Corona Strikes Back In Europe. Will It Boost Gold?

Commodities / Gold & Silver 2020 Sep 25, 2020 - 11:41 AM GMTBy: Arkadiusz_Sieron

The number of new daily infections in Europe is rapidly increasing, even reaching new heights in several countries. That is just another reminder that the second wave in fall or winter is upon us.

The number of new daily infections in Europe is rapidly increasing, even reaching new heights in several countries. That is just another reminder that the second wave in fall or winter is upon us.

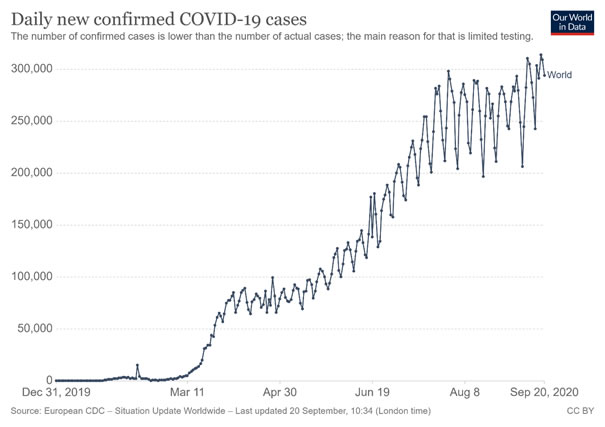

Yes, I know. You are all fed up reading about the coronavirus. And yet, the coronavirus is not fed up with spreading around the globe. The number of new daily infections keeps going up, as the chart below shows.

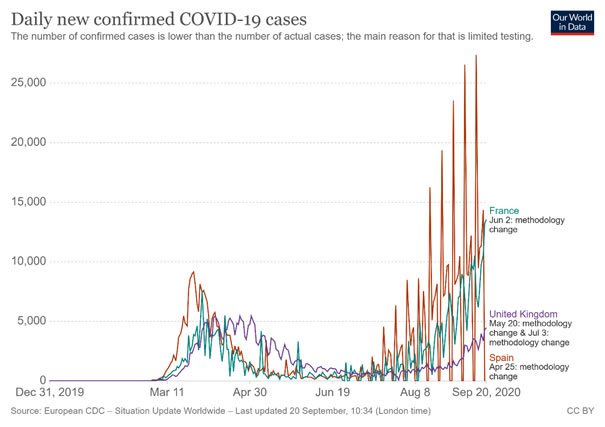

Most significantly, the coronavirus cases are in a dramatic rise across Europe. The weekly cases have now exceeded the reported levels when the pandemic first peaked in Europe back in March. Furthermore, the number of new daily infections has also reached record highs in several countries, such as Spain or France, as shown in the chart below.

Without a doubt, the improved testing procedures justify a segment of the infections‘ rise – but only a part. The death toll is now significantly lower than it was in spring, as the virus started spreading among the younger part of the population, while the healthcare systems are now better armed to handle the epidemic. But still, the WHO warns us that changes will happen as the winter approaches.

Therefore, if the virus became the new “normal” and people somehow stopped fearing it, that does not mean that the new virus stopped infecting people and influencing economies. Targeted lockdowns and restrictions are already returning across the continent to contain the spread of the coronavirus.

Hence, even though the gloomiest projections are not yet materialized, and the Fed even revised its economic growth forecast for 2020, the resurgence in new COVID-19 cases across Europe is a harsh reminder that the pandemic is not over yet. With that being said, in the upcoming months ahead, if the case count continues to rise worldwide, the global economic recovery could slow down.

Of course, there are reasons to be optimistic as well, as better therapeutics, rapid tests, and vaccines are on the horizon. However, the hopes that a Covid-19 vaccine will soon be widely available and solve all the problems are way too optimistic. As Sarah Zhang explains in “The Atlantic”,

A vaccine, when it is available, will mark only the beginning of a long, slow ramp down. And how long that ramp down takes will depend on the efficacy of a vaccine, the success in delivering hundreds of millions of doses, and the willingness of people to get it at all.

Indeed, billions of vaccine production and distribution across the world will take months, if not years. Moreover, people may still refuse to get vaccinated, given the fact that 20 percent of Americans have already said that they will not take the vaccine, while another 30 percent is unsure, which indicates that the vaccine might not provide the society with the herd immunity.

Implications for Gold

So, how does the new coronavirus developments affect the gold market? Well, the coronavirus no longer generates fears and panicking of massive magnitudes as it did in spring. Therefore, the rising number of cases in Europe doesn’t significantly affect the price of gold. However, the resurgence of patients in Europe is a brutal reminder that the pandemic is not over yet and that the second wave is only a couple of months away.

We believe that such a second wave would be positive for gold prices. However, it should include the US as well, as the resurgence in cases limited to Europe could strengthen the greenback against the euro and gold, neutralizing the increased safe-haven demand for the yellow metal.

If the second wave occurs, it should be bullish for gold not only because of the resulting economic slowdown and increased uncertainty but also because of the new stimulus programs that would probably be announced by both by the central banks and the governments.

You see, just like drug addicts are desperate for the next dose, the markets are always after more liquidity. It’s enough to say that the recent dovish FOMC statement accompanied by fresh dot-plot and Powell’s press conference was considered as disappointing by investors and not dovish enough. Both equities and gold declined in response to the Fed’s announcement. This is because the central bank did not offer fresh policy measurements and did not expand its quantitative easing program.

But don’t worry – a new stimulus is just a matter of time. The Fed may not care about the gold, but it won’t leave Wall Street in need. Gold will benefit from such a noble heart of the American central bank.

If you enjoyed the above analysis, we invite you to check out our other services. We provide detailed fundamental analyses of the gold market in our monthly Gold Market Overview reports and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. If you’re not ready to subscribe yet and are not on our gold mailing list yet, we urge you to sign up. It’s free and if you don’t like it, you can easily unsubscribe. Sign up today!

Arkadiusz Sieron

Sunshine Profits‘ Market Overview Editor

Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Arkadiusz Sieron Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.