Gold, Dollar and Rates: A Correlated Story

Commodities / Gold & Silver 2020 Sep 27, 2020 - 10:29 AM GMTBy: Arkadiusz_Sieron

Mining production? No. China’s consumer demand? No. The main drivers of gold prices are, as I’ve repeated many times, the U.S. dollar and real interest rates. You don’t believe it? You don’t have to – just look at the charts below.

Mining production? No. China’s consumer demand? No. The main drivers of gold prices are, as I’ve repeated many times, the U.S. dollar and real interest rates. You don’t believe it? You don’t have to – just look at the charts below.

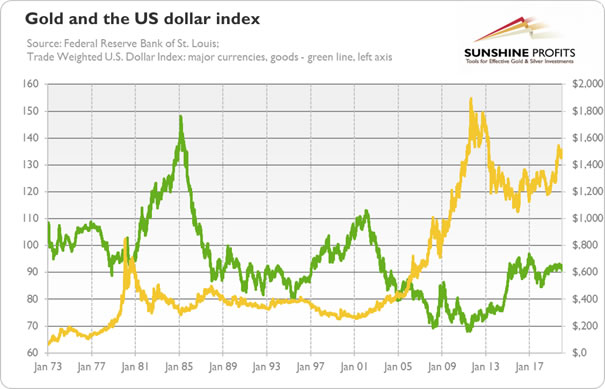

The first one displays the greenback and the dollar-denominated price of gold. Because other series start much later, I used here the Trade Weighted U.S. Dollar Index against major currencies that circulate widely outside the country of issuance. Although the correlation is not perfect, the inverse relationship is quite strong and bull and bear markets in gold coincide with the bear and bull trends in the U.S. dollar.

The second chart presents the U.S. real interest rates and the price of gold (London Gold Fix). As the data series for the yields of inflation-indexed Treasuries (which I treat a proxy for real rates) start only in 2003, I use here nominal bond yields adjusted for the CPI. Again, the negative relationship between displayed variables is far from being perfect (actually it is only -0.31), but it is clear that gold rallied the most when the real interest rates were negative.

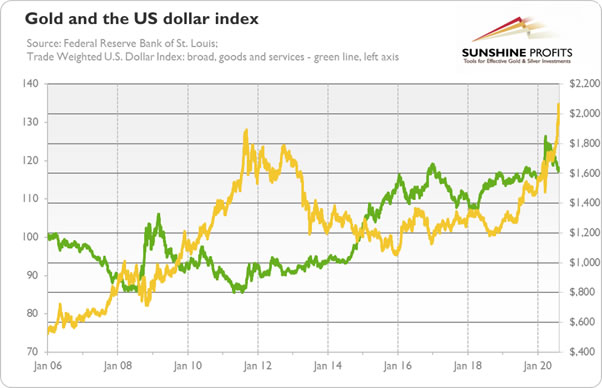

Now, let’s zoom in and use more recent data. The chart below shows the price of gold and Trade Weighted U.S. Dollar Index against the broad basket of currencies. As the two lines looks like their mirror images, the inverse relationship between the yellow metal and greenback becomes even clearer now.

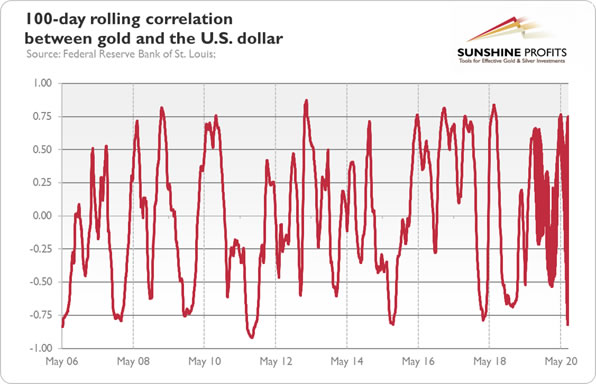

Or… does it really? The correlation coefficient is 0.26, so the relationship was positive in the analyzed period! Never trust your eyes, only numbers are real! As one can see in the chart below, the 100-day rolling correlation between gold and the U.S. dollar is quite volatile. Which is not so surprising, when we realize that both the yellow metal and the greenback can serve as safe-haven assets during economic crises. However, the correlation has become more negative recently.

