Has Gold's Upward Drive Come to an End?

Commodities / Gold & Silver 2020 Aug 13, 2020 - 02:07 PM GMTBy: Donald_W_Dony

Following the July 08, 2020 Market Minute titled: What is driving gold up?. We highlighted the main factors pushing gold prices upward. Are those factors still there? And if so, how much further is the precious metal going to rise (Chart 1)?

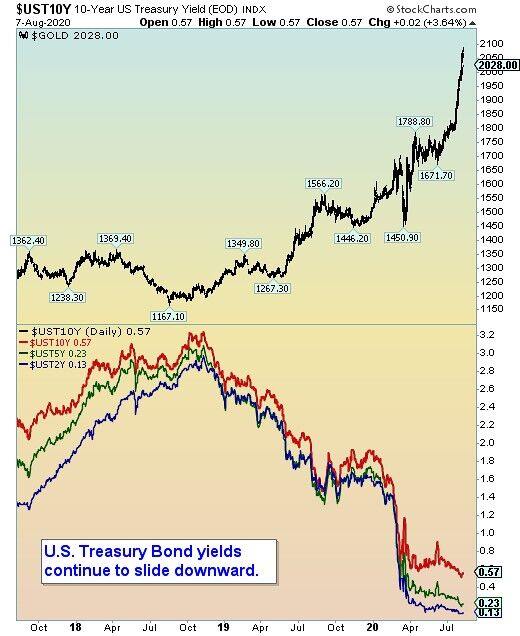

One of the main reasons gold prices are advancing is due to the prolonged decline in U.S. Treasury bond yields (Chart 2).

The yellow metal prices started the advance when bond yields peaked in Q4 2019 and continued to rise as bond yields decreased.

The price of gold has a close opposite correlation to U.S. Treasury bond yields.

At this junction, there is no evidence that yields are about to rise. Though it is very unlikely that U.S. Treasury yields will decline much lower.

The other primary reason for golds's upward strength has been because of the recent price weakness in the U.S. dollar (Chart 3).

Gold rose sharply when the Big dollar dropped below key support at $0.95 in early July.

The dollar now is oversold. This suggests that a minor rebound this month is probable. Any rise in the US$ would have a short-term negative impact on the price of gold.

Bottom line: The advance in gold's price has been dramatic. The precious metal has been driven mainly by the equally dramatic decline in U.S. Treasury bond yields. The interest rate return on 10 year to two year Treasury bonds has fallen over 90 percent since late 2019.

Models suggest that the outlook for spot gold prices moving forward is for a short-term pull back to about $1920 as U.S. bond yields stabilize and the US$ recoils over the next few weeks.

By Donald W. Dony, FCSI, MFTA

www.technicalspeculator.com

COPYRIGHT © 2020 Donald W. Dony

Donald W. Dony, FCSI, MFTA has been in the investment profession for over 20 years, first as a stock broker in the mid 1980's and then as the principal of D. W. Dony and Associates Inc., a financial consulting firm to present. He is the editor and publisher of the Technical Speculator, a monthly international investment newsletter, which specializes in major world equity markets, currencies, bonds and interest rates as well as the precious metals markets.

Donald is also an instructor for the Canadian Securities Institute (CSI). He is often called upon to design technical analysis training programs and to provide teaching to industry professionals on technical analysis at many of Canada's leading brokerage firms. He is a respected specialist in the area of intermarket and cycle analysis and a frequent speaker at investment conferences.

Mr. Dony is a member of the Canadian Society of Technical Analysts (CSTA) and the International Federation of Technical Analysts (IFTA).

Donald W. Dony Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.