Storm Clouds Are Gathering for a Major Stock and Commodity Markets Downturn

Stock-Markets / Financial Markets 2020 Aug 10, 2020 - 11:49 AM GMTBy: Clive_Maund

Technical analyst Clive Maund charts warning signs of a Fed-driven stock market downturn. There is a now widespread, universally held belief, especially among "dumb money" market participants, that the markets cannot drop because the Fed is going to keep creating money in ever greater quantities to throw at them, pumping them higher and higher.

This erroneous belief appears to be based on an assumption that the Fed cares about the economy or the welfare of the citizenry, when the reality is that the reason it exists is as a "wealth transfer engine" whose prime function is to serve as a mechanism for transferring the fruits of the labor of the population at large to the elite cadre at the top of the pyramid—and they even have a pyramid on their Federal Reserve notes.

They achieve this through "systemic inflation," with a fiat money system in place now for many years that enables them to print unlimited quantities of money, which they gift in the first instance to themselves and their crony associates and large, favored corporations, and then let the rest out into the economy, with the tab for all this being pushed onto the hapless citizenry in the form of inflation. This is why the dollar has devalued by about 97% in purchasing power since the Fed came into existence in 1913.

Now, with the fiat system approaching its nemesis, as debts and money creation go parabolic, the gloves are off and they don't even bother to make any pretense about it—they create trillions, which they hand straight to big. favored corporations and Wall St. banks. The implied challenge to the ordinary citizen is: "You don't like it? Well, what are you going to do about it?" They are not just above the law, they are the law, and they can and will do as they please.

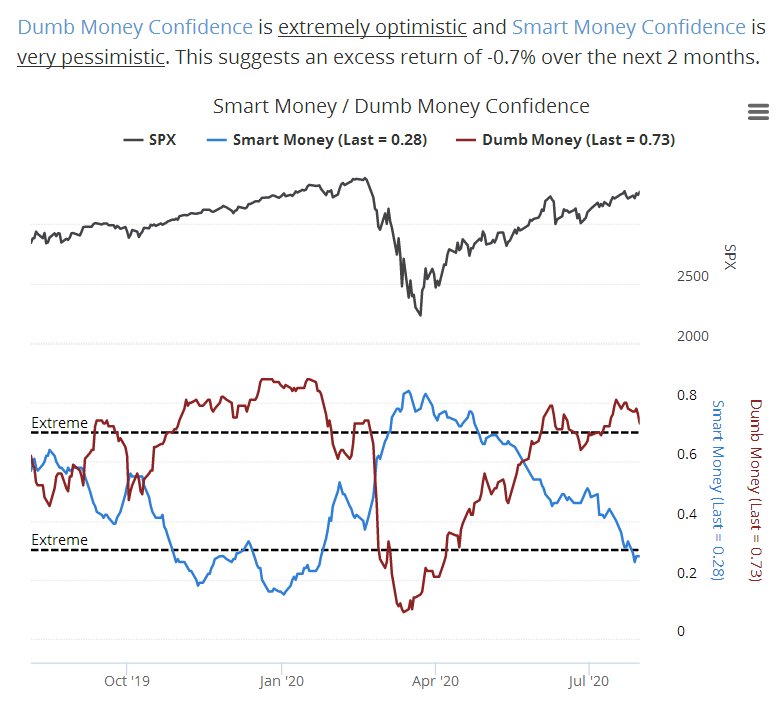

Given that the Fed's primary objective is to transfer wealth from the masses to the elites, and given that after months of the stock market trending higher, Dumb Money has been piling into the market again as Smart Money exits. We can see [this] on the latest Smart/Dumb chart below. It would seem irresistibly attractive to them to pretty soon rip the rug out from under the market and send it plunging again, as they did in the spring, and then move in and pick up Dumb Money's holdings when they sell in distress at the bottom, then start the whole wash, rinse and repeat cycle again. If they crash the markets soon, they should be able to achieve a long-held objective of getting rid of Trump for good measure, since the markets would not recover enough by election time for him to capitalize on it.

