Gold & Silver - Adapting Dynamic Learning Shows Possible Upside Price Rally

Commodities / Gold & Silver 2020 Nov 22, 2020 - 06:19 PM GMTBy: Chris_Vermeulen

Our advanced Adaptive Dynamic Learning (ADL) modeling system is showing some interesting future trends for both Gold and Silver. The rally in precious metals has really just started if our ADL system is accurately predicting future price trends.

Over the past two years, we’ve highlighted a number of ADL research posts that have proven to be incredibly insightful regarding future market price trends. The ADL predictive modeling system is unique in that it maps out price and technical indicator DNA markers and attempts to correlate future price characteristics into highly probable outcomes. The result is a clear picture of what the ADL system believes is the most likely outcome based on the selected price bar.

We attempt to use the ADL system to identify highly populated ADL DNA price bar markers and very infrequently populated ADL DNA price bar markers. We believe the highly populated ADL entries are ones that happen with some degree of regularity and are likely to prompt similar future price outcomes. We believe the infrequently populated ADL DNA entries are anomalies in price that may present unusually accurate price bar outcomes. Therefore, when an ADL entry shows seven (7) or more correlative matches, we consider that moderately highly populated. When an ADL entry shows less than three (3) correlative matches, we consider that infrequently populated.

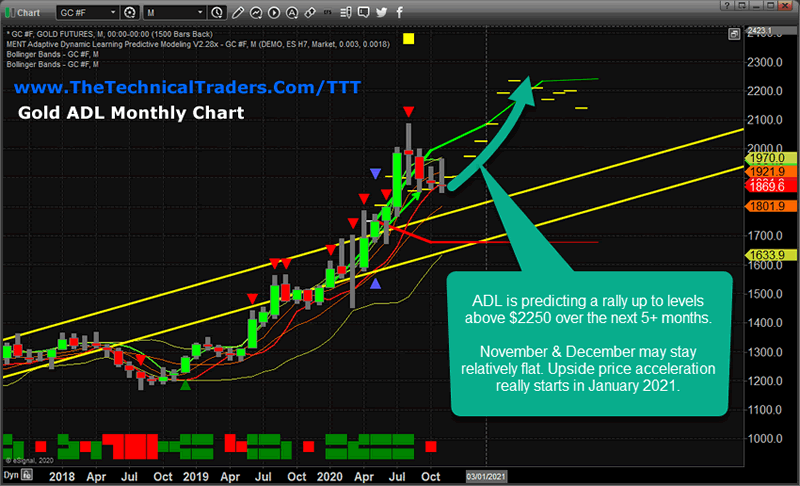

GOLD ADL MONTHLY CHART SUGGESTS $2250 TO $2350

Let’s start out with a Gold Monthly ADL chart below. It is showing a broad upside price trend initiating in late 2020 or early 2021. It is very likely that Gold will attempt to reach $2250 or higher by April or May 2021 (possibly sooner)after a flat December. It appears the real bullish trend starts to take place in early 2021 and continues into July 2021.

Notice how the ADL predictive price levels after July 2021 suggest Gold will stall near or above $2100. It is very likely this range of time represents some level of economic growth taking focus away from metals temporarily. The ADL DNA marker for this future price prediction consisted of 17 unique instances of this DNA marker – resulting in a range of probable outcomes between 92% and 99% likely success. With these high probability outcomes across 17 unique instances of ADL DNA mapping, we are fairly confident that Gold will follow along this projected price path over the next 12+ months.

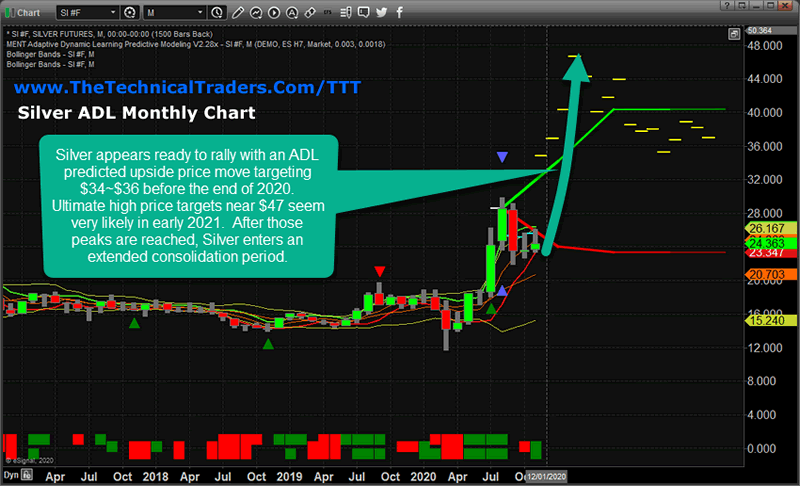

SILVER’S EXPLOSIVE ADL MONTHLY CHART

This next Monthly ADL Silver chart shows an incredible upside price explosion that is just 30 to 90 days away from blowing the doors off. This ADL price prediction mapped out at 20 unique instances with a probability range of 56% to 76% for the first 4 bars of this pattern (August 2020 through November 2020), then followed by 81% to 86% probable outcomes for the rest of the ADL predicted outcomes.

