Stock Market Mean Reversion

Stock-Markets / Stock Market 2022 Feb 16, 2022 - 02:27 PM GMTBy: Monica_Kingsley

S&P 500 refused further downside yesterday, and while credit markets didn‘t move much, rebound looks approaching as stocks might lead bonds in the risk appetite. When the East European tensions get dialed down, S&P 500 can be counted on to lead, probably more so when it comes to value than tech. That‘s why the tech participation is key as it would make up for the evaporating risk premium in energy. Or precious metals – these are likely to rise once again when the spotlight shifts to the inadequacy of Fed‘s tightening in the inflation fight.

For now, the war drums took the limelight away, but don‘t count on gold, silver or oil correcting significantly and lastingly. Cryptos are supporting the return of risk-on as the touted war just isn‘t happening either today or tomorrow, and market participants are dialing back the panicky bets. That‘s why Treasuries and tech movements are so key these days – copper trading shows that we‘re in for paring back of the fire sales. I can‘t call it a full fledged stock market reversal, not yet.

Let‘s move right into the charts (all courtesy of www.stockcharts.com).

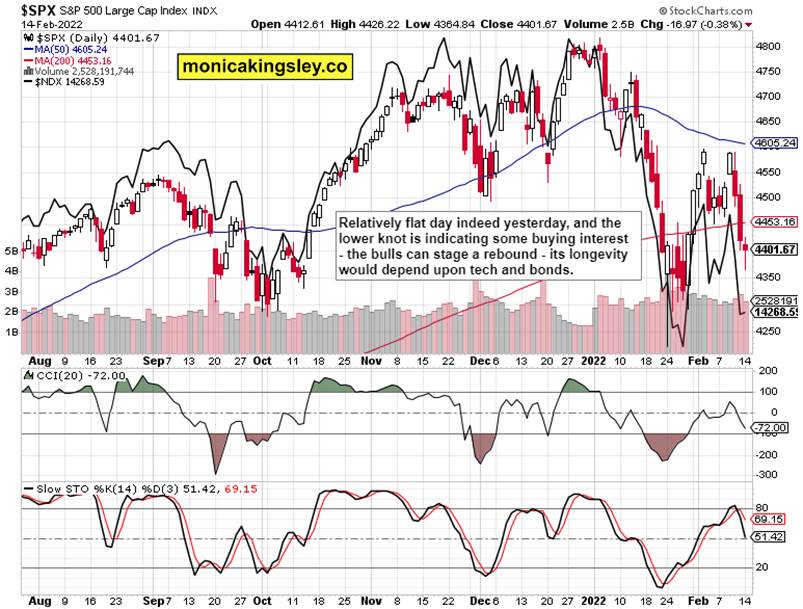

S&P 500 and Nasdaq Outlook

Pause but more likely a rebound, is what comes next for S&P 500. Closing above the 200-day moving average is possible, but more is needed for a trend reversal in this correction.

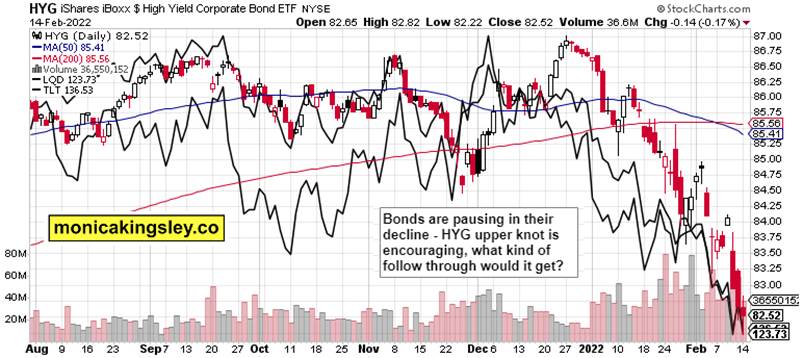

Credit Markets

Credit markets moderated their pace of decline, and there‘s no risk-on posture apparent yet. We may be though nearing the point of credit market reprieve – as much as that‘s compatible with rate raising cycle.

Gold, Silver and Miners

Miners and gold are benefiting from the tensions, but they‘ll just as easily give up some of these gains next. What‘s important though, is the continued trend of making higher highs and higher lows.

