Is the Precious Metals Market really Overwhelmed and Chaotic

Commodities / Gold & Silver 2020 Sep 07, 2020 - 11:43 AM GMTBy: Robert_Singer

August 13, the Market Oracle publishes my article on Gold, Silver, the Black Rock and the Twins. I claim something is going on that can’t be explained without knowing what happened in 2015 that changed the precious metals and mankind’s destiny.

I am still waiting to see if Silver tests the $21 resistance but what happened yesterday (August 11) and the next day is perplexing.

August 11

Let’s start with the Dow:

As a return of risk appetite following encouraging economic numbers and hopes of new coronavirus relief package boosted the S&P 500 to near record highs, within inches of its late-February all-time high, until the last hour when the Dow went into the red and lost 104.53 points to close at 27,686.91. The S&P 500 lost 0.8% to 3333.69. The Nasdaq Composite dropped 1.7% to 10,782.82.

And then the Precious Metals

(Reuters) – Gold sank as much as 5.3% on Tuesday, facing its worst one-day rout in seven years, Other precious metals also took a beating, with silver plunging as much as 13.8% – its biggest daily decline since October 2008. It was down 13.4% to $25.24 per ounce by 1:59 p.m. EDT (1759 GMT). Platinum dropped 4.7% to $940.08, and palladium slid 4.7% to $2,116.33. Gold for December delivery lost $93.40, or 4.6%, to settle at $1,946.30 an ounce on the Comex division of the New York Mercantile Exchange.

August 12 AM

Stocks rose on Wednesday as Wall Street rebounded from a sharp reversal in the previous session that led the S&P 500 to snap a seven-day winning streak. The Dow Jones Industrial Average climbed 268 points, or nearly 1%. The S&P 500 gained 1.3% while the Nasdaq Composite advanced 1.8%.

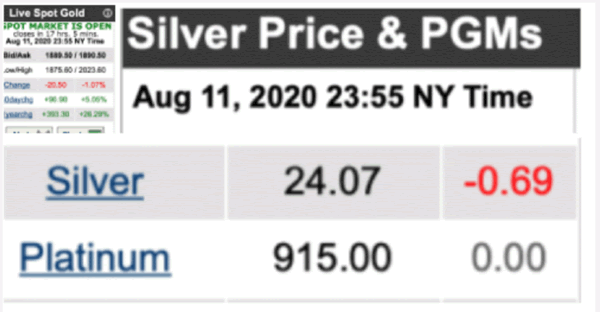

Silver and Gold were still correcting after hours

23:55 NY Time Gold Bid/Ask 1889.50 / 1890.50 Low/High 1875.60 / 2023.60 Change -20.50, Silver 24.07 -0.69 but at 9:31 Am they woke up to yesterday’s closing prices: Gold was $1941.82 Silver $25.66 .

One of the world’s premier retailers of precious metals products website as of 9:16 am August 12, is not being updated and still shows the after hours prices August 11, 23:55 NY Time, Gold $1889.50 Silver $24.07.

The August 12 prices, Silver as of 9:58:57 EST am was Up .66 to $25.70

I started the screen captures 6:57 am

A few times it took a while to load and I got a blank screen. [1]

I checked my phone to verify the mobile site was not updated as well. [2]

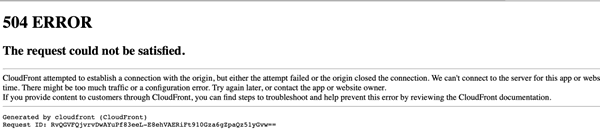

At 7:46 am, I got a 504 Error: too much traffic message alert

At 7:49 am, August 11 23:55 returns.

The site displayed August 11 23:55 am until August 12 5:10 pm.

The website has an impressive traffic rank.Global Rank Worldwide 2,057 Country Rank United States 727 Category Rank Finance > Investing 26

I am wondering if too many people are listening to one of the leading companies dedicated to providing investors with a secure, cost-effective, transparent way to purchase and hold physical bullion.

In conclusion, it is evident that holding gold should be a priority for investors considering the looming economic uncertainty within the economy, as well as the historically superior performance of gold over the last 20 years. It would be naïve for investors to continue ignoring the benefits of adding physical bullion to their portfolios during these turbulent times.

August 12, 5:31 pm Phone Call

I contacted the leading precious metals website by telephone. The representative that answered was aware the site was down since this morning but didn’t know that it was backup this evening. Overwhelmed and chaotic were the words he described as the activity for the last two weeks at the website.

If you have an explanation for this be sure and leave a comment.By Robert Singer

Robert Singer writes about Secrets, Sentient Creatures and The Federal Reserve at The Peoples Voice and The Market Oracle (rds2301@gmail.com)

Robert Singer is an Entrepreneur and the author of a forthcoming book on the Federal Reserve. His articles cover politics and the financial and environmental implications of our consumer society.

© 2020 Copyright Robert Singer - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.