This chart is really exciting because it suggests Silver is about to explode up to $44 or higher while Gold begins to move higher in January/February 2021. This suggests that Silver, which is currently undervalued to gold by historical ratio levels, should begin to really rally much higher – starting to close the ratio levels towards more normal levels.

The Gold to Silver ratio level is currently near 0.84. Historically, anything above 0.80 has represented a peak in Gold to Silver price ratios – which initiated a stronger upside price move in Silver to close the ratio gap. The recent peak in the Gold to Silver ratio level reached levels near 1.20 in April 2020. This is a very big ratio disparity between gold price levels and Silver price level. If Silver rallies to levels above $40 soon, the Gold to Silver ratio will likely fall to levels near 0.62~0.65. These levels represent historical normal ratio levels for metals.

Before you continue, be sure to opt-in to our free market trend signals before closing this page, so you don’t miss our next special report!

Notice on this Monthly ADL Silver chart that Silver begins to trail lower after July 2021 – very similar to the Gold ADL chart. This suggests some economic functions will detract from metals and shift the focus away from Gold and Silver (possibly briefly). Any way you look at these ADL predictions, Gold and Silver are likely to start a big upside price move with the next 60+ days. The probability that Platinum and Palladium will follow Gold and Silver is quite high. In fact, Platinum has already started a broad upside price trend which may be an early indication that Silver and Gold are poised for a breakout move.

Remember, the ADL predictive modeling system is attempting to show us what it believes are the highest probability outcomes based on a single ADL DNA price marker. In the past, the triggers from our ADL predictive modeling system have been highly accurate in the past – calling the 2018~2019 move in Gold and calling the 2019 collapse in Crude Oil. We caveat that there are instances where outside economic or global event disrupts price activity. Clearly, additional outside events could result in different price activity than our ADL predictive modeling outcomes.

Do you want to learn more about what we do and the incredible proprietary technology we use to help our members and to identify trade setups? We can help you find and identify great trading opportunities so visit www.TheTechnicalTraders.com to learn about my exciting ”Best Asset Now” strategy and indicators. You can also sign up for my daily pre-market video reports that walks you through the charts of all the major asset classes every morning.

Enjoy the rest of your Sunday!

Chris Vermeulen

www.TheTechnicalTraders.com

Chris Vermeulen has been involved in the markets since 1997 and is the founder of Technical Traders Ltd. He is an internationally recognized technical analyst, trader, and is the author of the book: 7 Steps to Win With Logic

Through years of research, trading and helping individual traders around the world. He learned that many traders have great trading ideas, but they lack one thing, they struggle to execute trades in a systematic way for consistent results. Chris helps educate traders with a three-hour video course that can change your trading results for the better.

His mission is to help his clients boost their trading performance while reducing market exposure and portfolio volatility.

He is a regular speaker on HoweStreet.com, and the FinancialSurvivorNetwork radio shows. Chris was also featured on the cover of AmalgaTrader Magazine, and contributes articles to several leading financial hubs like MarketOracle.co.uk

Disclaimer: Nothing in this report should be construed as a solicitation to buy or sell any securities mentioned. Technical Traders Ltd., its owners and the author of this report are not registered broker-dealers or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer. Never make an investment based solely on what you read in an online or printed report, including this report, especially if the investment involves a small, thinly-traded company that isn’t well known. Technical Traders Ltd. and the author of this report has been paid by Cardiff Energy Corp. In addition, the author owns shares of Cardiff Energy Corp. and would also benefit from volume and price appreciation of its stock. The information provided here within should not be construed as a financial analysis but rather as an advertisement. The author’s views and opinions regarding the companies featured in reports are his own views and are based on information that he has researched independently and has received, which the author assumes to be reliable. Technical Traders Ltd. and the author of this report do not guarantee the accuracy, completeness, or usefulness of any content of this report, nor its fitness for any particular purpose. Lastly, the author does not guarantee that any of the companies mentioned in the reports will perform as expected, and any comparisons made to other companies may not be valid or come into effect.

Chris Vermeulen Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.