Beyond the Surreal: Navigating the Precious Metals Minefield

Commodities / Gold & Silver 2020 Aug 21, 2020 - 01:43 PM GMTBy: The_Gold_Report

The story of how an inner city liquor store grew its business serves as an example of what sector expert Michael Ballanger calls " a compelling revelation of 'academics versus practicality.'"

In watching the travesty of disinformation, misinformation and moral hazard formation ongoing in the global financial markets, I am immediately reminded of a case study from my university days of which I was a part, the nature of which required that our team analyze a local business and make specific recommendations designed to improve it. Seeing as our campus was located in the Saint Louis inner city, surrounded on three sides by a ghetto second only to Detroit's in crime and murder, and on the fourth by Interstate 70, it was to no one's surprise that the "local business" we were to dissect was a package liquor outlet run by a large and very angry African American gentleman by the name of Marcus Thicke.

The first time we met Marcus, he took one look at me and then my two other classmates and said, "The bruthas will have a field day with them (pointing at the two diminutive students) but they will wanna take their time with you." (I was an extremely fit Canadian hockey player.) Marcus looked a great deal like Samuel L. Jackson in "Pulp Fiction." He had an Afro, piercing dark brown eyes and skin of a darker hue than most of his race and gender. If there was one thing I immediately liked about the man, it was that he was not going to be taking any bull from anyone, Saint Louis University (SLU) finance student or not.

Being Canadian, I was at a distinct advantage over my two American teammates. First, I was bigger and stronger, and, while at six feet tall (plus a half-inch), I was only four inches shorter than Marcus. Second, I was completely ignorant of the beatings and rapes and robberies of anyone that had as much as "fair" skin in that area of Saint Louis, because I grew up in a neighborhood in Toronto that had not one black family until I was well into high school. I had no ingrained fear of black people, so I easily bypassed any emotional roadblock that might have otherwise afflicted my teammates.

We spent a month at his store, watching from the sidelines, and while Marcus had a ton of traffic, really great employees (all former hookers now in their forties) and a superb location with tons of parking right next to Busch Stadium, when we counted his end-of-week cash, it was always about 10% of what we expected. We counted beginning and ending inventory; we counted beginning and ending cash. We went through cost of sales and every receipt from Cutty Sark, Jim Beam and Wild Turkey. What should have been a steady stream of positive cash flow was barely a break-even before tax.

You have to remember that we were students, and I was a student athlete, so there wasn't a great deal of extracurricular time to monitor Marcus' operation in the midnight hours. But one night, after dropping my girlfriend off in West County (no black people allowed except maids and lawn-cutters), I ventured over to his shop at around 1 a.m., only to see Marcus out in front, brandishing a large, sawed-off shotgun and swearing as if his preacher had just run off with his dog. I pulled over (I drove a '69 Chevy Impala with a broken hood latch, but a 350 turbo under the hood) and jumped out to help my "new best friend Marcus," at which he pointed his shotgun at me and screamed, "You! Get your white honky ass back into the car and go back to your white-ass dormitory and don't never come back here again."

The next week, we were to submit three separate reports and recommendations on the "Laclede Package Liquor case study," and as the SLU Billiken hockey squad was on the road on the U.S. East Coast (kicking butt in Boston and upstate New York), I had to rush to get mine in. The professor told me, "Gimme what you got, because your teammates have 80-page reports complete with financial statements. . ."

So, I decided to get my two "teammates" to read me their "final conclusions" over the phone as I was writing down (remember—no email, no fax and no laptops) their conclusions sitting in my underwear and dying for a beer.

Their conclusions were as follows:

- Fire the owner and replace him with an educated (white) retail "specialist."

- Request inventory pricing concessions from his suppliers. (He moves a great deal of product.)

- Replace the aging and somewhat tainted sales staff with younger people.

My report was sent as a cable to Professor Yeager from the Sonesta Hotel in Boston about three hours later, but only after I had talked to Marcus. It was a one-page essay.

Recommendations: Based upon location (football and baseball Cardinals), and based upon revenues (almost entire inventory replaced every day), I recommend that Mr. Thicke make the following changes and upgrades:

- Install a bullet-proof Plexiglas shield between the inventory and the cash/employees

- Buy three more Remington shotguns to fortify the shop and its employees

When I got back to campus, I was informed that my two teammates had received "A's" for the thorough job they had done on their analyses. I was getting a "C" because I failed to support my recommendations with "facts" (data).

Well, I passed that course (barely) and got my B.Sc., B.A., from the tenth-best undergraduate business school in the U.S. circa 1976, and the certificate still sits on my office wall.

However, after I quit pro hockey a few years later, I returned to the Saint Louis area on a business trip. I rented a car and toured the area with the intent to see how Laclede Package Liquors had made out. I walked inside and saw a large, bullet-proof, plexiglas screen behind which were the cash registers and a young black kid that looked like a cross between Samuel L. Jackson and Whitney Houston. The place was booming and had expanded, and was barely recognizable from the shop I saw in 1976. As I was leaving, I looked up on the wall behind the registers and there it was—a 1976 Remington double-pump shotgun, and beside it was a picture of a Saint Louis Billiken hockey player. I looked around for Marcus for a brief second but then decided that some accomplishments belong in the sweetness of memories past, and I left.

Why do I write stories about things unrelated to precious metals when all everyone wants to know is "how," "what" and "when?" The anecdote of Marcus Thicke's package liquor store is a compelling revelation of "academics versus practicality." It is like watching Tesla shares move to levels never before seen in the history of modern finance, and most certainly ever understood. It is like watching Jerome Powell of the U.S. Fed look at the camera and say, with a straight face, that Federal Reserve Operations "have not contributed to income inequality" in the mighty US of A. It is like watching the actions of last Tuesday, where three times annual silver production was dumped into the Crimex "paper market" as a method of lowering price.