Chart courtesy of sentimentrader.com

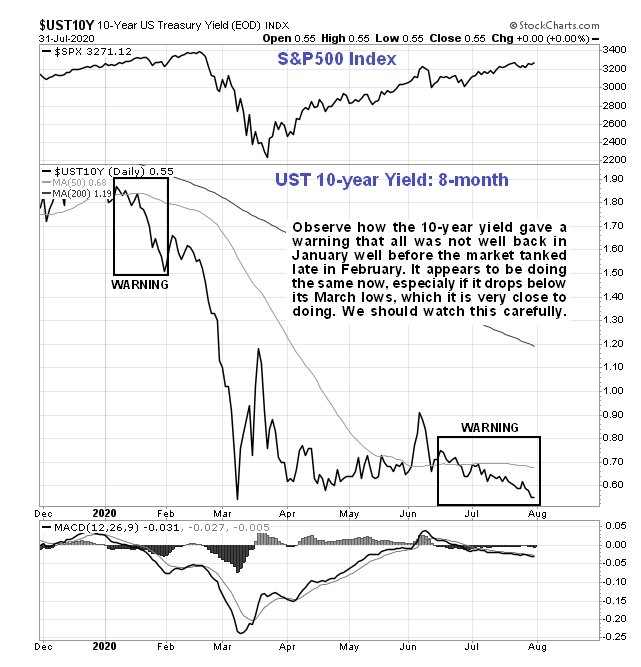

If this is what is setting up, it is incumbent on us to keep an eagle eye out for any warning signs that the markets may be about to about to buckle and plunge again. Fortunately, there are a number of things that we can watch that provide early warning of such a development. One important one is the 10-year yield, whose latest chart is shown below. This provided early warning of the spring market crash, as we can see. It is clearly an ominous development that it has been crumbling in recent weeks and is already threatening to break below its March lows. If it does, and especially if it should drop more steeply, it will probably trigger another severe market down wave soon after. This is said with an awareness that it can't actually drop all that much because it is already so low.

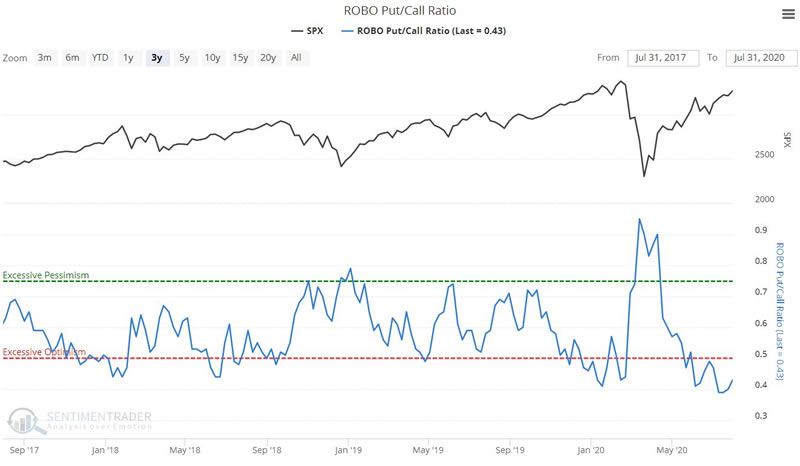

The put-to-call ratio is at a very low level, indicating universal bullishness and complacency, and is at the sort of extreme that we saw last February before the market caved in.

Chart courtesy of sentimentrader.com

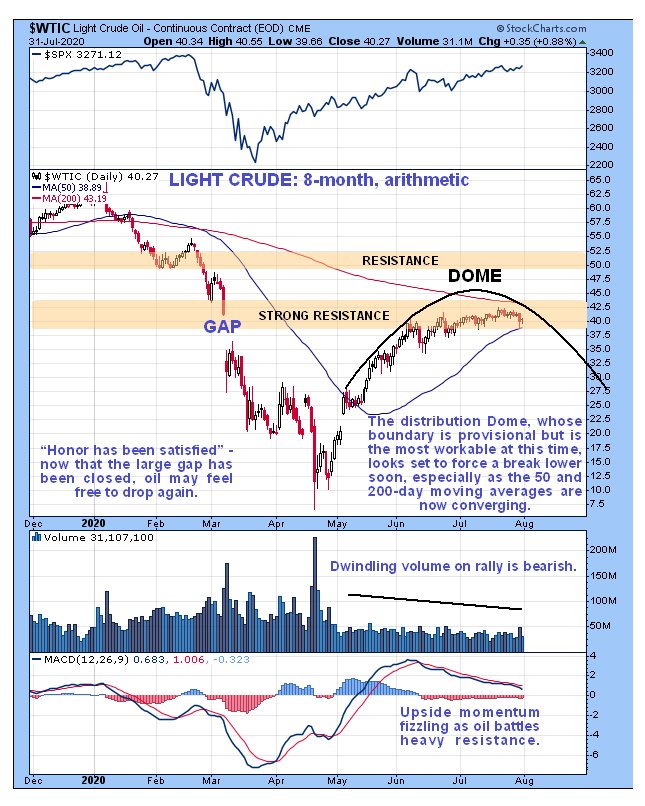

Next, keep a close eye on oil. On our light crude chart we can see that it is rounding over beneath heavy resistance having closed a big gap. Ominously, the 50-day moving average is drawing close to the still falling 200-day, so that these averages are still in bearish alignment with the potential for a big drop.