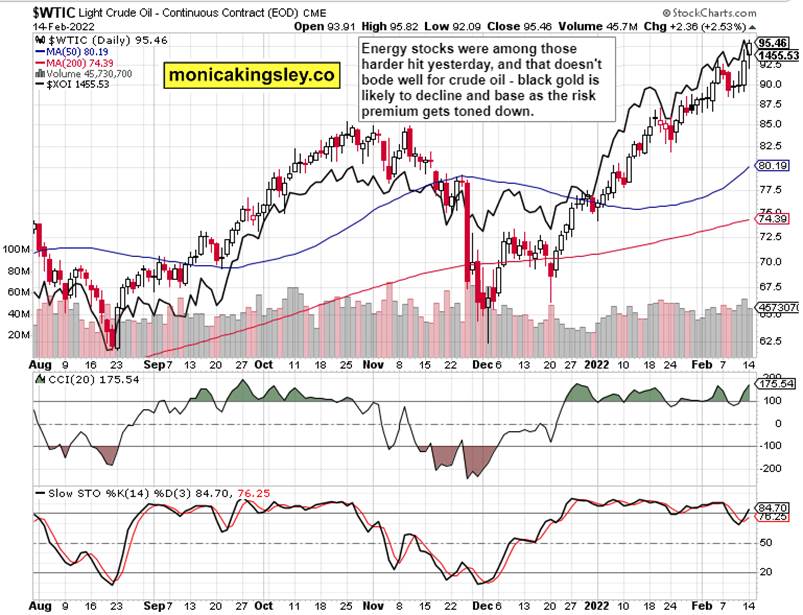

Crude Oil

Crude oil looks also likely to lose some of the prior safe haven bid, but similarly to precious metals, the trend is higher, and corrections are more or less eagerly bought. Only should the Fed‘s actions harm the real economy, would oil prices meaningfully decline.

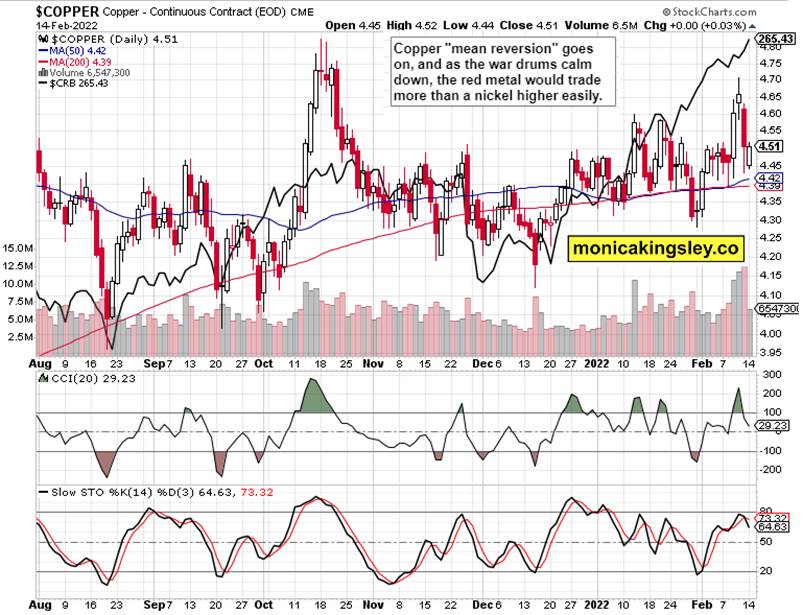

Copper

Copper is rebounding, but still remains trading in a not too hot fashion – the red metal is still trailing behind other commodities significantly.

Bitcoin and Ethereum

Cryptos deciding to go higher, is a positive sign for stocks as well – the volume looks to be noticeable enough at the close later today to lend the upswing credibility.

Summary

- S&P 500 bulls have the opportunity today, but the market remains as headline sensitive as everything else. Treasuries stabilizing or even moving higher while funds flow out of the dollar, that would be a bullish confirmation – and the same goes for precious metals not getting hammered, but finding a decent floor. The point is that war jitters calming down when Russia doesn‘t take the bait, makes assets to continue with their prior trends and focus, which is Fed and tightening. The bets on 50bp rate hike in Mar went down recently, and when they start rising again, it would make sense to deploy more capital – including into oil above $90, give or take a buck.

Thank you for having read today‘s free analysis, which is available in full here at my homesite. There, you can subscribe to the free Monica‘s Insider Club , which features real-time trade calls and intraday updates for all the five publications: Stock Trading Signals, Gold Trading Signals, Oil Trading Signals, Copper Trading Signals and Bitcoin Trading Signals.

Thank you,

Monica Kingsley

Stock Trading Signals

Gold Trading Signals

www.monicakingsley.co

mk@monicakingsley.co

* * * * *

All essays, research and information represent analyses and opinions of Monica Kingsley that are based on available and latest data. Despite careful research and best efforts, it may prove wrong and be subject to change with or without notice. Monica Kingsley does not guarantee the accuracy or thoroughness of the data or information reported. Her content serves educational purposes and should not be relied upon as advice or construed as providing recommendations of any kind. Futures, stocks and options are financial instruments not suitable for every investor. Please be advised that you invest at your own risk. Monica Kingsley is not a Registered Securities Advisor. By reading her writings, you agree that she will not be held responsible or liable for any decisions you make. Investing, trading and speculating in financial markets may involve high risk of loss. Monica Kingsley may have a short or long position in any securities, including those mentioned in her writings, and may make additional purchases and/or sales of those securities without notice.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.