What Happens When the Stock Market Dip Keeps Dipping?

Stock-Markets / Stock Market 2022 May 13, 2022 - 05:12 PM GMTBy: EWI

These can "work tirelessly to keep investors trapped on the wrong side of a bearish trend"

It's been a rocky road for the Dow and the S&P 500 index since the start of the year. And, even longer for the NASDAQ, which topped back in November.

Indeed, speaking of technology stocks, some of the most popular names took a big beating in April alone. As the Wall Street Journal noted (April 29):

The FAANG stocks, consisting of the popular quintet of Facebook parent Meta Platforms, Apple, Amazon.com, Netflix and Google parent Alphabet, have collectively lost more than $1 trillion in market value [in April], the most since Facebook started trading in May 2012.

So, you might think that this bumpy ride in the stock market would have many investors at least considering moving to the sidelines, especially those with a sizeable nest egg to protect.

Well, according to a UBS Investor Sentiment survey of millionaire investors -- conducted between April 5 and April 18 -- most of those surveyed plan to stick with stocks.

Here's a May 4 CNBC headline:

More wealthy investors would rather hold or add stocks than sell if markets keep sliding, survey says

Granted, this survey was taken before some of the roughest trading days in April. Still, it shows a recent willingness by even the "cream of the crop" in society to "buy the dip."

No doubt, that same lingering bullishness has persisted in other nations too.

With that in mind, the April Global Market Perspective, a monthly Elliott Wave International publication which provides analysis of 50-plus worldwide financial markets, provided an object lesson in buying the dip, using past bear markets in Germany's DAX as examples:

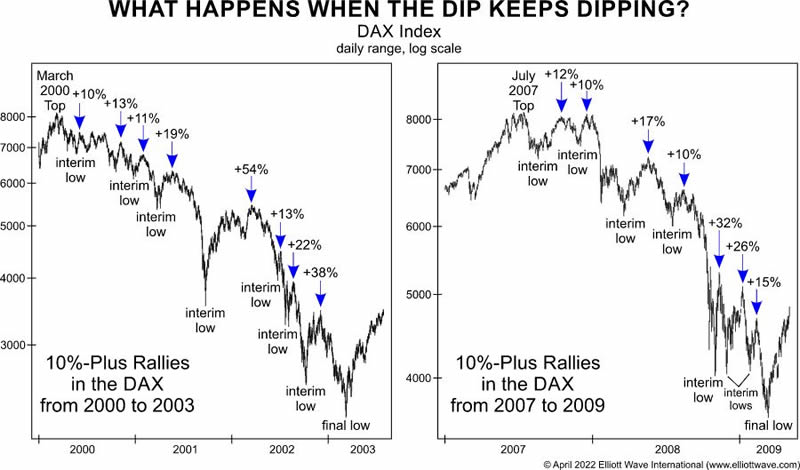

[These two graphs illustrate] the multi-week and multi-month rallies that work tirelessly to keep investors trapped on the wrong side of a bearish trend. The left graph depicts every plus-10% rally from March 2000 to March 2003, a three-year span that saw the DAX drop by 74%. The right graph illustrates the bear market from July 2007 to March 2009, which saw seven rallies of 10% or more.

So, "buying the dip" can be a financially dangerous strategy.

In our view, it's best to consult a financial market's Elliott wave structure before making a decision about your portfolio.

If you'd like to learn how the Elliott wave model can help you analyze financial markets, you are encouraged to read Frost & Prechter's Wall Street classic, Elliott Wave Principle: Key to Market Behavior. Here's a quote from the book:

"When you have eliminated the impossible, whatever remains, however improbable, must be the truth." Thus eloquently spoke Sherlock Holmes to his constant companion, Dr. Watson, in Arthur Conan Doyle's The Sign of Four. This advice is a capsule summary of what you need to know to be successful with Elliott. The best approach is deductive reasoning. By knowing what Elliott rules will not allow, you can deduce that whatever remains is the proper perspective, no matter how improbable it may seem otherwise. By applying all the rules of extensions, alternation, overlapping, channeling, volume and the rest, you have a much more formidable arsenal than you might imagine at first glance. Unfortunately for many, the approach requires thought and work and rarely provides a mechanical signal. However, this kind of thinking, basically an elimination process, squeezes the best out of what Elliott has to offer and besides, it's fun! We sincerely urge you to give it a try.

You can read the entire online version of Elliott Wave Principle: Key to Market Behavior for free once you become a Club EWI member!

Club EWI is the world's largest Elliott wave educational community and is free to join. Members enjoy free access to a wealth of Elliott wave resources on investing and trading.

Get started by following this link: Elliott Wave Principle: Key to Market Behavior -- free, unlimited and instant access now.

This article was syndicated by Elliott Wave International and was originally published under the headline Stock Markets: "What Happens When the Dip Keeps Dipping?". EWI is the world's largest market forecasting firm. Its staff of full-time analysts led by Chartered Market Technician Robert Prechter provides 24-hour-a-day market analysis to institutional and private investors around the world.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.