Similarly, the next chart zooms in on the relationship between gold and real interest rates, using more recent data and yields of TIPS. Again, the inverse, mirror relationship between both variables becomes more than clear. It is obvious at first sight, without any quantitative analyses.

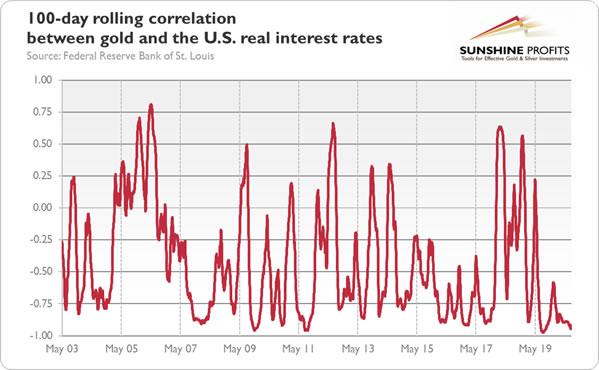

But never stop at the first impression! The correlation coefficient is -0.85, so it is indeed very strong negative correlation. And in the past 100 days, it was even stronger (-0.95), as the chart below shows. As one can see, correlation is not fixed but it is constantly changing. And gold has become recently even more sensitive to changes in the real interest rates.

What does it all mean for the gold market? Well, as I have repeated many times, the strong relationships with U.S. dollar and real interest rates stem from the fact that gold is not merely a commodity, but it is a monetary asset. Of course, the international price of gold is quoted in the dollar, so when the value of the greenback increases (decreases) relative to other currencies around the world, the price of gold tends to fall (rise) in the U.S. dollar. However, there is something more to the story. Gold is seen as another currency, or a bet against the greenback and other fiat currencies, so during times of fear, the price of the yellow metal tends to rise as confidence in the Fed (and other central banks), the U.S. government and the current monetary system fails.

The real interest rates are connected, of course, with the exchange rates. The lower the rates, the weaker the currency is. So, low interest rates tend to weaken the greenback, which also supports gold. Moreover, because the yellow metal does not bear any yield, the low rates reduce the opportunity costs of holding gold compared to other assets. And TIPS are used as protection against inflation, just as gold, so they move together.

Question: what about when the rates are low, or even negative? When either inflation is high, or when nominal interest rates are close to zero. Both cases mean that economic situation is grave or even that central banks have lost control, which drives investors toward gold.

Now, the real interest rates are at very low level, so there is a risk of a rebound. However, they were even lower during the 1970s, so the reversal is not certain, especially that the Fed is not even thinking about thinking about hiking the federal funds rate. So, although the U.S. central bank distanced itself somewhat from the idea of yield curve control, the interest rates are likely to remain ultra low for the foreseeable future. Which is great news for gold.

When it comes to the U.S. dollar, we see that it has peaked recently. It can go, of course, further north, but the current environment of the dovish Fed, negative real interest rates, narrowing divergence between monetary policies conducted by the U.S. and other countries, and soaring fiscal deficits and federal debt are important headwinds for the greenback. We know that other central banks and governments are not much better than their American counterparts, but it seems that more and more people are starting to worry about the soundness of the U.S. dollar (although the greenback, together with gold, still behaves like the safe haven during economic crises). So, more investors could be interested in buying gold, the ultimate currency.

If you enjoyed the above analysis, we invite you to check out our other services. We provide detailed fundamental analyses of the gold market in our monthly Gold Market Overview reports and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. If you’re not ready to subscribe yet and are not on our gold mailing list yet, we urge you to sign up. It’s free and if you don’t like it, you can easily unsubscribe. Sign up today!

Arkadiusz Sieron

Sunshine Profits‘ Market Overview Editor

Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Arkadiusz Sieron Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.