like HUI’s daily/weekly chart patterns now agree with the target of its big picture monthly chart so too do silver’s shorter-term charts agree with its big picture objective.

Those objectives are long-term resistance. Notice the down spikes to 26 in 2011 and 2012. That is resistance. So, given the energy that tends to be released once the silver horse gets the bit in its mouth we can establish a firm eventual target of 24-26 if/when silver makes it through the bull gateway of 21.23. We have had this target in play for months, but would activate it above 21.23.

It’s not as easy as jumping on now and riding the Silver Bullet to great prosperity. The volatility will be epic and the hard work was done in March, April and May. Now it is too easy. Despite the bull market gateway at hand, the play has already been played. If you buy now, you are chasing. You are running with momentum freaks and the machines they follow. You will be subject to great volatility after positioning late for the current phase.

It could still be quite a run higher and I think that whether sooner or later, a cyclical bull market will engage. But this is not a game. It is a metal that shook out some of its most ardent believers on that false spike down below 14 in March. That has acted as a slingshot and the stone will stop when it stops. But there will be new opportunities aplenty in the months and years ahead, not just for silver but also for gold and mining stocks and depending on an inflationary backdrop, maybe commodities and certain global markets.

I would advise you not to just follow the Men Who Stare at Charts (like those above) exclusively…

…but instead take a more holistic approach whereby the ‘top-down’ macro is considered. A big part of that macro will be the Silver/Gold ratio (SGR). In a subscriber update yesterday we reviewed the parameters of the current SGR rally but also dialed out to a bigger picture with a bigger message. Only by digging into and abiding by the market’s internal signals can we hope to be right on the larger trends.

[edit] There will always be new opportunities as there has been in silver recently and as we noted for the gold miners over a month ago: Gold Sector Correction is Maturing.

Patience and a sensible macro view are the keys.

Subscribe to NFTRH Premium (monthly at USD $33.50 or a 14% discounted yearly at USD $345.00) for an in-depth weekly market report, interim market updates and NFTRH+ chart and trade setup ideas, all archived/posted at the site and delivered to your inbox.

You can also keep up to date with plenty of actionable public content at NFTRH.com by using the email form on the right sidebar and get even more by joining our free eLetter. Or follow via Twitter @BiiwiiNFTRH, StockTwits or RSS. Also check out the quality market writers at Biiwii.com.

By Gary Tanashian

© 2020 Copyright Gary Tanashian - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Gary Tanashian Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.