The Year the World Fell Down the Rabbit Hole

Stock-Markets / Financial Markets 2020 Jan 04, 2021 - 05:23 PM GMTBy: Gary_Tanashian

Conspiracies and bias hurt investors

It’s no wonder so many people have been unable to attain proper market positioning in 2020. You invest with your heart, soul, fears or even sometimes your intellect and you risk blowing yourself up at worst, or missing out at best. For much of 2020 Twitter has been a forum for ‘influencers’ with tens of thousands of followers spewing dogma and influencing their herds alright. I watched it happen all year, in the Twitter machine and at other venues.

You know the perma-bearish or ‘got gold?’ types, issuing dire warnings and authoritative discussion of just how bad off the world is (well, it ain’t good, I grant them that). But it’s the practical reaction or lack thereof, not the news itself that matters.

So Warren Buffett bought a gold stock. The gold “community” immediately seized upon it as validation and an opportunity to lecture the herds. What it actually was though, was a top prior to a healthy and much needed correction (handily, right from our long-standing target of HUI 375).

The most visible of the perma-bear entities (in my experience, at least) is now pimping Bitcoin I assume because after a year like this you’d better be associated with something going right so why not something that has exploded higher and gained mass attention once again? The 2020 bear promo blew up in your face so why not jump the biggest hype train out there?

Notes From the Rabbit Hole is named after a time of personal paranoia (2002-2004), which was more the result of fear of the Federal Reserve and other monetary authorities than politicians or some conspiracy of the global elite. As I learned more about monetary policy (becoming a gold bug in the process) I literally felt like I was in Wonderland where all kinds of strange (and scary) things existed that the people in my former above-ground life did not know of.

I knee-jerked into gold, guns and ammo. Yeah, the usual. I knee-jerked into wood stoves, a generator, organic gardening and water storage and purification (even though we use well water, ha ha ha). In short, I do believe I was ‘that guy’ in town. The weirdo. I recovered and from this experience after being burnished with inputs about how bad things can be and decided that life will go on and my future market service would not be like the other lunatics. I am a lunatic who will not sell any kind of dogma, whether it is bullish or bearish. I only sell what the indicators and truth of any given matter instruct me to sell.

Today’s conspiracy theorists make a living tending herds and imbuing upon their followers a sense that they are being contrary the system, the mainstream, the markets. Just learn from the influencer and you shall survive and maybe even prosper. No… you shall follow a linear thinking guru using some combination of logic and fantasy to portray a narrative that makes sense, especially in times like these, when so much seems out of control. The conspiracy theorist always has the answer for you. To boot, it’s a lot easier to serve the Kool Aid virtually today than it was filling all those little paper cups at Jonestown.

Unfortunately, having an answer at the ready at all times and the truth of the matter are often quite different, which the herd usually finds out too late. Using the stock market as a prime example, sure the economy has been wrecked. Sure, the market was in free fall in March. That’s really really bearish, right? So what turned it and burned it from Armageddon to bubble?

Side Note: I have been rightly advised by a subscriber well acquainted with the mutual fund/financial services industry and some of its predatory analytical sources to stop giving away publicly the critical mechanics of NFTRH’s success so I will have to use restraint here [omitting an indicator that helps connect the dots in 2020 as it has in so many other market phases]. The general theme, however, is indicators over emotion and intellect, as long as you’re using the right indicators at the right times. I’ll do future articles that include technical analysis because frankly I don’t think my standard nominal TA is necessarily better than others out there. It’s the much less obvious indicators and market signals where the difference is made. They need to stay mostly tucked away within NFTRH’s confines (err, down the Rabbit Hole).

