Stock Market Trend Forecast Into Mid May 2022, AI Stocks Portfolio Update

Stock-Markets / Stock Market 2022 Apr 16, 2022 - 02:40 PM GMTBy: Nadeem_Walayat

What if you could know the future, had a chart of the stock market that showed a high probability trend forecast into the middle of May 2022. We'll that's what my Patrons got in a market brief at the end of March 2022, a trend forecast right into the middle of May 2022 -

Whilst my last market brief signaled to expect a strong April to be punctuated by an imminent correction into early April before the final forecast push higher into a May high that the following chart of the S&P better visualises of what I have in mind in terms of how the trend could play out.

And here's the updated chart which illustrates actual trend vs forecast.

The forecast for where the S&P price should be at right now is 4394, vs actual S&P index at 4393.6, with my expectations for the S&P to trend lower for another week before bottoming and rallying strongly into Mid May for a higher high.

AI Stocks Portfolio

My strategy remains as iterated in my last brief to accumulate stocks as and when opportunities arise with the anticipated correction to at least offer an opportunity for small buys if not for a big buy or two.

Putting My Foot into the Housing Market

Unfortunately, I've had to bolt on a few extra few days as I injured my foot so lost all of Tuesday sat in A&E and having gotten an ultrasound scan today with a clinic tomorrow morning.

Therefore ETA for UK housing market analysis is delayed by a few days, so briefly the current state of the housing markets without preempting my in-depth analysis -

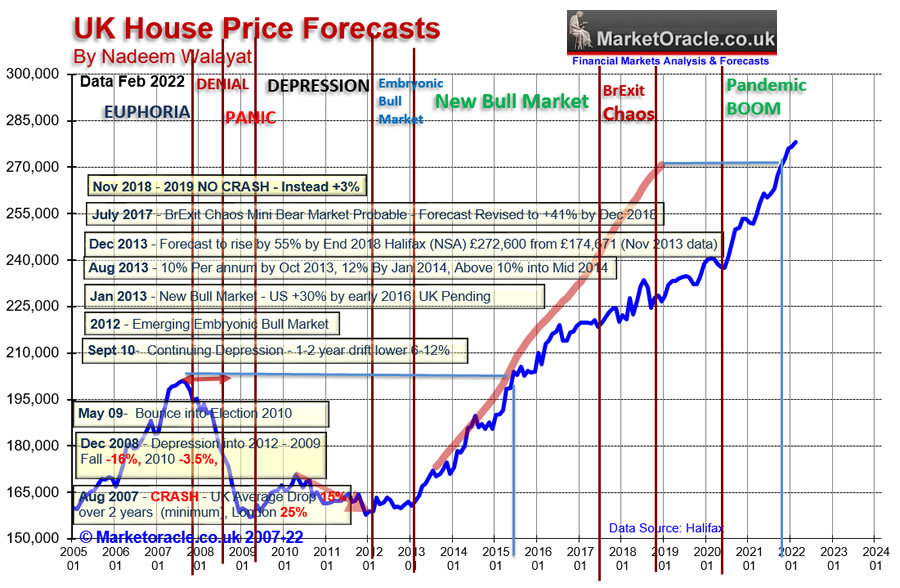

UK house Prices Trend Forecast Current State

UK house prices have soared into the stratosphere confounding the clueless perma doom merchants in the mainstream press who for the duration of the pandemic have always only seen one outcome that for an always imminent CRASH! Instead UK house prices have finally fulfilled my original long-range forecast that was the conclusion of my 100+ page UK housing market ebook of 2013 which forecast UK house prices to target a 55% rise from £174k to £272k, a 5 year trend forecast that pushed the envelope in terms of peering into distant the mists of time, long before the EU referendum was even a flicker in David Cameron's mind, let alone the Brexit chaos of a YES vote that acted to subdue the bull run until the Pandemic money printing boom concluded the forecast during 2021.

Clearly a 5 year house prices trend forecast is a bridge too far, instead a 2 to 3 year forecast is more realistically attainable in terms of a high probability trend forecast.

In terms of the present state, UK house prices momentum is hitting its limits at 10%, therefore momentum should moderate over the coming months. Unfortunately all who are waiting for a BIG DROP to finally hit the buy button will likely be disappointed due to VERY HIGH REAL INFLATION as a consequence of RAMPANT MONEY PRINTING. UK CPLIE is at 6.2%, REAL INFLATION is closer to 15%!

US House Prices Current State

Did the US house prices bull market continue as forecast or did the perma housing doom merchants finally get their broken clock moment?