There must be a mechanism whereby those that would relieve us of our wealth (central banks and the politically connected) can be effectively resisted through intelligent discourse and reasonable debate. Alas, there is not such a mechanism available to us. There could be in the future, but today? Nothing, except for the ownership of precious metals held outside of the banking system.

Then again, all they represent is a shield against monetary confiscation through the debasement of money.

A little packaged liquor store grew into a big packaged liquor store because Marcus Thicke rejected nonviolent, conventional solutions to the problem of inner city crime. Instead of changing staff and revamping inventory, he made it very difficult for people to rob him, and if they even tried, he had the firepower behind that Plexiglas screen to thwart them.

In today's world, filled with the insanity of entitlements, elitism and pork-barrel politics, there has never been a greater need for a shield that is politically and societally bulletproof, behind which true believers in free markets and the ethics of hard work can reside. Sadly, as the men and women who fought to defend freedom in the last century pass along into the eternal night, they are replaced by a generations of those who feel that governments owe them not only a living but a high-standard of living to boot, to which I say, "They are in for a very rude awakening."

As I wrote about last week, the time for being aggressive buyers of precious metals has passed.

I write this because the "easy money" has now been made. Sentiment and momentum models that have served me well early in 2020 are quite the opposite of conditions in mid-March.

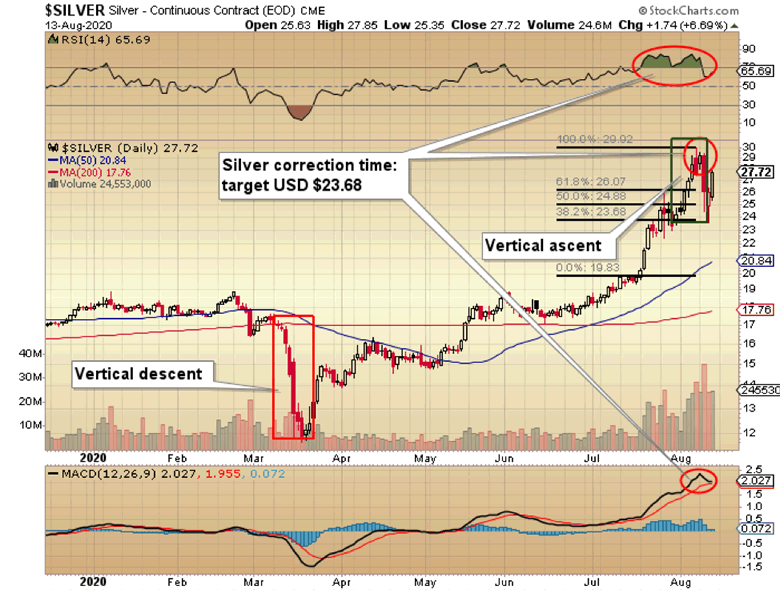

Using silver as the poster child for the current "crowded trade" scenario, note the vertical descent from last March that prompted my "Generational Buying Opportunity" missive, sent out the weekend before the lows were "in." It has since been replaced with another near-vertical decline, but this time it happened far too quickly for a bottom to have formed. I see continued consolidation through mid-September, as the late longs are punished into vacating precious metals positions that were surely (in their minds) "no-brainer" trades.

The current correction in precious metals is a healthy event, and one that has not only prolonged this bull market, but also strengthened it. Once the overbought conditions are resolved and I get "only" fifteen (instead of fifty) "silver to $100!" e-mails in my inbox every morning, then conditions will have improved representing a safe entry point.

Make no mistake, the bull is far from expired. He is resting, and when he decides to charge again, you will not want to be on the sidelines.

Follow Michael Ballanger on Twitter ;@MiningJunkie.

Originally trained during the inflationary 1970s, Michael Ballanger is a graduate of Saint Louis University where he earned a Bachelor of Science in finance and a Bachelor of Art in marketing before completing post-graduate work at the Wharton School of Finance. With more than 30 years of experience as a junior mining and exploration specialist, as well as a solid background in corporate finance, Ballanger's adherence to the concept of "Hard Assets" allows him to focus the practice on selecting opportunities in the global resource sector with emphasis on the precious metals exploration and development sector. Ballanger takes great pleasure in visiting mineral properties around the globe in the never-ending hunt for early-stage opportunities.

Disclosure: 1) Michael J. Ballanger: I, or members of my immediate household or family, own securities of the following companies mentioned in this article: Aftermath Silver Ltd., Great Bear Resources, Western Uranium, Stakeholder Gold, Getchell Gold. My company has a financial relationship with the following companies referred to in this article: Getchell Gold Corp. and Western Uranium & Vanadium Corp. My firm no longer does consulting work for Stakeholder Gold.. I determined which companies would be included in this article based on my research and understanding of the sector. Additional disclosures are below. 2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Great Bear Resources. Click here for important disclosures about sponsor fees. As of the date of this article, an affiliate of Streetwise Reports has a consulting relationship with Western Uranium and Vanadium and Aftermath. Please click here for more information. 3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy. 4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports. 5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports (including members of their household) own securities of Getchell Gold, Western Uranium and Stakeholder Gold and Aftermath, companies mentioned in this article.

Charts courtesy of Michael Ballanger.

Michael Ballanger Disclaimer: This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.