Herd Immunity or Herd Insolvency: Which Will Affect Gold More?

Commodities / Gold & Silver 2020 Nov 25, 2020 - 02:20 PM GMTBy: Arkadiusz_Sieron

Vaccines are coming. But so is the debt crisis. What does it imply for gold?

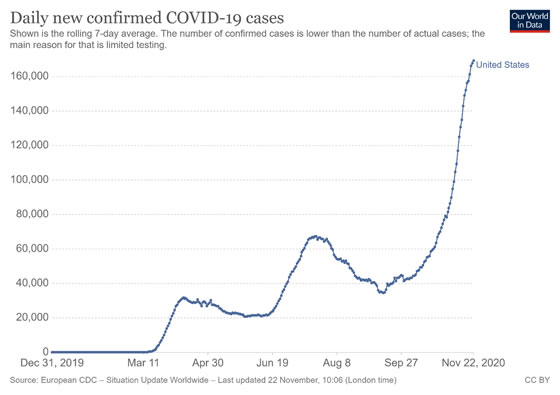

COVID-19 cases are still rising at an alarming rate in the United States. As the chart below shows, the rolling 7-day average of new daily infections stays above 160,000.

It means that the immediate economic outlook is rather dark. The short-term economic slowdown is good information for the gold market.

But there is also bad news for the yellow metal, and by that I mean the recent positive news on vaccine efficacy. It’s become clear that we will probably have the first doses of a vaccine – or even a few vaccines – by December 2020 or in early 2021, the tail-risk of no vaccines in the near future has been practically eliminated. This is why the stock market has increased despite rising Covid-19 cases. Simply put, some companies – like airlines – become investable again thanks to the breakthroughs in vaccine developments.

Does this mean that gold is doomed in the medium-term, or that the vaccines’ arrival will sink gold? Well, not necessarily. Although it’s true that the elimination of the tail risk weakens the safe-haven demand for gold , one mustn’t forget that gold was actually in a bullish trend before the pandemic started thanks to the accommodative Fed’s monetary policy .

So the question is: do you think that herd immunity will force the Fed to drop its dovish stance? Or will the eradication of the coronavirus make the whole new debt disappear? I don’t think so. In other words, the vaccines will solve the health crisis, but they will not solve all our economic woes. And the debt problem is poised to be one of the greatest global threats right now.

Indeed, just last week, the Institute of International Finance said that global debt is expected to surge from $257 trillion in 2019 to a record $277 trillion by the end of 2020. On a relative basis, the global debt is expected to soar from 320 percent to 365 percent of global GDP. This means that the global economy will struggle to get out from indebtedness without triggering an economic crisis .

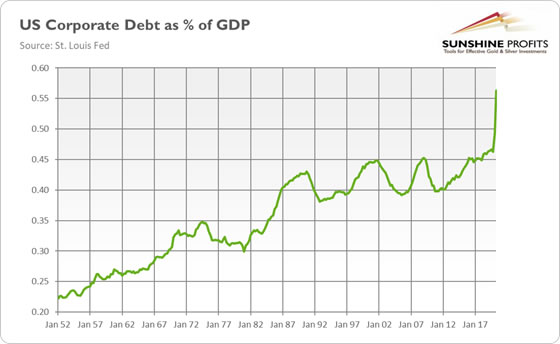

And if you have any doubts that the wave of debt insolvencies is coming; in the previous week, Chinese state-owned company Yongcheng Coal & Electricity Holding Group defaulted. What is important is that it wasn’t an isolated event but a part of a series of defaults by top-rated state-owned enterprises. This bankruptcy highlights the risk of defaults in the corporate bond market. Importantly, the pile of corporate debt is massive not only in China, but also in the U.S., as the chart below shows. As well, the Fed will not help if the debt crisis occurs. The central banks can deal with the liquidity crisis, but not the solvency crisis. Oh boy, 2021 is setting itself up to be an interesting year!

Implications for Gold

What does it all mean for the gold market? With or without the coronavirus, the U.S. economy is becoming increasingly debt-dependent. The only problem being is that debt-driven economic growth is not sustainable in the long-run. Even a small increase in interest rates could lead not only to higher borrowing costs, but also to a wave of debt defaults. What does this imply? One possible outcome is that the interest rates will have to be kept at ultra low levels for years. It goes without saying that gold thrives in an environment of low real interest rates .

Moreover, some economists point out that the end of the pandemic could accelerate inflation, and that the Fed and the state governments would not oppose too much. Actually, the U.S. central bank has already announced its new monetary regime in which it wouldn’t react to an increase in inflation rates above its target. After all, higher inflation would help Uncle Sam to reduce the real value of debt and gold should benefit in such a macroeconomic environment.

Thank you for reading today’s free analysis. We hope you enjoyed it. If so, we would like to invite you to sign up for our free gold newsletter. Once you sign up, you’ll also get 7-day no-obligation trial of all our premium gold services, including our Gold & Silver Trading Alerts. Sign up today!

Arkadiusz Sieron

Sunshine Profits‘ Market Overview Editor

Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Arkadiusz Sieron Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.