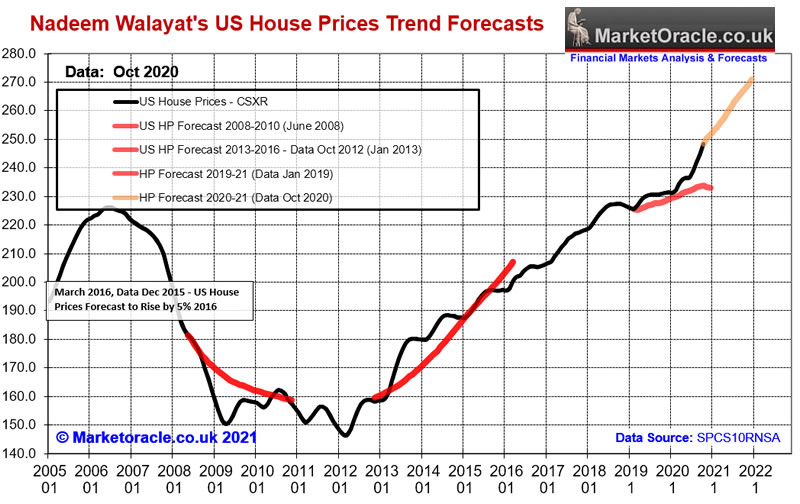

13th Jan 2021 - US Housing Market Trend Forecast 2021

Therefore my forecast conclusion is for the US housing market bull market to further accelerate to an annualised momentum of just over 10% per annum during Mid 2021 before momentum slows to end 2021 with a gain of about 7.7% for the year, on top of again of 1% for November and December 2020. For a total house prices gain of about 9% by the end of 2021. i.e. Case Shiller 10 city Index (SPCS10RNSA ) rising from 248.5 (Oct 2020 data) to 271 (Dec 2021 data) as illustrated by my trend forecast graph.

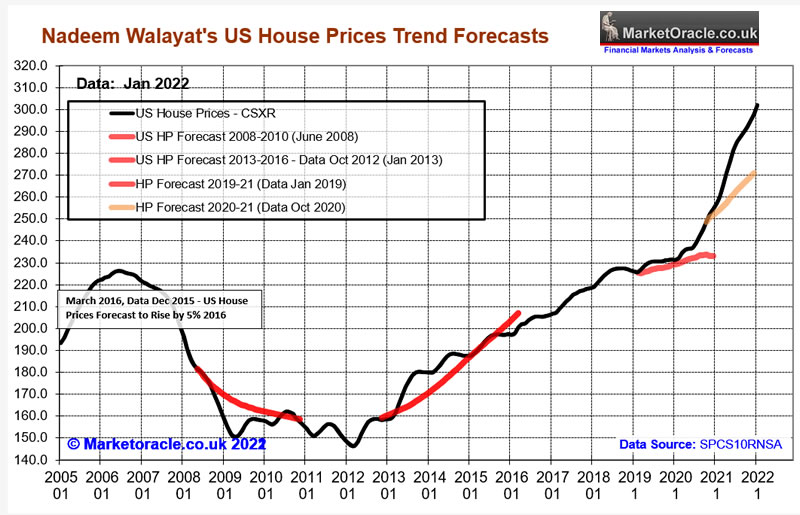

Nope we had a spectacular bull run courtesy of continuing Fed rampant money printing.

