Fed Can Control Yield Curve. But It Can’t Control Gold

Commodities / Gold & Silver 2020 Aug 25, 2020 - 08:01 PM GMTBy: Arkadiusz_Sieron

In a response to the coronavirus crisis, the Fed has already cut interest rates to zero and implemented quantitative easing. But that’s not enough and the U.S. central bankers are now talking about “yield curve control”. What is it and how it could affect the gold market?

Normally, the central banks lower the short-term interest rate to stimulate the economy. But the federal funds rate is already at zero, so the Fed now thinks about the yield curve control. It works basically like normal open-market operations – the only difference is that under the yield curve control, the Fed would target some longer-term interest rate. As the central bank would set the short-term rates at zero and it would target also longer-term rates, it would practically control the yield curve, which explains the name. Moreover, the Fed would also promise to buy enough bonds to keep the rate from moving above the target – this is why the yield curve control is also called “interest rate caps” or “interest rate pegs”.

It might be useful to compare the yield curve control with the quantitative easing. While the latter deals with quantities or amounts of bonds (e.g., the Fed commits to buying bonds worth $1 trillion, but the market still influences the price), the former deals with bond prices. In other words, under the yield curve control, the central banks pledge to buy whatever amount of bonds the market wants to supply at the target price (instead of a particular amount of bonds at whatever the price).

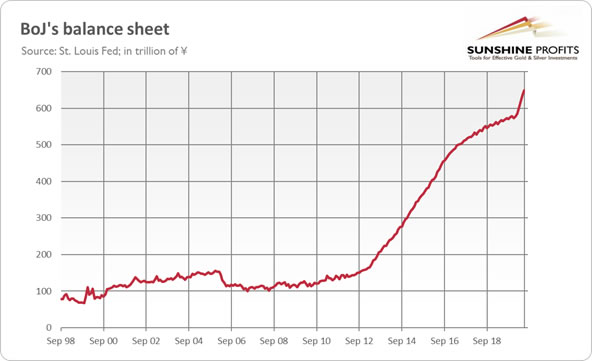

Although central banks normally target short-term interest rates, the yield curve control would not be a new policy. It was already used by the Fed during and after the World War II, when it agreed to help Treasury in financing military expenditures and cap the Treasury yields by buying any Treasury bond that yielded above the target. In a more recent history, the Bank of Japan introduced its yield curve control in September 2016, pegging yields on 10-year Japanese Treasuries around zero percent. Interestingly, under the yield curve target, the BoJ has been buying government bonds at a slower pace than under the QE, as the chart below shows. This is because investors accepted that the BoJ would buy whatever quantity of bonds to keep yields from rising, so it has not had to buy too many of them to set price.

And in March 2020, in response to Covid-19 pandemic and the following economic crisis, the Australia’s central bank started capping yields on 3-year government bonds at 0.25 percent, which triggered expectations that the Fed could follow suit.

What would the yield curve target imply for the monetary policy, economy and the gold market? Well, it’s not rocket science – capping bond yields means that bond yields will remain very low for longer that they would be without the caps. Importantly – oh, what a coincidence! – the Fed would cap Treasury yields, which would allow the government to continue its spending spree and to not worry about the fiscal deficits and soaring public debt.

Another issue is that the yield curve control flattens the yield curve, which hurts the commercial banks, which usually borrow short-term funds and lend long-term. So, a flat yield curve narrows their margins, impairing their lending ability, which is key to revive the economy.

Last but not least, the yield curve control can become very easily (if it’s not already) a blunt tool to help government issue debt smoothly and cheaply. As the FOMC admitted itself in minutes of its recent meeting, “monetary policy goals might come in conflict with public debt management goals, which could pose risks to the independence of the central bank.”

It should be clear now that the yield curve control should be positive for the gold prices, even if it would reduce the pace of the Fed’s balance sheet expansion (as in the case of the BoJ’s experience). After all, the caps on the Treasury yields imply low interest rates. Importantly, if inflation rises the cap on nominal interest rates would lead to the decline in the real interest rates, as it happened in the aftermath of the World War II. The yield curve control also caps the government’s borrowing costs, which encourage the increase in public debt, which raises the risk of the sovereign-debt crisis. Moreover, the yield curve control could spur some worries about the central bank’s independence, which could weaken the U.S. dollar. In such a macroeconomic environment, gold should shine. So, the Fed could cap the Treasury yields, while pushing gold upwards.

Thank you for reading today’s free analysis. We hope you enjoyed it. If so, we would like to invite you to sign up for our free gold newsletter. Once you sign up, you’ll also get 7-day no-obligation trial of all our premium gold services, including our Gold & Silver Trading Alerts. Sign up today!

Arkadiusz Sieron

Sunshine Profits‘ Market Overview Editor

Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Arkadiusz Sieron Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.