Gold and Silver Precious Metals Technical Analysis

Commodities / Gold and Silver 2021 Jul 30, 2021 - 02:58 PM GMTBy: The_Gold_Report

Technical analyst Clive Maund explains why he is bullish on gold and precious metals. Despite the looming threat of massive inflation, or at least stagflation in the event that markets collapse, many appear to have given up on gold at the worst possible time, perhaps due to the mistaken belief that it will be perpetually suppressed by market manipulators.

The key point to grasp with gold, which has always been the same, is that since it is "real money" with intrinsic value it will always retain its value, and this has never been more the case than in situations where a currency is rapidly losing its purchasing power, as is set to happen with the dollar—and is already happening—and with almost all currencies around the world. With the purchasing power of fiat money everywhere set to be vaporized by inflation/hyperinflation, gold's (and silver's) appeal as a store of value has never been greater.

It is crucial to understand that even if markets crash, and take gold and silver prices down with them, their prices should drop at a lower rate than most other assets, and thus they should retain or increases their purchasing power so you will be able to buy more—just ask the people of Venezuela what they would prefer to have owned before their country was destroyed by hyperinflation, their local currency or gold—by end of it gold would buy wagonloads of the currency. So, at a time like this, there are no asset better for retain value than gold and silver.

Whilst it is obviously ideal to have at least a portion of one's precious metal holdings in physical gold and silver, all gold and silver based assets should do well going forward, such as futures of course but also ETFs and the better precious metal stocks.

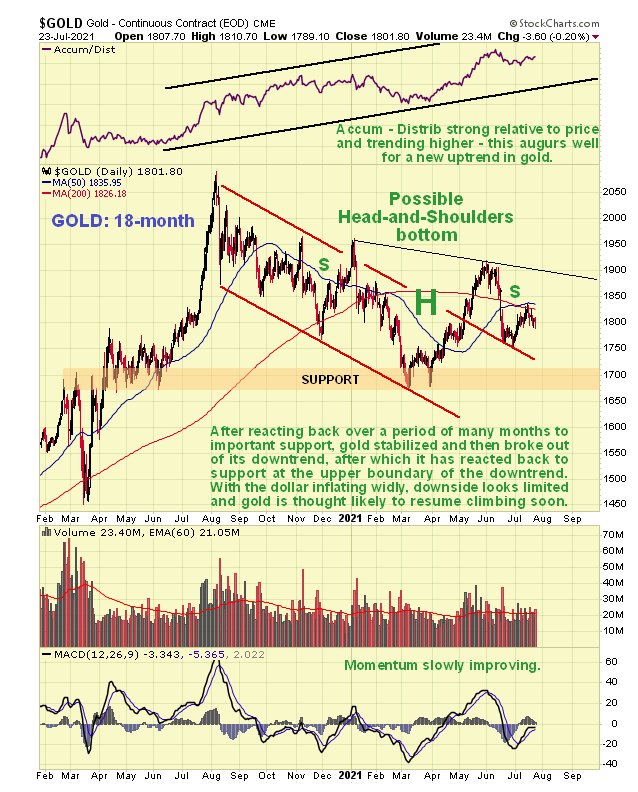

The reason that many investors have lost interest in gold is because it has been a dull market for a long time, having drifted lower for many months from its peak in August of last year. On the 18-month chart we can see that gold's reactive downtrend ended when it arrived at strong support in March, since which time it has made a clear breakout from this downtrend before backing off again to support at the top of the downtrend channel. What appears to be going on is that gold is floundering around marking out a large base pattern that will lead to renewed advance. It looks like a potential Head-and-Shoulders base pattern has been completing and if so gold is at a good buy spot here close to the Right Shoulder low of the suspected pattern. The strong Accumulation line supports this interpretation.

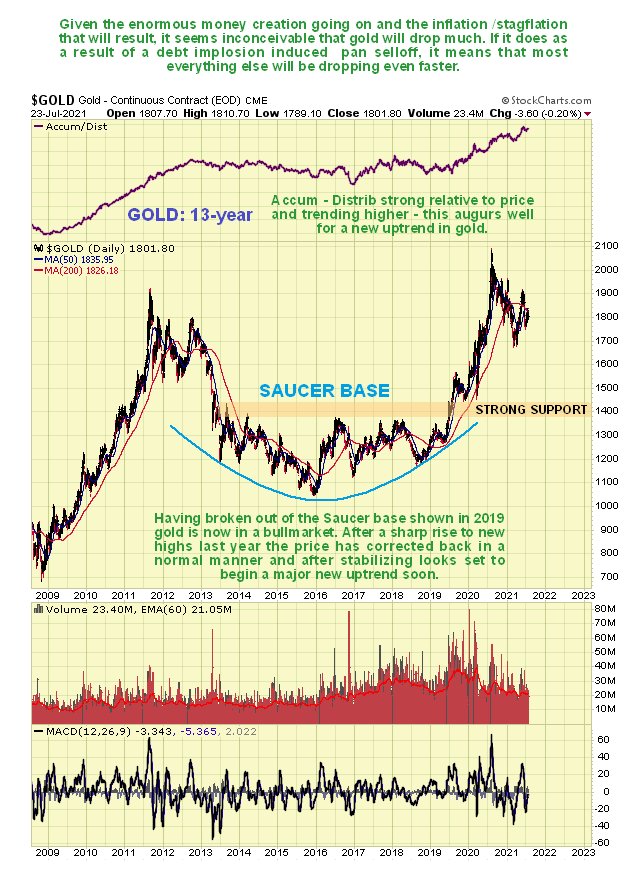

On the long-term 13-year we can see that it is perfectly reasonable for gold to have reacted back as it has since last August, given the magnitude of the advance following its breakout from a giant Saucer base in the middle of 2019. This chart suggests that after reacting back, gold is readying for renewed advance in another major upleg.

As for precious metal stocks, we see that although the 6-month chart for GDX looks rather grim, with a weak accumulation line and bearishly aligned moving averages, the long-term 13-year chart shows that it has reacted back close to strong support at the top of the giant base pattern that it broke out of last year. This therefore looks like a very good time to accumulate the better stocks across the sector.

Originally posted on CliveMaund.com at 2.45 pm EDT on 25th July 2021.

Clive Maund has been president of www.clivemaund.com, a successful resource sector website, since its inception in 2003. He has 30 years' experience in technical analysis and has worked for banks, commodity brokers and stockbrokers in the City of London. He holds a Diploma in Technical Analysis from the UK Society of Technical Analysts.

Disclosure: 1) Statements and opinions expressed are the opinions of Clive Maund and not of Streetwise Reports or its officers. Clive Maund is wholly responsible for the validity of the statements. Streetwise Reports was not involved in the content preparation. Clive Maund was not paid by Streetwise Reports LLC for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. 2) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports. 3) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

Charts and graphics provided by the author.

CliveMaund.com Disclosure: The above represents the opinion and analysis of Mr Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. Mr. Maund is an independent analyst who receives no compensation of any kind from any groups, individuals or corporations mentioned in his reports. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks can only be construed as a solicitation to buy and sell securities when they are subject to the prior approval and endorsement of a Registered Securities Advisor operating in accordance with the appropriate regulations in your area of jurisdiction.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.