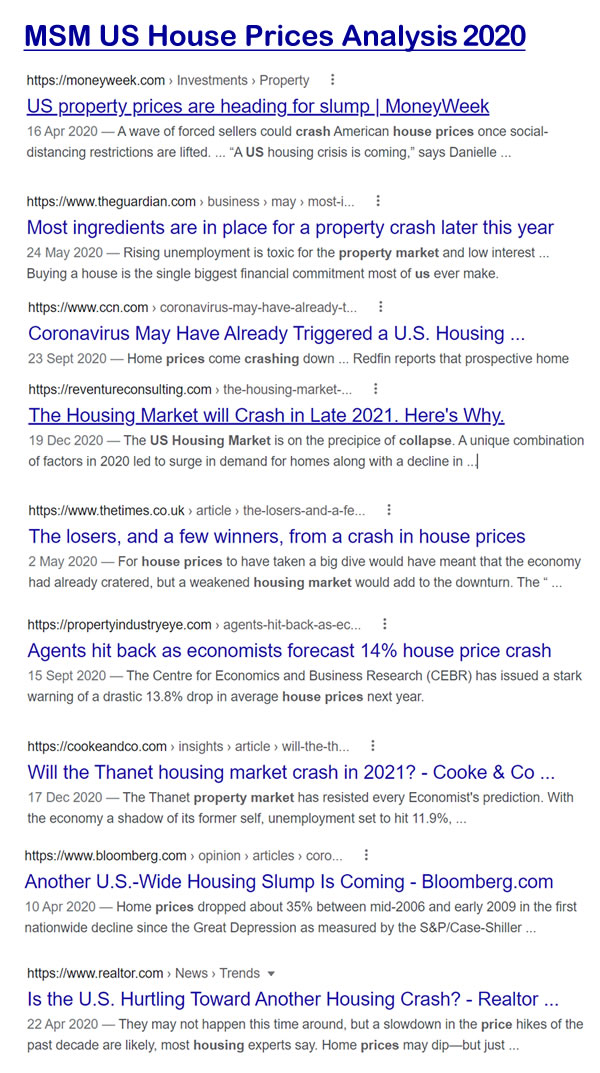

And here's why most FAILED to invest when US house prices were much cheaper than today throughout 2020, these so called 'analysts' from the likes of Bloomberg, CNN, MoneyWeek and Realtor frightened the crap out of would be buyers into a state of paralysis with their crash is always imminent mantra.

And if you googled right now, you will likely be reading much of the same today to the extent they may as well just copy and paste the same floating turd's from year to year until eventually a CRASH materialises.

As for where US house prices are headed next well US house prices are RED HOT galloping ahead at near 20% per annum which is unsustainable which means momentum will significantly moderate over the coming months. However, those looking for a big price plunge will be disappointed as we only need to look at the inflation smoking gun, US CPLIE is at 8%, with real at 15%, so those looking for US house prices to FALL in 2022 are going to be very disappointed.

Are We Approaching the End of the US Empire?

Not even close. Russia made a fatal mistake without checking it's balance sheet, and it remains to be scene if the China is determined to follow suit probably in a few years time.

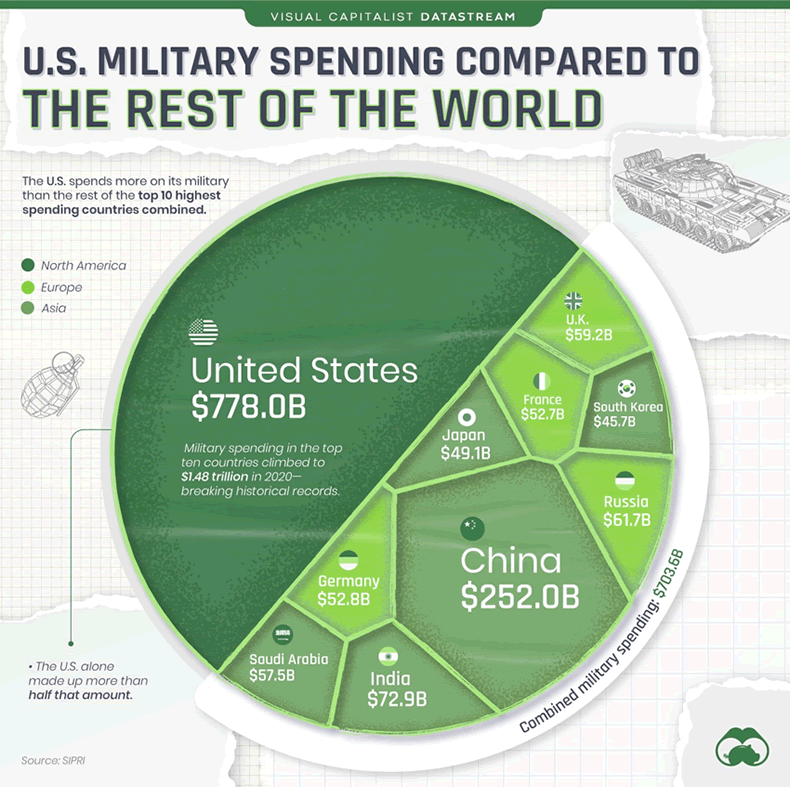

What if Russia China and perhaps the outlier India combined to present a united front of $387 billion annual spend, a formidable adversary in terms of spending, resources and man power. Though the problem with such an Axis is that the US can call upon two sleeping giants, Germany in Europe and Japan in Asia, who could easily see their annual spends double, triple and probably more to equal all that of Axis powers spend combined. Though if the US allowed such a move it could set the two former 'master races' once more off on buying into their own hype thus resulting in the loss of America's iron grip over them, especially Japan as the EU looks like having done a good job of keeping Germany firmly bolted down and focused on building an Economic Empire rather than an Military Empire, that and French and British Nukes ensure a Fourth Reich is highly improbable.

