The Return of Inflation. Can Gold Withstand the Dark Side?

Commodities / Gold and Silver 2021 Jun 07, 2021 - 06:34 PM GMTBy: Arkadiusz_Sieron

Inflation broke into the economy violently. It’s a destructive, dark force. But gold can resist it, being after all a much stronger asset than Anakin Skywalker.

Inflation broke into the economy violently. It’s a destructive, dark force. But gold can resist it, being after all a much stronger asset than Anakin Skywalker.

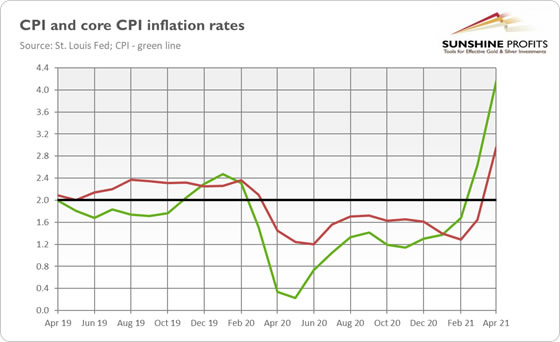

Last month, I wrote that “inflation is knock, knock, knockin’ on golden door”. I was wrong. Inflation didn’t knock, it broke down the door! Indeed, as the chart below shows, the core CPI surged 3%, while the overall CPI annual rate soared 4.2% in April – this is twice the Fed’s target!

Now, the question is whether this elevated inflation will turn out to be just “transitory”, as the Fed and the pundits claim, or become more permanent. On the one hand, given that April-May 2020 was the worst phase of the pandemic with the deepest price declines, the current high inflation readings are perfectly understandable, and we could see lower numbers later this year.

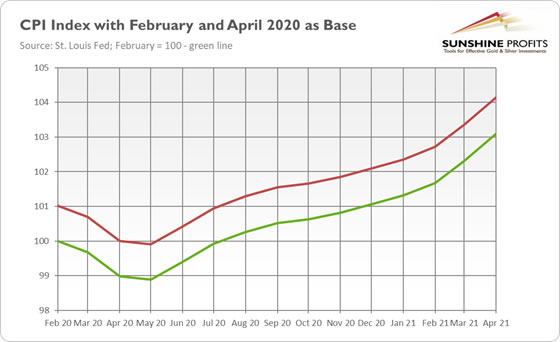

On the other hand, inflation may be higher and/or more persistent than many analysts believe . After all, the April reading came as a shock for them and even for the top US central bankers. For example, Richard Clarida, the Fed Vice-Chair, said: “I was surprised”. It shows that there is more in high inflation than just the base effect. Indeed, the CPI index with February 2020, i.e., the last pre-pandemic month as a base, has jumped 3.1% so far – lower but still significantly above the Fed’s target.

It shouldn’t be surprising given the surge in the broad money supply and increase in fiscal transfers to citizens. Incomes are higher and people are ready to spend their money. Stronger demand met with supply shortages, so the prices rose. And what is important, the increases are widespread: from commodities to used cars and houses.

However, there are a few important upside risks to inflation . First, a rise in wages. Although employment is far from the pre-epidemic level, entrepreneurs struggle to find workers. Therefore, they could be forced to increase wages to pull employees away from generous government benefits. If passed on, higher input costs would translate into higher consumer prices.

Second, a housing boom . Rising housing prices show that inflationary pressure is something more than just CPI inflation, and all this could drive shelter inflation higher. More importantly, though, as shelter dominates in the CPI basket, the official inflation would rise as a result.

Third, an increase in inflationary expectations. In May, the University of Michigan index that gauges near-term inflation expectations surged to 4.6%from 3.4%in April. What’s important, the index that measures inflation expectations for the next five years also rose – from 2.7% in April to 3.1% in May, which is the highest level in a decade. As the chart below shows, the market-based inflation expectations have also been surging recently.

This is a very important development, potentially even a game-changer. You see, inflation remained low for years partially because Americans didn’t expect high inflation. They used to see persistent inflation as a thing of the past. They had strong confidence in the Fed , believing that the US central bank would quickly intervene to prevent inflation.

However, that belief could go away now . The Fed’s new monetary framework and officials’ speeches clearly indicate that the US central bank has become more tolerant of higher inflation. The Fed has returned – just like in the 1970s – to focus on full employment and its “shortfalls” instead of deviations, forgetting that economies can become too hot as well as too cold. Given the dominance of doves in the Fed – but also in the Treasury with Yellen as a Secretary – one can reasonably doubt whether or not the US central bank is ready to hike the federal funds rate in response to higher inflation. Just like in the years before the Great Stagflation , the Fed could decide that it’s better to live with inflation than bear the pain of combating it.

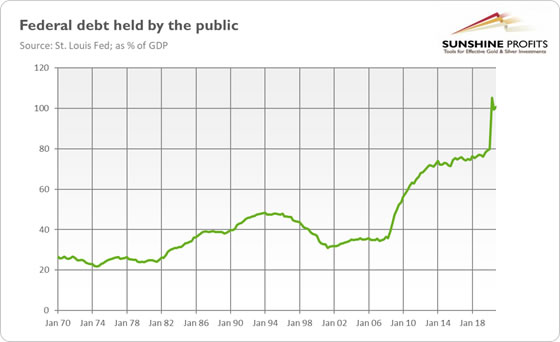

More importantly, such a fight would be challenging now, as the public debt is a few times higher.

As the chart below shows, the federal debt held by the public is now 100% of the GDP , four times larger than throughout the 1970s. Hence, the increase in interest rates would amplify fiscal deficits even more. To paint the perspective, April’s core CPI was the highest since 1982, when the Fed was trying to control inflation, and interest rates were double-digit. So, the government would be obliged to cut its expenditures, while the climate is rather to spend as much money as possible. Therefore, the Fed is under strong pressure not to tighten its monetary policy .

What does all this mean for the gold market? Well, when people question the willingness or ability of the government and central bank to tame inflation, they expect it to go higher, which increases the actual inflation and make it more persistent. Such a negative surprise, with inflation expectations unanchored, would make prices rise abruptly – but also the demand for gold as an inflation hedge would increase . Given the widespread economic repercussions and elevated uncertainty triggered by higher inflation – which is one of the biggest threats to this economic cycle – gold could gain as a safe-haven asset .

Of course, gold is not a perfect inflation hedge in the short term. If interest rates increase or the Fed tightens monetary conditions in response to inflation, gold may struggle. Actually, a start of normalization of the monetary policy could push gold downward, just as it happened in 2011.

However, given the current pretending that “there is no inflation” by the Fed, it’s likely that the US central bank won’t react promptly, remaining behind the curve. The delay in tightening could de-anchor inflationary expectations and trigger an inflationary spiral, pushing real interest rates down but also gold prices up.

Thank you for reading today’s free analysis. We hope you enjoyed it. If so, we would like to invite you to sign up for our free gold newsletter. Once you sign up, you’ll also get 7-day no-obligation trial of all our premium gold services, including our Gold & Silver Trading Alerts. Sign up today!

Arkadiusz Sieron

Sunshine Profits‘ Market Overview Editor

Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Arkadiusz Sieron Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.