Back in May I wrote a post that was critical of a well known (at least in gold bug circles) analyst reinforcing the herd’s fears during the post-crash recovery: Down the Rabbit Hole. The writer implored readers to “get ready for the worst depression in the history of the world.” I included this graphic with the post…

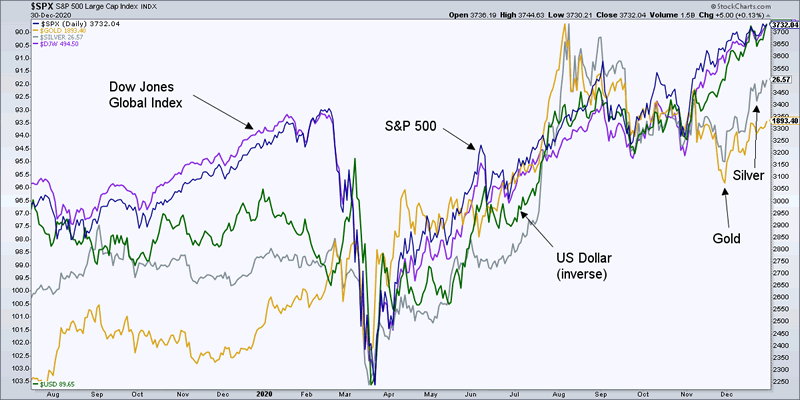

The stock market rally continues to this very day, the last one of 2020. Many call it illogical but it is really so simple as to be overly obvious. If the units of Thing 1 (let’s say SPX) are measured in units of Thing 2 (US dollars), should not units of Thing 1 increase in price with more units of Thing 2 in circulation, having driven its value down? The party will end, but as of day 365 in 2020 it has not yet ended and we have analyzed and ridden with it every step of the way as the market was fueled first by remote tools/cloud/SaaS Tech and then various rotations within the broad market.

The Federal Reserve is literally printing a bull market and they are doing it because the indicators (especially those directly and indirectly of inflation) say they can. And the USD being the reserve currency, the phenomenon is global. As for gold and silver, we had indicators to the need for that correction that began in August. But look who is attempting to get with the program after being excluded from the party since August; gold, which led the whole broad market recovery and silver, which is again taking up leadership from gold. The interplay between those two will be another key 2021 indicator just as it was in 2020.

We have a very clear point on one key indicator in particular to watch for an end to the party (in inflation-driven cyclical markets, at least) and I think I’ll include it in this weekend’s NFTRH 636 for a little sobriety as we enter 2021 on a bullish note.

Meanwhile, ‘It’s a bubble in stocks!’ demand linear thinkers laying out easily digestible nuggets for their herds. Err, it’s a bubble in policy and with all the non-reconcilable debt in the system it really is a type of Wonderland. But in Wonderland especially, don’t you play by the host’s rules? Extreme risk rides with extreme bullishness. This is not Grandpa’s stock market of sensible P/E ratios and forward earnings (not to mention relatively sound monetary policy). It is a desperate game of chicken where you invest or avoid as the indicators suggest. And it’s a moving target. You remain open minded and nimble.

As we head into 2021 the target is inflationary as led many months ago by gold, as eclipsed by silver and then most recently, copper. Some are calling it a great new commodity bull market. Could be, but as yet it’s just a cycle making up for years of deflationary ignominy.

A host of indicators and other inputs go into staying on the right track in a market that has continually rotated its way to a bullish 2020 as instigated by the balls out printing of funny munny. But as has also been made perfectly clear in 2020, if you did not have a very good year and you took to heart viewpoints of influencers who happened to be wrong, you might think about another method for the new year. One where you break from herd-think and look at the markets for what they are and what makes them tick.

We’ll have to clear the Santa seasonal and the suspect market signals therein. But as we enter 2021 there are sure to be a whole new set of rules to play by. We’ll need to have our unbiased thinking caps on every step of the way.

To kick off the new year consider an offer of two weeks of NFTRH Premium for free (for first time subscribers) while you evaluate the service. You can take my word for it that we had a great year in 2020 and that it was no accident, or you can get under the hood and see for yourself whether or not this type of no b/s analysis and market management is for you, with no obligation should you decide to cancel within the first two weeks. If you stay on after two weeks the regular monthly billing rate of $38 will apply.

Oh, and happy new year.

For “best of breed” top down analysis of all major markets, subscribe to NFTRH Premium, which includes an in-depth weekly market report, detailed interim market updates and NFTRH+ dynamic updates and chart/trade setup ideas. You can also keep up to date with actionable public content at NFTRH.com by using the email form on the right sidebar. Follow via Twitter ;@NFTRHgt.

By Gary Tanashian

© 2020 Copyright Gary Tanashian - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Gary Tanashian Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.