It isn't hard to see why it could suffer a big drop, despite all the recent market manipulation that has massaged it higher and higher, because the plain fact of the matter is that if they want to close down economies around the world in pursuit of their dream of crushing the masses, then there is going to be an awful lot more oil sloshing around than there is demand for.

The Bollinger bands, which are shown on a version of the year-to-date chart for light crude in the latest Oil Market update, are pinching in tightly, suggesting that a big move is now imminent.

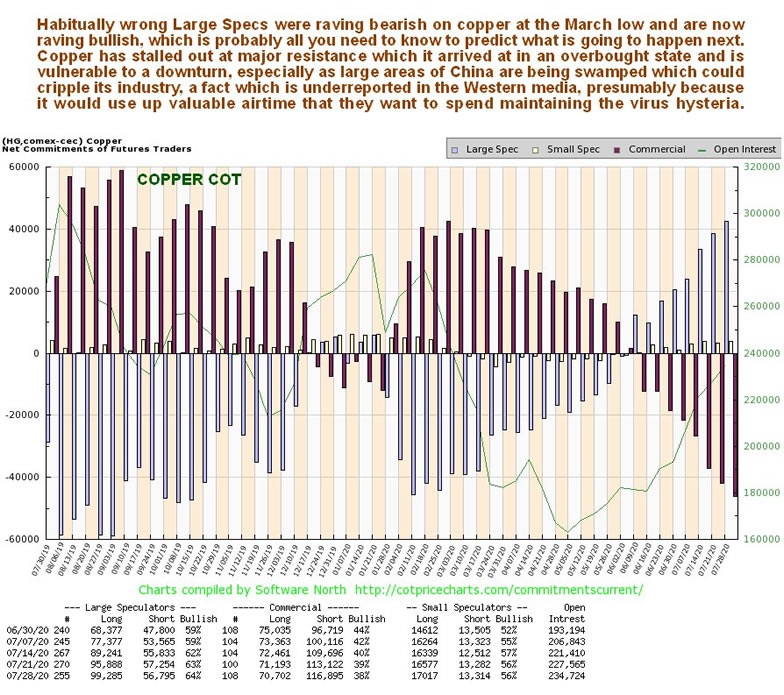

Next copper, whose big recovery rally from the March low to the present appears to have been driven both by a misplaced belief that demand will recover, and an even bigger misconception that demand will recover in China, which is going to be more difficult now that a large part of the heartland of the country is underwater, with the possibility of the Three Gorges Dam being breached for good measure. As we can see on copper's latest three-year chart, it has stalled out at a zone of strong resistance, which it arrived at in an overbought state.

Greatly increasing the chances of copper reversing and going into retreat very soon is its COT structure. On its latest COT chart we see that Dumb Money—the Large Specs—are now heavily long the metal after being heavily short at the March low. This COT chart looks very bearish and it is known that copper is a lead indicator for the markets, hence its nickname, Dr. Copper. So this is another clear warning sign.

Finally, GDX hit a trendline target in a very overbought state last week, with sentiment toward the precious metals sector at positive extremes. While we could not be more bullish on gold, and especially silver for, the longer term, that does not mean that they can't get dragged down temporarily in a correction by a crashing stock market. That's why we are pulling in stops and doing GDX puts as insurance.

This is quite a battery of indications calling for a major market downturn soon, I'm sure you will agree. Could the Fed override it all and keep the markets heading ever skyward by pumping more and more? Maybe, but as I've pointed out here they may not want to, since their Prime Directive, which is to transfer wealth from the lower classes to the upper classes or to those who control society, should make it irresistible to them to crash the markets here to crush the little guy, and provide yet another opportunity to mop up his holdings on the cheap, and probably seal Trump's fate into the bargain.

Clive Maund has been president of www.clivemaund.com, a successful resource sector website, since its inception in 2003. He has 30 years' experience in technical analysis and has worked for banks, commodity brokers and stockbrokers in the City of London. He holds a Diploma in Technical Analysis from the UK Society of Technical Analysts.

Disclosure: 1) Statements and opinions expressed are the opinions of Clive Maund and not of Streetwise Reports or its officers. Clive Maund is wholly responsible for the validity of the statements. Streetwise Reports was not involved in the content preparation. Clive Maund was not paid by Streetwise Reports LLC for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. 2) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports. 3) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

Charts provided by the author.

CliveMaund.com Disclosure: The above repr0esents the opinion and analysis of Mr Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. Mr. Maund is an independent analyst who receives no compensation of any kind from any groups, individuals or corporations mentioned in his reports. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks can only be construed as a solicitation to buy and sell securities when they are subject to the prior approval and endorsement of a Registered Securities Advisor operating in accordance with the appropriate regulations in your area of jurisdiction.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.