The up shot is that there is no bear market for the defence sector, whilst LMT is the only one which features on my public list, others such as Raytheon are bubbling under the surface to capitalise on rampant military spending.

Market briefs are an additional relatively short pieces (by my standards) that Patrons are now also in receipt of as I quietly beaver at the mega-pieces of analysis such as my recently posted UK House Prices Three Trend Forecast 2022 to 2025 where I pealed away every layer of the UK housing market I could think of to arrive at a high probability of trend forecast.

UK House Prices Trend Forecast 2022 to 2025

THE INFLATION MEGA-TREND

WE HAVE NO CHOICE BUT TO INVEST IN STOCKS AND HOUSING

High Inflation Forecast for Whole of this Decade Due to Rampant Money Printing

Fed Inflation Strategy Revealed

Russian Sanctions Stagflation Driver

RECESSION RISKS 2023

UK Debt Inflation Smoking Gun

Britains' Hyper Housing Market

UK Population Growth Forecast 2010 to 2030

UK House Building and Population Growth Analysis

UK Over Crowding Ratio

Overcrowding Implications for UK House Prices

UK Housing Market Affordability

UK House Prices Real Terms Sustainable Trend

UK House Prices Relative to GDP Growth

UK House Prices Momentum Forecast

UK House Prices and the Inflation Mega-trend

Lets Get Jiggy With UK INTEREST RATES

Is the US Yield Curve Inversion Broken?

UK house Prices and Yield Curve Inversions

Interest Rates How High WIll they Go?

Work From Home Inflationary BOOM?

Formulating a UK House Prices Forecast

UK House Prices 2022 to 2025 Trend Forecast Conclusion

Peering into the Mists of TIme

Risks to the Forecasts

US House Prices Trend Forecast 2022-2024

And Access to -

World War 3 Phase 1 - Putin WINS Ukraine War!

What Putin Plans for Ukraine

JRS.L Capitalising on Russia's War CRASHED Stocks

THE 2020's INFLATION MONSTER!

Stock Market Trend Forecast Current State

Stock Market FOMO Gives Way to FEAR of Buying the Dip

AI Stocks Portfolio Current State With Updated Buying Levels

FACEBOOK Stock 45% CRASH - Game Over for META?

FACEBOOK RINSE AND REPEAT

INVESTING LESSON - HAVE A PLAN AND THEN EXECUTE IT!

HIGH RISK STOCKS - INVEST AND FORGET

High Risk Stocks Portfolio Revised Buying Levels

GROWTH STOCKS TO CAPITALISE ON THE PANIC OF 2022

1. XXXX - RANK 1 - $121.8, PE 7.8, EGF 38%

2. XXXX - RANK 1 - $58.5, PE 9.9, EGF 30%

3. XXXX- RANK 2 - $16.7, PE 8.7, EGF 33%

4. XXXX - RANK 2 - $89.5, PE 17.2, EGF 23%

5. XXXX - RANK 2 - $49.7 - PE 196, EGF 188%

Whilst my next market brief will will be posted during the weekend.

So if you want immediate access to a high probability trend forecast of UK house prices, with US and global housing markets analysis to follow soon then do consider becoming a Patron by supporting my work for just $4 per month. https://www.patreon.com/Nadeem_Walayat.

My Main Analysis Schedule

- UK House Prices Trend Forecast - Complete

- US House Prices Trend Forecast - 70%

- Global Housing / Investing Markets - 60%

- US Dollar / British Pound Trend Forecasts - 0%

- Stock Market Trend forecast into End 2022 - 0%

- High Risk Stocks Update - Health / Biotech Focus - 0%

- How to Get Rich - 85%

- Gold and Silver Analysis - 0%

- Stocks Stealth Bear Market

- Current Best Value AI Tech Stocks, New Tax Year Best Stocks and Shares ISA"s - POSTED

- Why Draw downs Don't Matter

- The VR Mega-trend

Again for immediate access to all my work do consider becoming a Patron by supporting my work for just $4 per month. https://www.patreon.com/Nadeem_Walayat.

Your my left foot analyst.

By Nadeem Walayat

Copyright © 2005-2022 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 30 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.